Analytics, Budget, EU – Baltic States, Financial Services, GDP, Investments, Legislation, USA

International Internet Magazine. Baltic States news & analytics

Saturday, 27.04.2024, 05:56

Government expenditures in the EU: hiding national priorities

Print version

Print version

The EU-28 has been the world's second most prosperous economy in 2014, at $17.61 trillion (or about € 14 trillion).To compare, the US GDP was slightly less – at $17.46 trillion. However, the EU’s GDP per capita is about $38,300 because it must spread the wealth among 509 million people; whereas the US GDP per capita is $54,800. Recent Eurostat statistics dwell on government resources available for socio-economic growth in the member states. We provide some comparisons with the US.

The EU’s general picture

In 2014, total general government expenditure amounted to €6 701 bn in the European Union. This represented almost half (48.1%) of EU GDP in 2014, compared with 48.6% in 2013. In the euro area, the share stood at 49.0% in 2014 (49.4% in 2013).

Among

the EU states, general government expenditure varied in 2014 from less than 35%

of GDP in Lithuania and Romania to more than 57% in Finland, France and

Denmark.

Thus, only in six EU states, including three Baltic States, government expenditures have been less than 40%.

GDP and government expenditure

Something shall be mentioned to understand the way Eurostat used “government expenditure” figures. As a rule, GDP (Gross Domestic Product) represents the broadest quantitative measure of a national economy's total economic activity. More specifically, GDP represents the monetary value of all goods and services produced within a national economy's geographic borders over a specified period of time, usually a year.

GDP can be calculated in several ways: e.g. through production approach, through income statistics and through expenditure approach.

It is the government expenditure, which the Eurostat’ account is related to; and –to repeat- it is only one of the national GDP’s components, as calculated through expenditure approach.

The other components shall be mentioned too, e.g. consumption, investment and net exports (trade balance through export-import).

Thus, Eurostat covers all expenditure made by the member states’ government, which is, however, only one part of GDP.

According to the EU statistical approach, the general government sector has four subsectors:

2. state government, among the reporting EU Member States and EFTA countries, this is only applicable in Belgium, Germany, Spain, Austria and Switzerland;

3. local government;

4. social security funds, social security funds are not separately reported in Ireland, Cyprus, Malta, the United Kingdom and Norway.

In the European system of accounts (ESA2010), paragraph 2.111 the general government sectors is defined as the general government sector (S.13) consisting of:

- "… institutional units which are non-market producers whose output is intended for individual and collective consumption, and are financed by compulsory payments made by units belonging to other sectors, and institutional units principally engaged in the redistribution of national income and wealth."

In the European system of accounts (ESA95), paragraph 2.68, the sector "general government" has been defined as containing:

= "All institutional units which are other non-market producers whose output is intended for individual and collective consumption, and mainly financed by compulsory payments made by units belonging to other sectors, and/or all institutional units principally engaged in the redistribution of national income and wealth".

Therefore, the main functions of general

government units are:

- to organise or redirect the flows of money, goods and services or other assets among corporations, among households, and between corporations and households; in the purpose of social justice, increased efficiency or other aims legitimised by the citizens; examples are the redistribution of national income and wealth, the corporate income tax paid by companies to finance unemployment benefits, the social contributions paid by employees to finance the pension systems;

- to produce goods and services to satisfy households' needs (e.g. state health care) or to collectively meet the needs of the whole community (e.g. defence, public order and safety).

http://ec.europa.eu/eurostat/statistics-explained/index.php/Glossary:General_government_sector

EU’s GDP: division by the member states

GDP in the EU-28 had reached € 13.9 trillion in 2014, which was about 6.2 % more than in the United States. The euro area (EA-19) accounted for 72.6 % of the EU-28 GDP in 2014, down from 75.8 % in 2009.

In 2014, the sum of the five largest EU state economies (Germany, the UK, France, Italy and Spain) was 71.4 % of the EU total GDP; note: cross-country comparisons should be made with caution as notably exchange rate fluctuations may significantly influence the development of nominal GDP figures when converted into a common currency. Thus, exchange rate is the price of one country’s currency in relation to another.

