Analytics, Baltic, Direct Speech, Exchange, Financial Services

International Internet Magazine. Baltic States news & analytics

Tuesday, 30.12.2025, 11:00

2019 on Baltic Stock Market – the Good, the Bad or the Ugly?

Print version

Print version

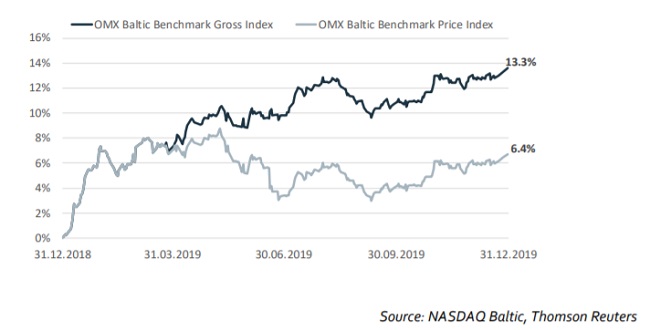

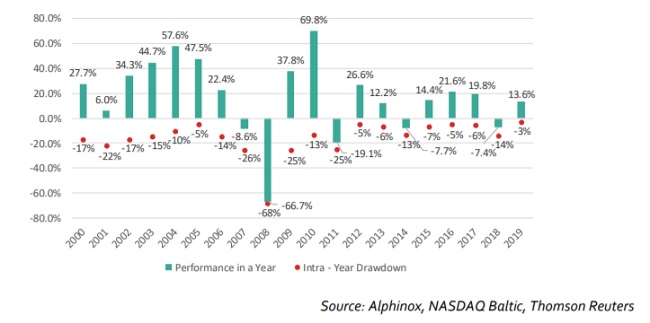

Although 2019 did not bring stellar results to Baltic

investors within a historical perspective, one could have slept well at nights

as volatility was very moderate. On the chart below one can spot that 2019 was

a year with the lowest intra-year drawdown (peak-to-trough decline) of just 3%

over the last two decades. However, we expect the uncertainty around global

economy to increase in 2020, which could lead to higher volatility and,

therefore, higher drawdown.

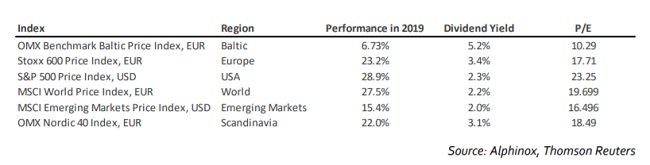

Many Baltic investors, though possibly happy with

double-digit (13.6% to be precise) total return, might feel envious seeing what

a crazy rally European (STOXX 600 with 23.2%) and US market (S&P 500 index

with 28.9%) have experienced. The main driving force behind this growth

evidently was ongoing loose monetary policy conducted by Federal Reserve and

ECB.

In 2019 Baltic market remained on the sidelines, watching

other markets taking off, but nevertheless still offering attractive dividend

yield of 5.2% and trading at a discount to peers (P/E 10.3).

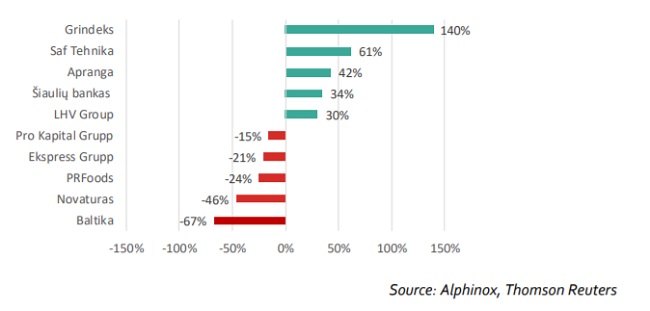

Tops and flops in Baltics

Grindeks shareholders should have been very happy with a gain of 140% in 2019, with share price rocketing in response to the mandatory share buyback by the major shareholder. Another star was SAF Tehnika – the stock that was badly sold-off in 2018 and partly recovered on positive financial news. Additionally, share price got support from major shareholder Koka Zirgs that acquired some additional free-float shares.

Third best result goes to Apranga, which has also recovered after being

oversold in 2018 and which reported improved financial results thanks to the

significant store count expansion in Riga (newly built shopping mall Akropole

and expansion in Alfa). Apranga’s stock was also supported by major

shareholder that increased its stake.

2019 was quite miserable for Baltika and Novaturas

shareholders. The stock price of both companies continued their negative

performance trend also last year. Baltika marketing brands such as

Monton and Baltman undergo restructuring process in an attempt to survive in a

very competitive apparel industry. Novaturas’ share price drop is caused

by company’s inability to appeal to investors with satisfactory financial

results as competition increases and hot summer also took its toll.

Market with value character

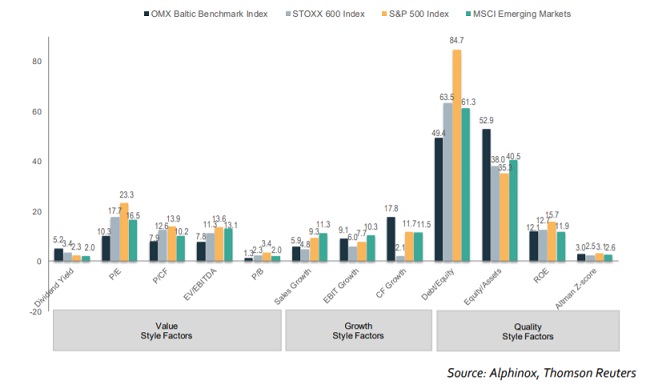

Baltic market clearly is a value market – if compared to the

global equity markets, it has the cheapest valuation on all accounts – P/E,

P/B, P/CF, while the dividend yields are envious. This fact deserves particular

attention at times when one’s idle money yield virtually nothing when kept in

deposits.

Baltic companies are not capable of expanding top line at a

high pace, which is evidenced by rather low sales growth, but they manage to be

efficient, which results into decent growth in operating profit. Another trait

of Baltic companies is conservatism with regard to capital structure: low

interest rates are not an incentive strong enough for the top management to

take on more debt as judged by the levels of Debt to equity and Equity to

Assets. Return on capital makes Baltic companies comparable with their peers

operating in Western Europe and in Emerging markets.

Summarizing it all, there is good fundamental quality of the

Baltic companies and a potential for further growth, which can be unlocked

entering the new decade.

- 25.01.2021 Как банкиры 90-х делили «золотую милю» в Юрмале

- 29.12.2020 В Латвии вводят комендантский час, ЧС продлена до 7 февраля

- 29.12.2020 В Rietumu и в этот раз создали особые праздничные открытки и календари 2021

- 29.12.2020 Latvia to impose curfew, state of emergency to be extended until February 7

- 29.12.2020 Lithuanian president signs 2021 budget bill into law

- 29.12.2020 Президент Литвы утвердил бюджет 2021 года

- 28.12.2020 Рынок недвижимости Эстонии осенью начал быстро восстанавливаться

- 28.12.2020 Tartu to support students' solar car project

- 28.12.2020 New Year Cards and Calendars of Rietumu Bank presented

- 22.12.2020 In 2019, household disposable income in Latvia increased by 6.8%

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!