Analytics, Baltic, Banks, Financial Services, Latvia

International Internet Magazine. Baltic States news & analytics

Wednesday, 17.12.2025, 23:32

Money Laundering Issues: Limited Impact on Baltic Economies - DBRS

Print version

Print versionWidespread deficiencies in risk management in the financial

sector can weaken a sovereign’s credit quality by inflicting reputational

damage on its banks, potentially leading to deposit flight and even liquidity

crisis with spill-over effects on the economy. Thus far, these revelations in

the Baltic countries have not had an adverse effect on economic fundamentals

with still strong growth rates (see Exhibit 1), nor on sovereign credit

ratings.

DBRS Morningstar sees several positive effects of

recent developments. In particular, the reduction of non-resident deposit (NRD)

exposures and the strengthening of supervisory institutions should help enhance

financial soundness and governance in all three Baltic countries. As the

authorities make more progress in addressing these weaknesses, greater

confidence in their financial sector should become more of a positive for their

sovereign ratings.

Macroeconomic Performance in the Baltics Remains Relatively Strong

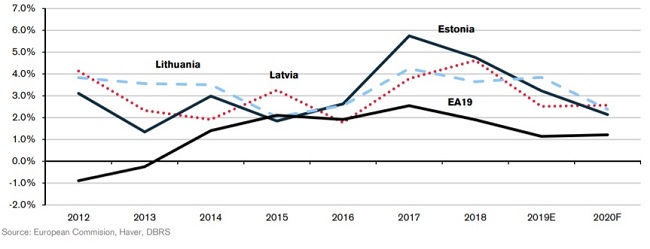

Exhibit 1: GDP Growth Rate

Key macroeconomic metrics have been unaffected by the negative news flow from the banking sector. The three Baltic economies have outperformed the eurozone average in the last few years (See Exhibit 1) and are expected to remain among the strongest performers in Europe in the coming years.

Notwithstanding the banking sector challenges, credit

extension in Estonia and Lithuania remains strong, and is improving in Latvia.

Likewise, the recent allegations against individual banks have not affected the

fiscal or debt performance. Lithuania has run a fiscal surplus since 2016, and

small managed deficits in Estonia and Latvia reflect policy priorities (See

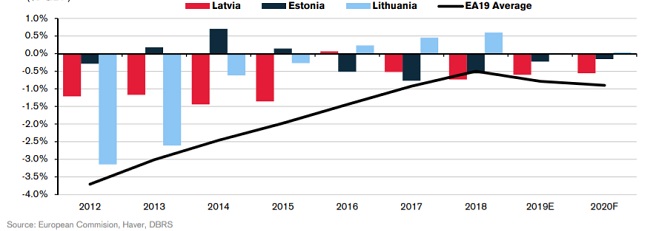

Exhibit 2).

Exhibit 2: Headline Fiscal Balance

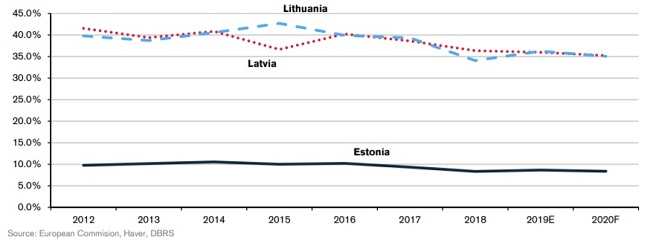

In addition, the debt-to-GDP ratios for all three countries remain on a downward trend. Over the next few years, this ratio is expected to hover in the mid to low 30s for both Latvia and Lithuania and remain around 8.5% in Estonia (See Exhibit 3).

Exhibit 3: Debt/GDP

Benefits of More Transparency in the Baltic Banking Sector

Even though the overall macroeconomic impact from banking

sector challenges has been limited, there are still clear benefits to improving

the transparency of the Baltic banking sector. In general, a more transparent

financial system is likely to invite higher rates of foreign investment, or at

the very least, dissuade capital outflow from investors who may question their

presence in jurisdictions with reputations for opaque financial systems. More

specifically, DBRS Morningstar sees three positive outcomes of recent

banking sector-related revelations: (1) accelerated shrinking of the

non-resident deposits (NRDs) in the Baltic financial system; (2) strengthened

governance frameworks through the expedient passage of tighter AML regulations;

and (3) greater regional cooperation between regulators.

