Analytics, Financial Services, Latvia, Legislation, Shadow economy, Taxation

International Internet Magazine. Baltic States news & analytics

Sunday, 21.12.2025, 23:57

A rift in the Latvian budget: large tax debtors

Print version

Print version

Based on the latest study performed by the Stockholm School of Economics in Riga, the shadow economy in Latvia is equal to about 21.3% of the country’s GDP. This is higher than in the neighbouring states of Estonia and Lithuania. This shadow economy can be leveraged to increase the budget but this would be a long-term solution. There still is a high tolerance to not paying taxes in society. Major tax debtors and the fight against the grey market will be among the objectives for the new head of the State Revenue Service (SRS). The country needs to be giving more thought to how it might obtain additional income in order to manage acute necessities.

Combating the shadow economy, promoting export, attracting investment – these are some of the instruments that promote economic growth, but collection of taxes from major tax debtors should not be forgotten: large companies still owe the country 1.4 billion euros in taxes. About 700 million euros is value added tax that Latvia fails to collect on an annual basis.

According to the latest State Revenue Service data, the 100 largest taxpayers currently owe the state over 262.95 million euros.

Many of these debtors may have used various “carousels” and other financial schemes to defraud the state budget. However, their cash flows have been recorded on bank accounts in Latvia. Lately, the Financial and Capital Market Commission has been paying much more attention and doing a lot more to improve transparency of Latvia’s financial system for international transactions, although non-transparent local transactions have not attracted the banking supervisor’s attention.

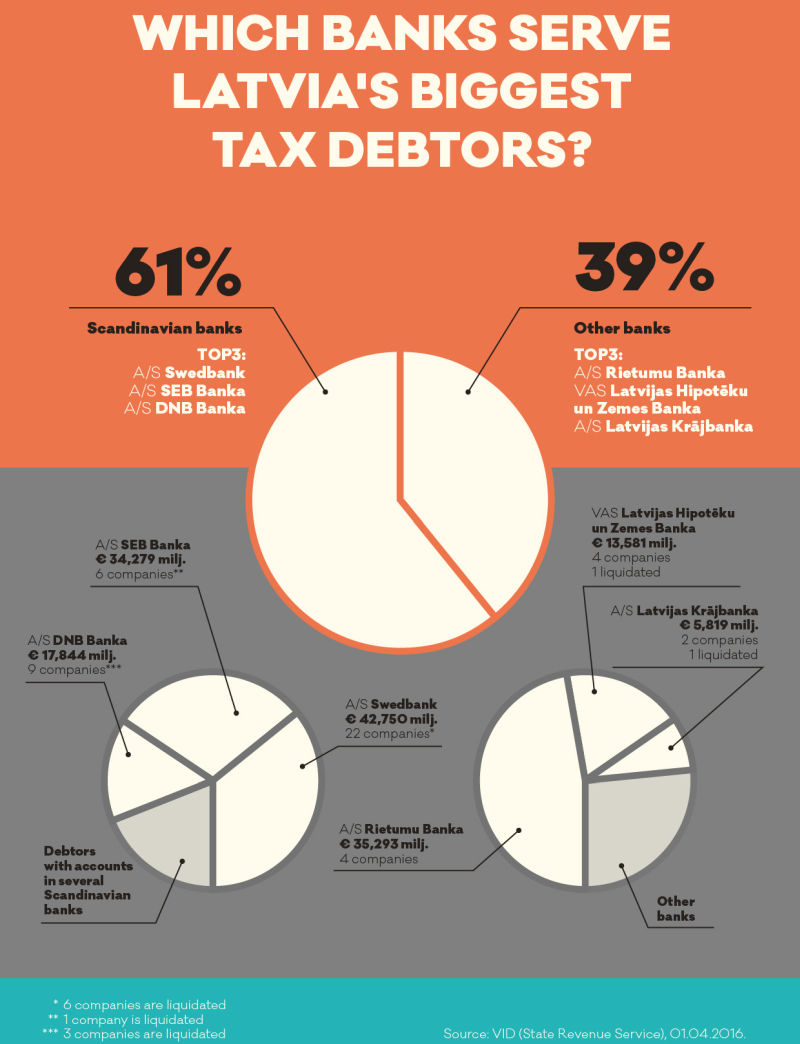

Based on available information, the largest tax debtors are mostly serviced by the five major banks – Swedbank, Rietumu Banka, SEB banka, DNB and Nordea. 79.57% of the total owed in taxes is linked to companies with accounts in the Swedish-funded banks and in Rietumu banka, while the other banks host just 20.43% of the major tax debtors.

The largest number of tax debtors hold their accounts with Swedbank – these are one-fourth of the top debtors, who owe the Latvian government 42.75 million euros, or 22.21% of the total in overdue taxes. SEB banka comes in second with 34.28 million euros or 17.81% of the debt, followed by DNB banka with 17.84 million euros (9.27%).

One therefore hopes that the regulator will continue to pay attention to banks, including those prominent in servicing Latvia’s major tax debtors.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!