Analytics, Latvia, Real Estate, Statistics

International Internet Magazine. Baltic States news & analytics

Wednesday, 24.04.2024, 12:17

Latvia: In 2019, housing costs an average constituted EUR 151 monthly

Print version

Print versionMonthly housing costs and share thereof in household disposable income in 2012–2019

|

Housing

costs |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

on average per household, EUR |

127 |

134 |

136 |

142 |

140 |

138 |

150 |

151 |

|

on average per household member, EUR |

53 |

55 |

57 |

59 |

58 |

59 |

65 |

67 |

|

share in household disposable income*, % |

17.2 |

17.3 |

16.1 |

15.2 |

14.0 |

13.5 |

13.4 |

12.2 |

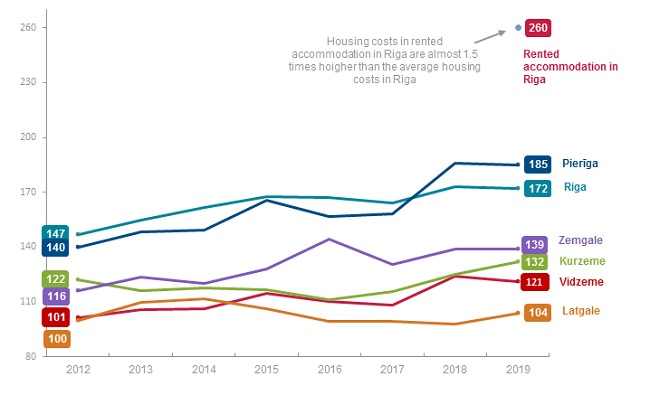

Highest housing costs in Pierīga and lowest in Latgale

Households living in Pierīga spent on average EUR 185 monthly on housing, while in Riga those were EUR 172. In other regions these costs were lower: EUR 139 in Zemgale, EUR 132 in Kurzeme, EUR 121 in Vidzeme and EUR 104 in Latgale. Housing costs cover the average expenditure on housing during both summer season with lower and heating season with higher costs.

The national average costs in households renting accommodation (from individuals, local governments, etc.) constituted on average EUR 182 monthly, whereas in Riga those were EUR 260 monthly.

Single elderly spent one fifth of their income on housing

On average one household spends 12.2% of their income on housing. Housing costs imposed the heaviest financial burden on single elderly population (aged 65 and over) – they spent 22.2% of their disposable income on housing. Housing costs in households consisting of one adult with children constituted 19.4% of their disposable income, whereas single people aged 16–64 spent 18.7%.

In households consisting of a couple housing costs varied between 10.1% among those having one child and 11.7% among those with two children. Couples without children spent 11.0% of their disposable income on housing.

Average

housing costs by household type and size, 2019

|

Household

type |

Monthly

housing costs, EUR |

Share

of housing costs in disposable income, % |

Average

number of household members |

|

ALL HOUSEHOLDS |

151 |

12.2 |

2.3 |

|

Single person aged 16–64 |

131 |

18.7 |

1.0 |

|

Single person aged 65 and over |

93 |

22.2 |

1.0 |

|

One adult with children |

194 |

19.4 |

2.3 |

|

Couple without children |

143 |

11.0 |

2.0 |

|

Couple with one child |

191 |

10.1 |

3.0 |

|

Couple with two children |

250 |

11.7 |

4.0 |

|

Couple with three and more children |

226 |

11.5 |

5.3 |

* Housing

costs of the reference period are compared with the household disposable income

of the previous period.

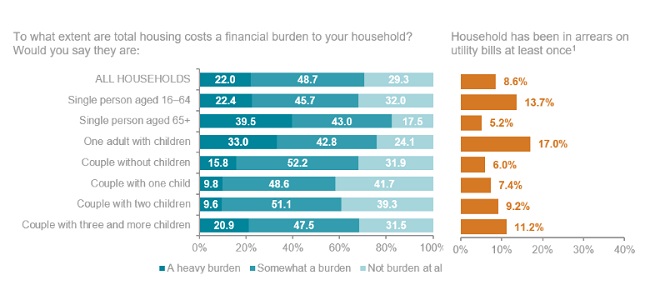

Share of people admitting that housing costs impose a heavy burden has dropped to 22%

In 2019, 22.0% of households admitted that housing costs impose a heavy burden, which is 6 percentage points less than in 2018 (28.2%). At the same time, the share of households admitting that housing costs are somewhat a burden has risen (from 47.6% in 2018 to 48.7% in 2019), as has the share of those admitting that housing costs was not burden at all (from 24.4% in 2018 to 29.3% in 2019).

Last year, the largest share of households admitting that housing costs are a heavy burden was observed in Zemgale region – almost one third or 29.7%, whereas the smallest share of such households was registered in Riga – 16.7%.

The greatest difficulties to cover housing costs were observed in households consisting of single person aged over 65 and single-parent families (one adult with children). Housing costs imposed a heavy burden to 39.0% of single elderly people (aged 65 and over) and 33.0% of single-parent families. Among large families (couples with three and more children), 20.9% admitted that housing costs impose a heavy burden, which is notably higher share, compared to the couples with one child (9.8%) and couples with two children (9.6%).

Single-parent families constitute majority of those in arrears for public utilities, whereas single elderly comprise the smallest share

In 2019, 8.6% of the households due to the financial difficulties have been in arrears during the last 12 months. The greatest share of such households was recorded among single-parent families (17.0%), households consisting of single person aged 64 and under (13.7%), as well as couples with three and more children (11.2%). The smallest share of such households, in turn, was observed among households consisting of single persons aged 65 and over (6.5%) and couples without children (6.0%).

Housing cost burden in different types of households, 2019

(as %)

- 28.01.2022 BONO aims at a billion!

- 25.01.2021 Как банкиры 90-х делили «золотую милю» в Юрмале

- 30.12.2020 Накануне 25-летия Балтийский курс/The Baltic Course уходит с рынка деловых СМИ

- 30.12.2020 On the verge of its 25th anniversary, The Baltic Course leaves business media market

- 30.12.2020 Business Education Plus предлагает анонсы бизнес-обучений в январе-феврале 2021 года

- 30.12.2020 Hotels showing strong interest in providing self-isolation service

- 29.12.2020 В Латвии вводят комендантский час, ЧС продлена до 7 февраля

- 29.12.2020 В Rietumu и в этот раз создали особые праздничные открытки и календари 2021

- 29.12.2020 Latvia to impose curfew, state of emergency to be extended until February 7

- 29.12.2020 18-19 января Наталия Сафонова проводит семинар "Управленческий учет во власти собственника"

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!