Analytics, EU – Baltic States, Internet, Markets and Companies, Technology

International Internet Magazine. Baltic States news & analytics

Monday, 19.01.2026, 22:38

European e-commerce: tearing down barriers to trade

Print version

Print version

The internet and digital technologies are transforming business activity and trade world. However, some barriers do exist in online trade, which mean that citizens miss out on goods and services, internet companies and start-ups have their horizons limited, and businesses and governments cannot fully benefit from digital tools.

The EU's single market –and that on the member states- shall fit for the digital age while tearing down regulatory walls and moving from 28 national markets to a single one. This could contribute €415 billion per year to the European economy and create hundreds of thousands of new jobs.

Hence, the EU digital single market strategy is made up of three policy areas or 'pillars': better online access to digital goods and services; better digital networks and infrastructures; and ensuring that EU’s economy and business can get full advantage of digitalisation.

See more on http://ec.europa.eu/priorities/digital-single-market_en

Inquiry into the e-commerce sector

The Commission gathered information on geo-blocking as part of its ongoing antitrust sector inquiry into the e-commerce sector. In particular, the replies from more than 1400 retailers and digital content providers from all 28 EU Member States show that geo-blocking is common in the EU for both consumer goods and digital content.

Commission questionnaires were mainly sent to retailers selling consumer goods in the following product categories:

· clothing, shoes and accessories, consumer electronics (including computer hardware), electrical household appliances, computer games and software, toys and childcare articles, books (including e-books), CDs, DVDs and Blue-ray discs, cosmetic and healthcare products, sports and outdoor equipment (excluding clothing and shoes), and house and garden, and to service providers offering the following types of digital content:

· films, sports, fiction TV (e.g. drama), children programmes, TV non-fiction (e.g. documentaries), music and news.

The sample of respondents was designed to ensure a broad representation of the entire spectrum of companies and business models active in e-commerce, both for consumer goods and for digital content.

The number of respondents by the EU states varies mainly because of the different size of e-commerce markets across the states, and the number of spontaneous requests to participate in the inquiry that the Commission received.

The results present valuable insight into the prevalence of geo-blocking practices in the EU but are not statistically representative of EU e-commerce markets overall.

More information on antitrust e-commerce sector inquiry and competition sector inquiries in general, are on the Factsheet from the launch of the inquiry and DG Competition's sector inquiry webpage.

Main initial findings on geo-blocking

The initial findings suggest that geo-blocking is widespread throughout the EU. In relation to consumer goods, geo-blocking is mostly based on unilateral business decisions of retailers. Geo-blocking in digital content, on the contrary, is mostly contractually required by suppliers.

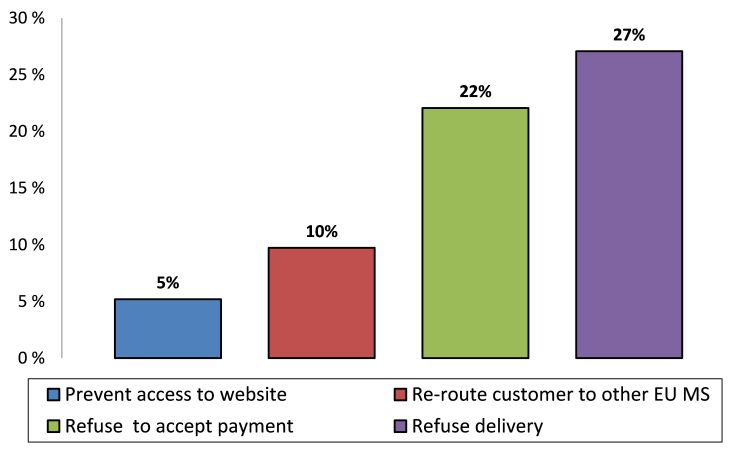

= Consumer goods. Retailers were asked whether they gather any location related information from users (e.g. internet protocol (IP) address, credit/debit card details) in order to geo-block users. 38% of participating retailers reported they collect such data and use it for geo-blocking purposes. The methods they use to implement geo-blocking of consumer goods in EU-28 states are outlined in the figure below.

|

| Figure 1. Respondents that gather location information for each geo-blocking purpose. |

Note: single respondent was able to select multiple types of purposes for which it gathers location information.

Geo-blocking by

retailers may result from unilateral business decisions by retailers or be

based on contractual restrictions agreed between the retailer and its suppliers.

