Analytics, Covid-19, Good for Business, Industry, Latvia, Markets and Companies

International Internet Magazine. Baltic States news & analytics

Monday, 23.02.2026, 13:30

In August business confidence indicator in Latvian retail trade has reached positive value

Print version

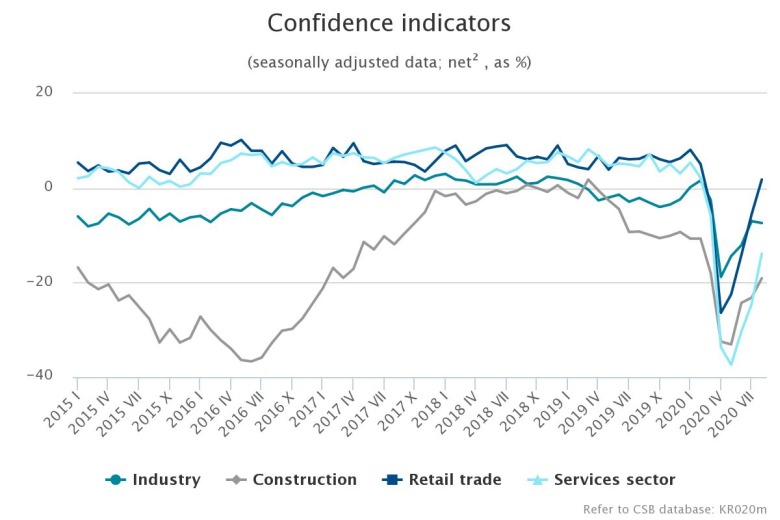

Print versionBusiness confidence indicators characterize general situation in the sector and they are acquired by carrying out business surveys in industry, construction, retail trade and services sector. If the indicator is above zero, business environment is positive, if it is below zero – business environment is negative.

For the first time since COVID-19 crisis confidence indicator in retail trade is positive

According to seasonally adjusted data, in August confidence indicator in retail sale for the first time, since economy of Latvia was significantly affected by consequences of COVID-19, has reached positive value 1.8. As compared to July, this indicators has grown by 7.4 percentage points. Improvement of confidence indicator was mainly affected by positive assessment of respondents regarding growth of economic activity during the last months. As situation in business continued to improve, confidence indicators in August were positive both in retail sale of food products and of non-food products, as well as in retail sale of fuel and trade of motor vehicles, motorcycles and their parts and accessories, in some sectors even exceeding indicators of the respective period of the previous year. Confidence still remained negative in maintenance and repair of motor vehicles.

Confidence indicator in services sector as improved significantly, but remains negative

In services sector in August 2020, according to seasonally adjusted data, confidence comprised -13.9. As compared to July, this indicator has grown by 10.7 percentage points. In August, confidence indicators still are negative in major part of services sectors, reaching positive values only in building maintenance and landscape architectural services sectors (14.8), computer programming (11.7), information services (5.0), postal and courier activities (20.1), rental and leasing services sector (21.9), as well as financial service activities, except insurance and pension funding (12.1). The lowest indicators still were in accommodation (-37.6) and travel agency and tour operator sectors (-53.6). In August, compared to July, confidence indicator of catering services has improved sharply (by 40.7 percentage points), reaching value -2.6, which still lags behind confidence of this sector in August last year by 11.4 percentage points.

Confidence indicator in construction has increased by 4.1 percentage points; remains negative

In August confidence indicator in construction, according to seasonally adjusted data, comprised -19.1 and, compared to the previous month, increased by 4.1 percentage point, which was affected by a more positive assessment of entrepreneurs regarding the level of construction orders, but assessment of entrepreneurs regarding the expected development of employment in the next three months was more negative. Confidence indicator increased in construction of buildings, but reduced in civil engineering and specialized construction activities.

As compared to July this year, in August the number of respondents indicating insufficient demand (33 % of construction enterprises surveyed) and impact of COVID-19 (7 % of respondents) out of all factors affecting economic activity of construction enterprises has reduced, but the number of enterprises indicating financial difficulties as restrictive factor has slightly increased (15 % of respondents). In August, economic activity of 36 % of construction enterprises was not affected by any restrictive factor. More than a year ago construction enterprises felt insufficient demand (of 10 %), but less – lack of labour force and impact of weather (10 % and 2 %, respectively).