The highest growth rates in 2014 were recorded in

Ireland (4.8 %), Hungary (3.6 %), Malta (3.5 %) and Poland

(3.4 %). Growth in 2014 in Spain (1.4 %) was marginally above the

EU-28 average (1.3 %) and this was the first annual growth in the Spanish

economy since 2008. While GDP growth in 2014 in Portugal (0.9 %) and

Greece (0.8 %) was below the EU-28 average, for Portugal this was the

first annual growth since 2010 and for Greece the first since 2007.

The Cypriot, Italian and Finnish economies contracted for the third consecutive year in 2014 while in Croatia the run of consecutive annual falls in real GDP extended to six years: in three of these four Member States the contraction in 2014 was relatively small, the exception being Cyprus where GDP fell 2.3 %.

The average annual growth rates of the EU-28 and the euro area (EA-19) between 2004 and 2014 were 0.9 % and 0.7 % respectively. The highest growth, by this measure, was recorded for Poland (average growth of 3.9 % per annum) and Slovakia (3.8 % per annum), followed by Romania (2.7 %), Bulgaria, Latvia and Malta (all 2.5 %).

By contrast, the overall development of real GDP during the period from 2004 to 2014 in Greece, Italy and Portugal was negative.

As to the structural impetus into GDP, services contributed 73.6 % of the EU-28’s total gross value added in 2013 compared with 71.5 % in 2003. The relative importance of services was particularly high in Luxembourg, Cyprus, Malta, Greece, France (2012 data), the United Kingdom, Belgium and Denmark where they accounted for more than three quarters of total value added.

According to “European Economy Spring 2015” account, only 12 EU member states cope with the main EU’s requirement for a “sound economy”, i.e. public debt shall not exceed 60% of the GDP. Fortunately, all three Baltic States are in this “lucky group” together with Denmark, Sweden, Poland and Finland. All other are much more above the required limits… Even the average among the eurozone states is heading to 100 per cent! And in six states –Belgium, Cyprus, Ireland, Portugal, Italy and Greece the public debt is over 100 per cent.

Who and why has allowed that happen; it doesn’t make the EU economy stable, does it!?

Income distribution within the EU states

An analysis of GDP within the EU-28 from the income side shows that the distribution between the production factors of income resulting from the production process was dominated by the compensation of employees, which accounted for 47.9 % of GDP in 2014.

The share of gross operating surplus and mixed income was 40.2 % of GDP, while that for taxes on production and imports less subsidies was 11.9 %.

Romania had the lowest share of the compensation of employees in GDP (31.3 %), followed by Greece (33.4 %), while shares of 50.0 % or higher were recorded in seven EU states, peaking at 53.1 % in Denmark.

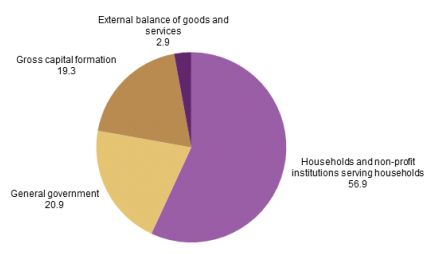

|

| Expenditure components of GDP, EU-28, 2014 (% share of GDP) |

More on EU-Member States economic statistics on:

http://ec.europa.eu/eurostat/statistics-explained/index.php/National_accounts_and_GDP

Example: the US government expenditures

The US Federal government budget was about $3.021 tril. in 2014, $3.176 in 2015 and expected to be $3.525 trillion in 2016 (in 2000 it was just $2trillion).

The individual taxpayers provide most of the income for the Federal Government’s budget. That's because income taxes contribute $1.646 trillion, nearly half of the total. Another third ($1.1 trillion) is contributed by the payroll taxes.

This includes $801 billion for Social Security, $245 billion for Medicare and $56 billion in unemployment insurance. Corporate taxes toss in $473 billion, while excise taxes and customs tariffs contribute $150 billion.

U.S. federal payroll taxes include:

· Taxes withheld from employee pay for federal income taxes (FIT) owed by the employees. The amount of FIT is determined by information employees provide on Form W-4 at hire. This form can be changed by the employee at any time and as often as the employee wishes.