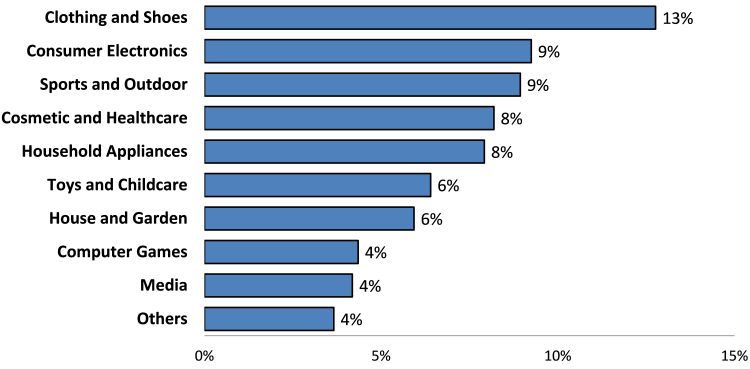

On the basis of the information gathered, contractual restrictions to sell cross-border can be found in all investigated product categories. The figure below summarises the proportion of retailers that reported having such contractual restrictions broken down by product category. Overall, 12% of retailers across the EU reported facing contractual restrictions to sell cross-border.

Figure 2. Respondents that have a contractual restriction to sell cross-border for each product category in EU 28

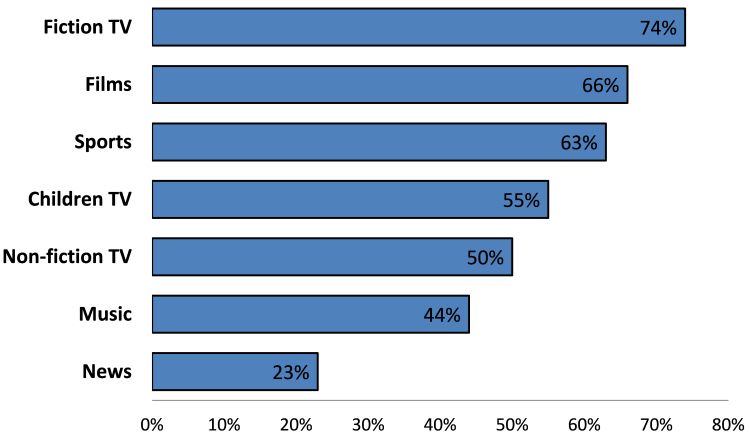

= Digital content. The majority of providers participating in the inquiry (68%) replied that they geo-block users located in other EU states. 59% reported to be contractually required by suppliers to geo-block. They do so mostly by verifying the IP address of users, which identifies and gives the geographic location of a computer or smartphone.

All types of content covered by the sector inquiry are affected to some extent by geo-blocking practices.

|

| Figure 3. Proportion of agreements requiring providers to geo-block by category: average for all respondents in EU 28 |

The results also show that there are significant differences as regards the prevalence of geo-blocking between different digital content categories and EU states.

Initial findings and data on geo-blocking published presently do not prejudge the finding of any anticompetitive concerns or the opening of any antitrust cases. The findings will feed the Commission's ongoing analysis in the sector inquiry to identify possible competition problems and also complement actions launched within the framework of the Commission's Digital Single Market Strategy, to address barriers that hinder cross-border e-commerce.

In some cases, geo-blocking appears to be linked to agreements between suppliers and distributors. Such agreements may restrict competition in the Single Market in breach of EU antitrust rule. This however needs to be assessed on a case-by-case basis.

In contrast, if geo-blocking is based on unilateral business decisions by a company not to sell abroad, such behaviour by a non-dominant company falls outside the scope of EU competition law.

If the Commission identified specific competition concerns, it could open case investigations to ensure compliance with EU rules on restrictive business practices and abuse of dominant market positions (Articles 101 and 102 of the Treaty on the Functioning of the European Union, TFEU). Any competition enforcement measure would have to be based on a case-by-case assessment, which would also include an analysis of potential justifications for restrictions that have been identified.

There are a number of reasons for retailers and service providers not to sell cross-border and the freedom to choose one's trading partner remains the basic principle. Against that background, it is a key priority of the Commission to address unjustified barriers to cross-border e-commerce with legislative actions as part of its Digital Single Market Strategy and it will come forward with further legislative proposals in May. The common objective of competition enforcement and the Commission's legislative initiatives is to create an area where European citizens and businesses can seamlessly access and exercise online activities, irrespective of their place of residence.

Reference: European Commission press release: MEMO-16-882 “Antitrust: Commission publishes initial findings on geo-blocking from e-commerce sector inquiry; Factsheet”, Brussels, 18.03.2016. In: http://europa.eu/rapid/press-release_MEMO-16-882_en.htm?locale=en

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!