Analytics, Energy, EU – Baltic States, Financial Services, Investments, Modern EU

International Internet Magazine. Baltic States news & analytics

Tuesday, 16.12.2025, 12:44

EU’s “green deal”: investment and financial facilities for the states

Print version

Print version |

|---|

In any strategy there are some main ingredients for

transforming it into a success story: the narrative

(in our case, the “green deal”, which is based on the EU leaders’ agreement on

carbon neutrality by 2050), the instruments

(necessary regulations and directives concerning new farming rules, use of

pesticides, environment quality standards, fisheries, product safety, as well

as fiscal, tax and social issues) and the financial

resources.

In December 2019, the Commission presented the European

Green Deal*), with the ambition of becoming the first climate-neutral bloc in

the world by 2050. Europe's transition to a sustainable economy means significant

investment efforts across all sectors: reaching the current 2030 climate and

energy targets will require additional investments of €260 billion a year by

2030.

The success of the European Green Deal Investment Plan will

depend on the engagement of all actors involved. It is vital that the member states

and the European Parliament maintain the high ambition of the Commission

proposal during the negotiations on the upcoming financial framework. Hence, a swift

adoption of the proposal for a transition fund regulation will be crucial.

*) More on the “green deal” in the BC’s publications (see

the list below +); the main reference in: https://ec.europa.eu/info/publications/communication-european-green-deal_en

The Commission will closely monitor and evaluate the progress

on this transition path. As part of these efforts, every year the Commission will

hold a Sustainable Investment Summit, involving all relevant stakeholders

and it will continue to work for promoting and financing the transition. The

Commission invites the member states’ investment community and authorities to

make full use of the enabling regulatory conditions and ever-growing needs for

sustainable investments, taking an active role in identifying and promoting

such investments.

Main EGDIP’s objectives

According to the Commission’s proposals, the EGDIP has three

main objectives:

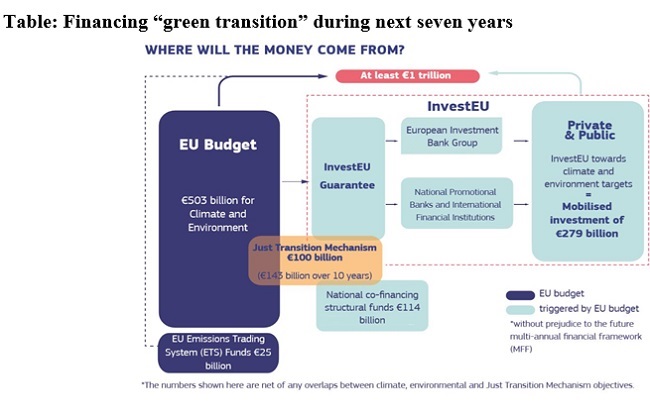

a) increasing funding for “green transition” and mobilizing at

least €1 trillion to support sustainable investments over the next decade

through the EU budget and associated instruments, in particular InvestEU;

b) creating “an enabling framework” for private investors

and the public sector to facilitate sustainable investments; and

c) providing support to public administrations and project

promoters in identifying, structuring and executing sustainable projects.

The European Green Deal Investment Plan, EGDIP (often called

Sustainable Europe Investment Plan, SEIP), is the EU’s “green deal” investment

pillar. The ultimate goal is to mobilize at least €1 trillion in sustainable

investments over the next decade. Part of the plan, the Just Transition

Mechanism, will be targeted to a fair and just green transition. The latter is

expected to mobilize at least €100 billion in investments during 2021-27 to

support workers and citizens in EU’s regions most affected by the “green transition”

process (see the table below).

More on the “green deal” investment plan in: https://ec.europa.eu/commission/presscorner/detail/en/qanda_20_24

As soon as the EU budget alone cannot be sufficient and

enough in tackle climate change and meeting “green transition” measures, the

investment needs will be also covered by the member states’ budgets and active private

sector.

Source: https://ec.europa.eu/commission/presscorner/detail/en/qanda_20_24

EIB’s loan facilities

The EIB’s loan facility will target mostly those EU regions

that would be most affected by the green transition. The exact geographical

coverage will be the same as under the InvestEU “just transition scheme”, i.e. supporting

projects in those regions which have approved transition plans as well as the projects

directly benefiting such regions.

Investment facilities will cover energy supply and transport

infrastructure, district heating networks, energy efficiency measures including

renovation of buildings and other spheres of “social infrastructure”, to name a

few.

The support under the public sector loan facility benefits

projects which do not generate revenue and would otherwise not get financed. It

will therefore be complementary to the products offered by the InvestEU

dedicated just transition scheme.

