Analytics, Economics, Estonia, EU – Baltic States, Financial Services, Funds, Investments, Pensioners

International Internet Magazine. Baltic States news & analytics

Friday, 10.05.2024, 03:20

Estonian pension funds among poorest in OECD with output of 4.7%

Print version

Print version

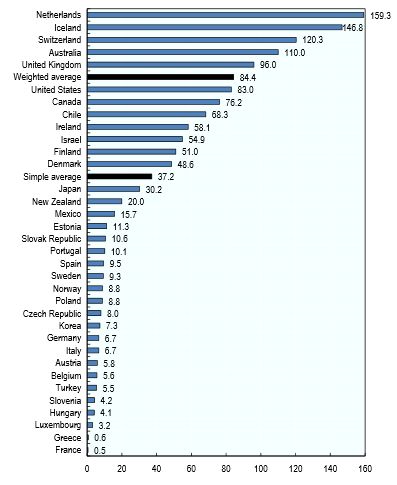

The OECD average is 6.8% which means that Estonia is well below that. The weighed average of OECD member states' pension funds was 5% last year which means that Estonia was quite close to the average, the newspaper reports.

|

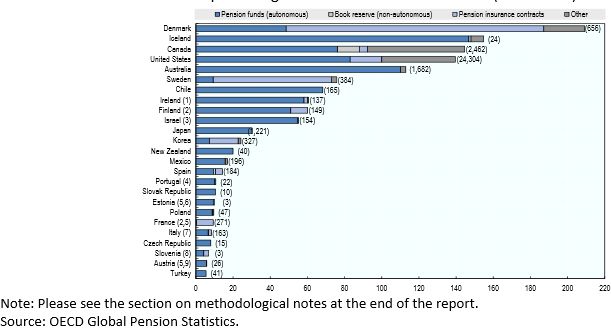

| Private pension assets under management by type of financing vehicle in selected OECD countries, 2014, as a percentage of GDP and in absolute terms (USD billion) |

The output of the pension funds of several non-OECD member countries was also mentioned in the report, and it can be seen that the output of Latvian and Lithuanian pension funds is better than Estonia's, totaling respectively 4.9% and 7.5%.

According to fund managers, high inflation which reduces Estonian funds' real output is behind Estonia's weaker net output compared to other countries. Funs managers are also criticizing the report's methodology and trustworthiness.

|

| Importance of pension funds relative to the size of the economy in the OECD, 2014, as a percentage of GDP |

"It seems to me that the output of Estonian funds has been miscalculated because in 2014 the Estonian pension index increased 5.1% which means that last year's real output was 5.6% not 4.7% like it has been said in the survey," member of the board of SEB Varahaldus, Sven Kunsing, told the daily.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!