Analytics, Economics, EU – Baltic States, Latvia, Legislation, Markets and Companies

International Internet Magazine. Baltic States news & analytics

Tuesday, 30.12.2025, 12:05

OECD’s economic survey for Latvia: better policies for better lives

Print version

Print versionSince July 2016, Latvia is an OECD member; Estonia joined it in

December 2010. These two Baltic States’ contribution to OECD is 1.4% of GDP

(Lithuania is not a member).

The OECD is a kind of global “think-tank” and “economy-monitoring”

group of experts in such fields as national fostering economic development issues,

combating poverty, ensuring environmental impact of growth and in general social

development progress. It is also dealing with a range of issues, including

raising the standard of living in the member countries, contributing to the

expansion of world trade and promoting economic stability. It’s head-quarter is

in the Chateau de la Muette in Paris,

France.

See more on OECD: Organization for Economic Cooperation and Development

(OECD), in: http://www.investopedia.com/terms/o/oecd.asp#ixzz4u3jEyoln

OECD consists of 34 member countries with the main purpose of discussing and providing the

member states with economic reviews on national polit-econ development while supporting

open market economy growth. Reference: http://www.investopedia.com/terms/o/oecd.asp.

History and functions

The Organisation for European Economic

Co-operation (OEEC) was established after World War II in 1948, to mainly administer

the U.S.- funded Marshall

Plan for post-war European reconstruction. The group emphasized the

importance of working together for economic development, with the goal of

avoiding any more European warfare. The OEEC was instrumental in helping the

European Economic Community (EEC), which has since evolved into the European

Union, in establishing a European Free Trade Area.

In 1961, the United States and Canada joined the

OEEC, which changed its name to OECD to reflect the broader membership with numerous

countries that joined the OECD since; as of 2016, there are 34 member states.

The OECD’s main “products” are officially published

economic reports (global, regional or national in orientation), statistical

databases, analyses and forecasts on the outlook for economic growth around the

world and in the member states. A group of experts analyzes and reports on the

impact of social-economic growth, and makes policy recommendations.

OECD is the global leader in tax issues: it maintains

a so-called "black list" of nations that are considered uncooperative

tax havens. It

led a two-year effort with the Group of 20 nations (G-20) to encourage tax

reform worldwide and eliminate tax avoidance

by constructive corporations. The recommendations included an estimate that

such avoidance costs the world’s economies between $100 billion and $240

billion in tax revenue annually.

Besides, OECD provides consulting assistance and

support to nations in Central and Eastern Europe in implementing market-based

economic reforms.

OECD assessment and recommendations

The

yearly membership in the organisation for each of the two Baltic States

(Lithuania is not a member) is 1.4% of GDP; hence for Latvia it is about €300

million. The two booklets of the OECD analysis with a total of about 200 pages,

seems to be the most expensive survey: over one million euros per page! However,

depending on the national economic power, other OECD members’ GDP share is much

bigger, e.g. 5.4% for France, 7.4% for Germany, 4.1% for Italy, 3% for Spain

and 5.5% for the UK (the US share is the largest – 20.6% of GDP). Quite

notable: the states’ contribution to OECD is much larger than, for example, for

the European Union, which is about 1%. Are these expenses well worth for

Latvia?

The OECD economic survey for Latvia consists of survey booklet (139 pages) and an overview (55 pages). Latvian economic situation was initially reviewed in May 2017and an agreed report was presented in June 2017; the survey’s presentation in Latvia occurred in mid-September. A previous survey was issued by OECD in February 2015.

OECD’s Latvian survey consists of: a) country’s economy assessment with some recommendations and b) evaluating progress in Latvian structural reforms. Besides, there are two thematic chapters: a) analysis of Latvian potentials in globalisation (global value chain) and b) analysis of country’s economic and social infrastructure. Survey is richly equipped with numerous tables and figures.

Assessments: additional efforts needed

Showing

some positive aspects in Latvian growth, e.g. GDP increase by 20% since 2010,

rising wages, solid fiscal position (with balanced government budget and public

debt near 40% of GDP with EU’s limits at 60%) and strong financial market

confidence, to name a few.

Riga

metropolitan area has been a key economic growth driver, contributing about 69%

to national GDP. It’s good for the metropolitan region but shows a drastic

discrepancy with the rest of the country, e.g. Latgale and Zemgale, where

unemployment and risk-of-poverty rate are higher. Thus, although peoples’

income convergence “may have resumed” (p.14), growth shall be more inclusive:

Latvians are still less satisfied with their lives (according to OECD’s Better

Life Index).

The

relative weakness areas are: little access to well-paid jobs, problems in

health care system and the housing market, poverty being among the highest in

the OECD, low availability of affordable quality housing, 15% of dwellings lack

basic facilities, life expectancy is six years below the OECD level, etc.

(p.15).