Confidence indicator in manufacturing remains negative

In August confidence indicator in manufacturing comprised –7.4 (0.4 percentage points less than in July this year). Compared to the previous month, slightly less optimistic are forecasts of enterprise managers regarding activity of their enterprise in the next three months (the expected production activity), as well as development of sale prices of goods and employment in the following months. However, slightly more positive is current level of orders and assessment of overall economic activity.

Confidence indicator reduced in such manufacturing sectors as manufacture of machinery and equipment n.e.c., manufacture of metal products, other manufactured goods n.e.c. manufacture of paper and paper products. In turn, the largest growth, as compared to the previous month, was registered in manufacture of textiles, manufacture of wearing apparel, manufacture of furniture and manufacture of basic pharmaceutical products and pharmaceutical preparations.

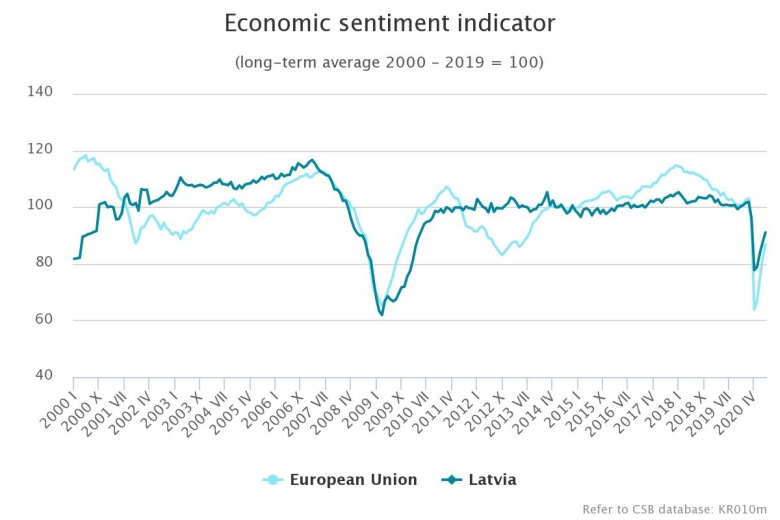

In August 2020 economic sentiment indicator comprised 91.0 (3), which is 3.4 points more than in July. Economic sentiment indicator characterizes general socio-economic situation in the country during a certain period of time (month), and it is calculated by the European Commission, Directorate-General for Economic and Financial Affairs for all EU countries according to a common methodology, taking 15 various seasonally adjusted components included in industry, construction, retail trade and services sector, as well as in consumer confidence indicator, as a basis.

More information on confidence indicators is available in the CSB database section “Business indicators”.

1) Business surveys in industry, construction, retail trade and services sector are carried out by the CSB monthly, accordingly methodology of the Joint Harmonised EU Programme of Business and Consumer Surveys co-financed by the European Commission.

2) Net (balance) is calculated as difference between positive and negative answers of entrepreneurs surveyed, which are expressed in per cent.

3) Value of the indicator exceeding 100 means that numeric characteristic of the economic situation exceeds long-term average value(2000 – 2019). While value of the indicator smaller than 100 means that characteristic of economic situation is below long-term average value.

- 28.01.2022 BONO aims at a billion!

- 13.02.2021 Моя жизнь в газете. Очерки по новейшей истории Латвии. Глава 1

- 25.01.2021 Как банкиры 90-х делили «золотую милю» в Юрмале

- 30.12.2020 Накануне 25-летия Балтийский курс/The Baltic Course уходит с рынка деловых СМИ

- 30.12.2020 On the verge of its 25th anniversary, The Baltic Course leaves business media market

- 30.12.2020 Business Education Plus предлагает анонсы бизнес-обучений в январе-феврале 2021 года

- 30.12.2020 Hotels showing strong interest in providing self-isolation service

- 30.12.2020 EU to buy additional 100 mln doses of coronavirus vaccine

- 30.12.2020 ЕС закупит 100 млн. дополнительных доз вакцины Biontech и Pfizer

- 29.12.2020 В Rietumu и в этот раз создали особые праздничные открытки и календари 2021

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!