· Taxes paid for social security and Medicare, called FICA taxes (FICA stands for "Federal Insurance Contributions Act"). Employees and employers share these FICA taxes, with the employer deducting the employee share (one-half the total due) from employee wages/salaries, and the employer paying the other half.

Most of the taxes in the budget are either through income or payroll taxes:

· Income taxes contribute 47%.

· Social Security, Medicare and other payroll taxes are 32%.

· Corporate taxes are 13%.

· Excise taxes and tariffs contribute 3%.

· Earnings from the Federal Reserve's holdings (thanks to Quantitative Easing) add 2%.

· Other miscellaneous revenue make up the remaining 3%.

It's estimated that each US taxpayer works until April 21 to pay for all Federal revenue collected. This is known as Tax Freedom Day.

Reference: http://biztaxlaw.about.com/od/glossaryp/a/payrolltaxes.htm

As a rule, GDP per capita allows to compare the prosperity of countries with different population sizes. For example, U.S. GDP was $17.46 trillion in 2014, the biggest in the world. However, the United States must spread its wealth among 319 million people. As a result, its GDP per capita is only $54,800, making it the 19th most prosperous country per person.

The European Union (EU) is the world's second most prosperous economy, at $17.61 trillion. It's an economy made up of 28 separate countries. Its GDP per capita was only $38,300 because it must spread the wealth among 509 million people.

Japan's GDP per capita was slightly higher, at $37,800, because it can spread the benefits of its economy among only 127 million people.

China's GDP per capita was only

$12,900 because it has four times the number of people (1.36 billion) as does

the U.S. Even though its GDP is $17,63 trillion, the largest in the world, it's got to spread

the wealth among all those people, making it much poorer on a per capita basis.

(Source: CIA World Factbook).

Ten highest GDP per capita in the world (2014)

The most prosperous country per person is Qatar: its GDP per capita is $144,400. The other countries in the “top ten” are: Luxembourg – $92,400; 2. Liechtenstein – $89,400; 3. Macau – $88,700; 4. Bermuda – $86,000; 5. Isle of Man – $83,100; 6. Singapore – $81,300; 7. Monaco – $78,700; 8. Brunei – $77,700 and 9. Kuwait – $71,000.

Source: http://useconomy.about.com/od/glossary/g/Gdp-Per-Capita.htm

US budget and GDP composition

The BEA (Bureau of Economic Analysis) divides U.S. GDP into four major components:

1. Personal Consumption Expenditures

Nearly 70% of what the United States produces is for personal consumption. In 2014, $11.929 trillion of the total $17.418 trillion produced in the U.S. went toward household purchases. The BEA sub-divides personal consumption expenditures into goods and services.

Goods contributed $3.968 trillion in 2014, almost 1/4 of total GDP. Goods are further sub-divided into two even smaller components. The first is durable goods, such as autos and furniture; this is the smallest sub-component, at only $1.302 trillion. The second is non-durable goods, such as food, clothing and fuel, which contributes $2.666 trillion. The retailing industry is a critical component of the economy, since it delivers all these goods to the consumer (the latest data is at: latest retail sales statistics).

Services are a much larger sub-component of personal consumption expenditures. In 2014, $7.96 trillion in services was produced, nearly half (45.7%) of GDP. This is much larger than in the 1960s, when services contributed less than 30% to the economy. A large driver of this growth has been the dramatic increase of the financial services and healthcare industries. Most of these are consumed in the States, as services are difficult to export.

Why does personal consumption make up such a large part of the U.S. economy, one might ask? America is fortunate to have a large domestic population within an easily accessible geographic location. It's almost like a huge test market for new products. That advantage means that U.S. businesses have become very good at knowing what consumers want.

2. Business Investment

Business investment includes purchases that companies make to produce consumer goods. However, not every purchase is counted. If a purchase only replaces an existing item, then it doesn't add to GDP and so isn't counted.

Total business investment in 2014 was $2.854 trillion, beating its pre-recession peak of $2.327 trillion in 2006, and nearly doubles its recession low of $1.549 trillion in 2009. The BEA divides business investment into two sub-components: Fixed Investment and Change in Private Inventory.

Most of fixed investment is non-residential investment, contributing $2.211 trillion in 2014. This consists primarily of business equipment, such as software, capital goods, and manufacturing.