References:

www.oecd.org/eco/surveys/economic-survey-Latvia.htm

Latvian

economic growth has been consumption based; e.g. continued robust household

consumption is supported by strong real wage growth. However, exports are still

largely low value-added, reported the OECD experts. Still, the share of exports

going to Russia remains the third largest after Lithuania (18%) and Estonia

(12%). Latvia’s goods exports still largely consists of raw materials and

natural-resource-intensive products: “in the medium-term the transit of exports

from Russia is expected to continue declining but still contributes

substantially to service export revenues” (p.17).

There is much to do in the export sector: Latvia’s export is concentrated in activities with relatively small “quality upgrading and product differentiation”, argued the survey and further loss of cost competitiveness (partly due to strong wage growth, higher than in other two Baltic States) can undermine country’s export performance. As a small open economy, Latvia is exposed to trade with main partners –the EU and Russia; exports to the UK will diminish and Brexit will lower emigrants’ remittance, which amounts to 0,8% of GDP, and possibly could boost return migration.

High

structural unemployment (instigated by local differences) raises the risk of

poverty, underlines the survey: these two features are much higher in the East

(particularly in Latgale region) than in the Riga municipality and Pieriga

area. Thus, 72% of vacancies are registered in the latter, while 45% of the

unemployed were registered for a year or longer, mostly in Eastern rural areas.

Besides, unemployment benefits are reduced by half after six months and expire

after nine months (p.22). And unemployment rate is almost five times higher for

workers with low education; unemployment rate of workers aged 55-65 is close to

10%, which is among the highest in the EU. The hourly earnings gap between men

and women (about 17%) also contributes to inequality.

The

survey notes difficulties in credit growth while depicts supportive monetary

policy. Thus, the three largest banks (two are owned by Nordic banks) are

directly supervised by the ECB. Besides, Latvia benefits from the Single

Resolution Mechanism (SRM), which provides an EU-wide framework for resolution

of large banks. Other Latvian banks are supervised by the states’ Financial and

Capital Market Commission (FCMC); the latter implements national

macro-prudential policies as well together with the Bank of Latvia and Ministry

of Finance. Foreign deposits in Latvian banks amount to around 43% of total

deposits at the end of 2016; they are mostly related to business links with

Russia, as OECD reports (p. 27).

However,

stricter anti-money laundering and other controlling finances’ rules will be

further tightened to withstand large chocks.

Attention to tax reforms

Latvian Parliament

approved during 2016-17 reforms of personal and corporate income tax in line

with the country’s general idea of broader tax reform. Reforms are reducing the

basic personal income tax rate from 23 to 20% for incomes up to €20 thousand per

year starting in 2018. Corporate tax rates are increased from 15 to 20% with

the exception that non-distributed corporate tax income will be fully tax exempt,

which turns such tax into a tax on distributed profits, as it is in Estonia where

firms have responded to the tax system largely by accumulating cash rather than

investing in fixed assets. Corporate tax reform could encourage investment by

boosting retained earnings, which is the main source of finance for business

investment. However the current corporate tax rate is already low and

accelerated depreciation allowances are generous.

It is clear that lower

personal income taxes reduce the taxation of labour; this is why the OECD

notices that “in view of high poverty, targeting these tax reductions to

low-wage workers may be preferable” (p. 30).

Present micro

enterprise tax system in Latvia exempts small companies from income tax and

social security contributions: instead they pay a low turnover tax. This novice

encourages firms to remain small (on one side) or to keep part of their

activity in the informal sector (on the other) in order to benefit from low

taxation. Young start-up firms financed with venture capital pay a low lump sum

tax per worker, which the OECD report sees as “regressive”. The employees in the start-ups are

not covered by unemployment or pension insurance; the report notices that such tax

breaks should be abolished. There

are also generous tax credits and exemptions for four Latvian special economic

zones, mostly in the port areas.

Latvian government

has taken steps, as recommended by OECD three years ago to lower labour taxes

on low-income earners raised and increase excise and environmental taxes.

The labour tax

wedge is still high; reducing it on low income earners further (presently at

about 42%, with 32% as OECD’s average) could have particularly large benefits

and reduce unemployment and undeclared employment and could damp emigration of

young workers with low wages. Recent forms have increased the basic income tax

allowance for low-income households. This tax allowance now diminishes as

income rises.

The solidarity tax

levied on high salaries progressivity in the personal income tax system could

be a good thing in view of high income inequality.

The tax reform,

argue OECD experts, foresees setting tax rates on capital income received by

households (such as interest income) at 20%, at the same rate as other

household income. Capital income received by households (such as interest

income) is currently taxed at lower rates than other household income. Low

taxes on such income tend to favour high-income households, making the tax

system less inclusive. The tax reform could also reduce administrative costs to

some extent.

Shadow

economy

It is difficult to

capture the exact size of the country’s informal sector (shadow economy), it

was estimated in 2015 to amount to more than 20% of GDP (p.32). Latvian government

has made considerable effort to improve tax collection by intensifying tax

audits on individuals and firms operating in sectors where informal activity is

widespread; introducing criminal sanctions against employers paying undeclared

wages; strengthening controls, resources and co-ordination among relevant

authorities (tax authorities, labour inspectors and customs); and raising fines

and increasing personal liability of company board members. These steps helped

increase tax revenues, which are estimated to have reached 31% of GDP in 2016,

up from 29% in 2015.

