Analytics, Economics, EU – Baltic States, Investments, Markets and Companies

International Internet Magazine. Baltic States news & analytics

Wednesday, 24.12.2025, 22:41

Swedbank Baltic Report: it's time to invest in boosting long-term growth potential

Print version

Print versionThe business cycle is young and no major imbalances have been built up yet,

the report says, warning that the main risks ahead are associated with

geopolitics and populism.

The growth of the Baltic Sea Index (BSI), drawn up by Swedbank, has been negligible lately. There have been institutional

improvements in the region, but they have been as fast as elsewhere in the

world. To overtake competitors, it is necessary to run faster. Education,

logistics and governance are still the region's main advantages as the Baltic

Sea region is among the world's top 20 in these areas. Meanwhile, more work

remains to be done to achieve improvement in the labor market, diversification

of financial markets and tax policies. The greatest challenge holding back the

region's growth is differences in countries' business environments, the Swedbank report says.

At the same time, the authors of the report acknowledge certain structural

convergence. "If we look back 10 years, we see some convergence in

structural qualities within the region (as measured by the BSI) has actually

taken place, although the BSI for the region improved only marginally."

Poland, Russia and Lithuania have seen the steepest improvement. whereas the

Nordics have experienced declines.

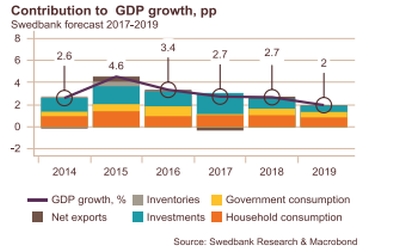

"Following a few mediocre years, in 2017 growth in Latvia has

surprised on the upside. Growth will go downhill but over the next two years

will still remain above its medium-term potential of 2.5-3% per annum. This

cyclical upswing is driven by rising global demand, which is improving overall

domestic confidence and supporting long-overdue pickup in domestic demand.

Growth is seen across all sectors. Over the past decade, exports of goods and

services have contributed most to real GDP growth, boosting its share from 42%

of GDP to the current 62%. In 2017, we forecast export volumes to expand by a

sturdy 5%. With strong global growth continuing, export volumes will surely keep

expanding, but their rate of growth is already past its peak."

The Swedbank analysts expect

labor market challenges to remain also in following years.

Swedbank said in its

Baltic Sea Region Report that Estonia's business environment is above the EU

and regional average, scoring 7.7 points out of 10.

According to the bank Estonia is 23% behind the world's best business

environments. Estonia's rating was lower than Sweden's, Norway's, Denmark's,

Finland's and Germany's, but was higher than the EU average and Lithuania's,

Poland's, Latvia's and Russia's average. Russia received the lowest rating out

of all the countries in the region.

"The Estonian economy is doing rather well at the moment: GDP growth

is rapid, the unemployment rate is low, the current account is in surplus. The

current good times should be used to prepare for more difficult times.

According to Swedbank's index,

however, for the third straight year, the overall business environment in

Estonia did not improve in 2017, compared with other countries. The government

should focus on long-term structural issues rather than short-term political

gains," the bank said.

One year ago, the economy was sending mixed signals: the labour market was

overheating but economic growth remained modest. This year's data show clearly

that, besides the labor market's tightening, economic activity has entered a

fast-growth phase. The economy is expected to grow well above its potential in

2017-2018 as stronger external demand lifts exports and investments. The latter

are also supported by the EU structural funds. Higher inflation eats into

consumption this year, but in 2018 consumption is expected to strengthen again,

mostly because remarkably higher tax-free income will push up the net wages of

most employees, the bank said.

According to Swedbank, the main

risks to growth are external – political uncertainty in Europe and/or possible

corrections in the Scandinavian real estate market could have an impact on the

Baltics through financial links, lower export demand, or the incomes of the

workers employed there. Domestically, the scarcity of labor is driving up labor

costs and could pose a threat to competitiveness. This scarcity of a suitable

workforce is the most important factor restricting business for one-third of

the manufacturing and service companies and for one-half of the construction

companies. Construction volumes have increased significantly this year. The

good news is that, currently, construction prices are still growing modestly

despite vigorous demand.

In the current phase of economic development, the government should plan

its expenditures carefully. Although the nominal fiscal deficit is small, as

nominal GDP growth has accelerated, the structural fiscal deficit is more

noticeable and will widen in 2018, given the large positive output gap.

Government spending should be planned in a conservative manner. The state's tax

income in 2018 is hard to predict due to substantial changes in tax policy in

effect from next year (lower corporate income tax rates on "regular"

dividends, different taxing of banks, an increase in the monthly tax exemption

of individuals, and excise tax rate hikes).

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!