A small but important part of non-residential investment is commercial real estate construction. The BEA only counts the new construction that adds to total commercial inventory. Resales aren't included, since these structures were counted as contributing to the GDP in the year they were built. Commercial real estate's contribution to GDP went from a high of $586.3 billion in 2008 to its low of $376.3 billion in 2010. This represents a decline from 4.1% to 2.6% of GDP. In 2014, it rebounded a bit to $507 billion or 2.9% of GDP.

One might wonder why so much commercial real estate was still being built during the recession. That's because the commercial real estate pipeline can take years from initiation, getting financing and zoning approvals, to final construction. Once a building gets into the pipeline, it will be completed, even if tenants can't be found or pull out, and the building is left vacant. For more on this cycle, see Commercial Real Estate Lending.

Fixed investment also includes residential construction, which includes new single-family homes, condos and townhouses. Just like commercial real estate, the BEA doesn't count housing resales as contributing to GDP. New home building reached its peak in 2005, when it added $775 billion to GDP. It didn't hit bottom until 2011, when only $338.7 billion was added. Housing's contribution to GDP plummeted from 6.1% to 2.2% during this time. Residential construction rebounded to $559 billion or 3.2% of GDP in 2014.

Combined, commercial and residential real estate construction contributed $1.195 trillion, or 8.9% of GDP, at its peak in 2006. It fell to a low of $716.9 billion in 2010, or 4.9% of GDP. In 2014, it was $1.006 trillion, or 6.1% of GDP.

Government spending added $3.176 trillion to the economy in 2014, 18.2% of total GDP. This was up from 17% in 2000, but slightly less than the 19% it contributed in 2006. In other words, the government was spending more when the economy was booming, when it should have been spending less to cool things off. Slower spending now is a result of sequestration, which was also timed poorly. Some say that Austerity measures shouldn't be used when the economy is struggling to recover.

The Federal Government added $1.219 trillion. Nearly two-thirds of this, or $761 billion, was military spending. On the other hand, state and local governments can't spend more during a recession. They are usually mandated to balance their budgets, and so must cut spending when tax revenues drop. Presently, then the recession is over, state and local government contributed $1.957 billion.

4. Net Exports of Goods and Services

Imports and exports have opposite effects on GDP.

Exports add, while imports subtract, from GDP. The United

States imports more than it exports, creating a trade deficit. That's because America

still imports a lot of petroleum, despite gains in domestic shale oil production.

The U.S. service-based economy is difficult to export (for more, see Import and Export Components).

In 2014, imports were $2.875 trillion, while exports were $2.335 trillion. As a result, international trade subtracted $540 billion from GDP. (Source: U.S. Bureau of Economic Analysis, National Income and Product Accounts Tables; Gross Domestic Product Note: The figures reported are real GDP, and are rounded to the nearest billion).

Mandatory spending consumes most of the US government’s budget

Mandatory spending is the benefits provided by Social Security, Medicare and other programs established by prior Acts of Congress. It consumes nearly two-thirds of total spending. It's estimated to come in at $2.543 trillion in FY 2016.

The breakout of the major programs:

· Payments to retirees for Social Security ($938 billion) and Medicare ($583 billion).

· Income support programs such as Medicaid ($351 billion), Food Stamps, Unemployment Compensation, Child Nutrition, Child Tax Credits, Supplemental Security for the blind and disabled, and Student Loans. For more, see Welfare Programs: Myths vs Facts: .

· Retirement and Disability programs for Civil Servants, the Coast Guard and the Military.

· The TARP program and a credit from healthcare reform in FY 2011. The Troubled Asset

Recovery Program (TARP) had its roots in the October 2008 bank bailout bill. Then Treasury Secretary Hank Paulson's original idea was to set it up as a reverse auction.

Mandatory spending is skyrocketing, thanks to the huge number of Baby Boomers who are reaching retirement age. Social Security and Medicare benefits have grown from 28% of the budget in FY 1988, to 36% in FY 2016; they will consume 40% of the budget by FY 2024.

Source: http://useconomy.about.com/od/fiscalpolicy/p/Budget_Spending.htm?utm_term=federal%20government

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!