Table

I: Size of shadow economy in the Baltic States, %

=The size of shadow

economy (% in GDP): Estonia -15;

Lithuania -17; Latvia -20.

=Underreported

corporate profits (% of actual profit): Estonia

-8; Lithuania-12, Latvia-18.

=Underreported

wages (% of actual wages): Estonia-16;

Lithuania-15; Latvia-18.

The following measures

are envisaged by the Latvian government to raise tax revenues: to provide

essential social services and lower the tax burden on low income earners; to

make better ICT-use for tax law enforcement; to require electronic record

keeping in cash registers; to combat tax evasion in electronic commerce and to

enable electronic exchange of information between credit institutions and tax authorities.

Presently, tax revenues collection in Latvia is one of the lowest in the EU-28:

about 30%, with about 42-47% in other Baltic Sea region’s states (e.g. Sweden,

Denmark and Finland). Surveys show that company owners and managers accept “informal

activity” as a result of their strong dissatisfaction with business legislation.

Compared to Estonia and Lithuania, Latvian businesses display lower trust in

the government: this trust is at the level of 20% compared to over 40% on

OECD’s average and about 60% in Denmark (p.34).

Therefore

increasing trust in public governance helps improve tax morale more direct

political participation possibilities for the population’s willingness to pay

taxes.

Latvian main

corruption prevention and combating bureau budget (KNAB) is formed by a

proposal from the Council of Ministers with parliament’s annual approval, which

is weakening its independence. Full bureau’s independence in necessary for investigating

corruption cases properly. As is the case for competition authorities,

budgetary independence should be reinforced by mechanisms reducing government

discretion, such as fixed multiannual budget allocations and allocation of

fixed revenue sources.

Energy

policy: contributing to green- growth and environment

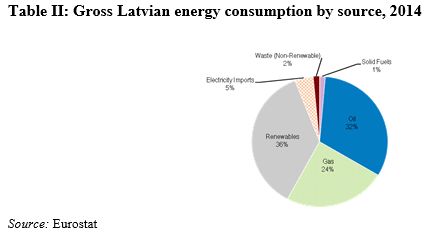

Latvia’s primary

energy supply is still dominated by fossil fuels, in particular oil and gas

(see table below), which is mostly imported from Russia, as well as by locally

generated renewables.

Renewable energy

consumption is growing; it largely reflects use of hydropower and bio-mass

(mostly fuel-wood).

Latvia’s implicit

tax rate on energy is among the lowest in the EU; though taxes for heating are

much lower than for transport and the difference is bigger than in other EU

countries. There is a possibility, according to OECD, to gradually align tax rates

according to the carbon content of the taxed fuels. Carbon taxes on heating and

transportation fuels exist in a number of EU states; however, higher taxes on

heating fuels would need to be accompanied with measures to ensure that the real

incomes of low-income households are protected. This can in part be achieved

through policies to improve energy efficiency.

Energy

consumption in residential buildings in Latvia is 7-10% higher than in the EU

states.

Conclusion

In

the three general executive summaries

experts in the OECD’s survey have been “honestly positive”:

a)

Latvian economy has grown robustly but not enough for strong convergence in

living standards;

b)

boosting growth requires better export performance, and

c)

better access to housing, jobs and health care would boost inclusive growth.

In improving access to low-cost housing, the following measures are recommended by OECD:

= Improving legal certainty in rental regulation and encourage out-of-court procedures;

= Simplify the administrative process for obtaining a

building permit.

= Provide more funding for low-cost rented housing in

areas of expanding employment.

= Expand the mobility programme, which provides

temporary support for relocation and transport.

= Create a nation-wide registry that allows eligible

persons to apply for housing assistance where they expect better job

opportunities.

= Require housing

developers to allocate a proportion of their dwellings as affordable units.

In improving access to health services:

= Reduce out-of-pocket payments especially for the low-income population.

= Develop key service quality and performance indicators

for health care providers at

national, local

and provider-level.

= Deliver preventive care more effectively by expanding

the activities nurses and pharmacists

are

allowed to carry out, notably in rural areas where health services are scarcer.

In improving transport infrastructure:

= Apply the same cost-benefit tests to large national projects as are applied to EU funded

projects.

= Introduce incentive regulation for the prices of

monopoly services set by the infrastructure manager and the incumbent rail

service operator.

= Set wages of managerial staff in the railway regulator

independently from the Transport Ministry.

= Make use of the latest technologies to favour

demand-responsive collective road transport services tailored to the needs of

customers in rural areas.

= Raise the priority of investment in safer road

infrastructure. Improve maintenance of rural roads, Raise the quality of the

most densely trafficked roads with investments in motorway sections and develop

pedestrian-friendly infrastructure in urban areas.

In strengthening energy policy:

= Gradually raise and harmonise the taxation of fossil fuels in transport and heating according to their carbon content.

= Encourage energy efficiency investment in the building

sector through tax-lien financing and utilities’ on-bill financing.

= Support the

deployment of wind energy through competitive tendering.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!