The EIB will contribute to a public sector loan facility to

support national and regional authorities with low-interest loans. With the

contribution from the EU budget of €1.5 billion and the EIB lending of €10 billion

at its own risk, the public sector loan facility could mobilise about €25-30

billion of public investments during 2021-27. It will be used for investments

in energy and transport infrastructure, district heating networks, renovation

and insulation of buildings, etc. The Commission expects to finalise a draft

for setting up a new public sector loan facility in March 2020.

Other EU financial instruments:”just transition”

The transition mechanism inspired and financed by the EU

institutions will consist of three main sources of financing:

1) A transition fund, with about €7.5

billion from the EU funds (expected to come from the additional part of the

next long-term EU budget). In order to qualify for the fund’s support, the

member states, in consultation with the Commission, have to identify the

eligible “transitional territories” and economic sectors. These resources have

to be “coordinated” with the financial support from the European Regional

Development Fund and the European Social Fund Plus. In sum, this will provide about

€30-50 billion of funding guarantees, which will mobilise even more

investments. The fund will primarily provide grants to regions in the states to

support, for example, vocational training for workers to develop skills and

competences for the sustainable growth market, perspective SMEs, start-ups and

incubators to create new economic opportunities in these regions. It will also

support investments in the clean energy transition, for example in energy

efficiency and transportation.

Reference: https://ec.europa.eu/commission/presscorner/detail/en/fs_20_39

2) A dedicated transition scheme under

InvestEU to mobilise up to €45 billion of investments. It will seek to

attract private investments, including in sustainable energy and transport that

benefit those regions and help their economies find new sources of

growth.

3) A public sector loan facility with the

European Investment Bank backed by the EU budget to mobilise between €25

and €30 billion of investments. It will be used for loans to the public sector,

e.g. for investments in district heating networks and renovation of buildings. These

two directions are of paramount importance for the housing and construction

market in the Baltic States. The Commission will come with a legislative

proposal to set this up in March 2020.

Advantages for the Baltic States

However, these “transition mechanism” concept is more than

funding and financial resources: relying on a transition platform, the

Commission will be providing advises and technical assistance to the EU states

and investors and make sure the affected communities, local authorities, social

partners and non-governmental organisations are involved.

Thus, the transition mechanism will include a strong

governance framework centered on regional and territorial “green transition”

plans.

In the “transition mechanism”, the following advantages are

expected for the member states: - supporting transition to low-carbon and

climate-resilient activities; - creating new jobs in the green economy’s

sectors; - investing in public and private sustainable transport; - providing

technical assistance in sustainability; - investing in renewable energy

sources; - improving digital connectivity; - providing affordable loans to

local public authorities; - improving energy infrastructure, including district

heating and transportation networks.

More in the Commission Communication on “green deal” (Annex

on the road map and key actions): https://ec.europa.eu/info/sites/info/files/european-green-deal-communication-annex-roadmap_en.pdf.

General information in the following web-links:

- MEMO: The European Green Deal Investment Plan

and the Just Transition Mechanism explained; = Factsheets: Investing

in a Climate-Neutral and Circular Economy; The Just

Transition Mechanism: Making sure no one is left behind, and EU-funded

projects to green the economy;

- Commission

Communication on the Sustainable Europe Investment Plan;

- Proposal

for a regulation establishing the Just Transition Fund;

- Amendments

to the Common Provisions Regulation;

+) BC’s list of

publications on “green deal”:

- Green

Deals’ final approval: great days for Europe. 13.12.2019. In: http://www.baltic-course.com/eng2/modern_eu/?doc=153069

and http://www.baltic-course.com/eng2/modern_eu/?doc=153093;

- Energy

efficiency issues in the construction sector. 02.01.2020. In: http://www.baltic-course.com/eng2/modern_eu/?doc=153285;

- Energy policy and

“green deal”: the EU and Baltic’s perspectives. 06.12.2019. In:

http://www.baltic-course.com/eng2/modern_eu/?doc=152950;

- “Green

financing”: creating durable, effective and sustainable solution. 19.12.2019.

In:

http://www.baltic-course.com/eng2/modern_eu/?doc=153170

- 28.01.2022 BONO aims at a billion!

- 26.08.2021 LLC Dizozols Investments finalizes investment attraction deal with Crowdestor with record-high profits

- 25.01.2021 Как банкиры 90-х делили «золотую милю» в Юрмале

- 30.12.2020 Hotels showing strong interest in providing self-isolation service

- 30.12.2020 EU to buy additional 100 mln doses of coronavirus vaccine

- 30.12.2020 ЕС закупит 100 млн. дополнительных доз вакцины Biontech и Pfizer

- 29.12.2020 В Латвии вводят комендантский час, ЧС продлена до 7 февраля

- 29.12.2020 В Rietumu и в этот раз создали особые праздничные открытки и календари 2021

- 29.12.2020 Latvia to impose curfew, state of emergency to be extended until February 7

- 29.12.2020 Linde Gas открывает завод в Кедайняйской СЭЗ

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!