(2) The strengthened governance framework is indicated by

the passage of tighter anti-money laundering regulation

Baltic legislators are making a concerted effort to

strengthen prevention and enforcement of ML/FT rules. There is policy consensus

in Latvia to make it a priority to address any shortcomings in its financial

system. The amendments to the Law on Prevention of Money Laundering and

Terrorism Financing went into force in May 2018. As of July 2018, banks in

Latvia can no longer perform any operations with high risk client accounts,

including shell companies that have no real economic activity. The Latvian

government in October 2018 approved the action plan measures necessary to

implement the recommendations made by the MONEYVAL Committee of the Council of

Europe, and there are clear signs of progress.

The Estonian government presented to the Parliament in late

2018 a draft law, which establishes stricter sanctions in the financial system,

introduces reverse burden of proof on suspicious assets, and strengthens

regulation of virtual currencies. That law has not yet been approved. DBRS

Morningstar expects the new Estonian government to move forward with the

legislation. While in Lithuania, authorities are aware of threats from ML/FT

and are working to implement MONEYVAL recommendations around the improvement of

supervision and prosecution of cases.

(3) Baltic and European regulatory efforts are ongoing,

leading to increased oversight

Efforts to improve regulatory oversight have also increased

at the supranational level. In May of 2019, Riga hosted an international

conference for regional financial intelligence units. The conference covered

international standards on compliance and effective monitoring and sanctioning.

The EU’s fifth Anti-Money Laundering Directive comes into force in 2020. It

introduces further measures to increase transparency of financial transactions

and extends the scope and intensity of regulatory checks. The EU is also

exploring the creation of an independent authority with broad enforcement

authority. Greater oversight will inevitably need to come from cooperation

among member state regulatory bodies and from a newly created central

authority.

More Transparency is Encouraging, But the Elimination of ML/FT Is Not Guaranteed

DBRS Morningstar welcomes the changes discussed in

this commentary. Renewed attention on the longstanding challenges to the Baltic

banking sector has spurred an aggressive reduction in the NRD sector and

increased regulatory scrutiny. This enables the authorities to better manage

banking sector risk related to reputational and operational damage. Perhaps of

most importance, Baltic legislators and regulators are visibly demonstrating a

commitment to addressing the banking sector challenges in a meaningful way.

Unfortunately, the complete elimination of ML/FT behavior

can not be guaranteed. So long as there are incentives for citizens in

countries to use subterfuge to move money of suspicious origins across

jurisdictions, demand for ML/FT services will continue to exist. Nevertheless,

the Baltic and European authorities can strive for enhanced levels of financial

sector transparency and disclosure that significantly reduces the extent of

such flows. DBRS Morningstar considers the ongoing regulatory efforts a credit

enhancement for Baltics countries.

(1)

The reduction of non-resident deposits (NRDs)

increases the transparency of deposit origin and usage

By way of background, the Baltic banking system is made up

of two groups of banks with distinct business models: (1) subsidiaries of

Nordic banks that focus on domestic clients and (2) the non-resident deposit

(NRD) banks that services foreign clients.

The bulk of domestic financial services in all three Baltic

countries is delivered by subsidiaries of Nordic banks, principally Swedbank,

SEB, and Luminor – a joint venture formed by DNB Bank and Nordea’s

Baltic operations; 60% of Luminor’s shares were sold to

Blackstone in September 2019. Roughly four-fifths of their balance sheets

are funded by local deposits. These subsidiaries are responsible for a vast

majority of the domestic lending. Macro financial soundness indicators in each

of the Baltic countries point to healthy financial sector conditions. Asset

quality is strong, and these banks are profitable, liquid and well-capitalized.

NRD banks, on the

other hand, have a negligible impact on domestic economic conditions. They

emerged as a link between Commonwealth of Independent States (CIS) countries

and Europe, offering discretionary and wealth management services to foreign

clients. Assets in NRD banks are highly liquid and the banks hold high levels

of capital. Yet, questions have arisen around the origins and usage of the

non-resident deposit base. In DBRS Morningstar’s view, the higher the share of

NRDs in the small Baltic countries, especially deposits from non-EU origins,

the higher the risk around ML/FT behaviour. Therefore, the decline in NRDs in

recent years reflects a reduction in financial sector risk.

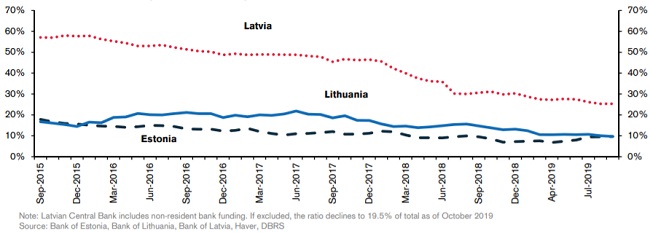

Latvia has made the most progress in reducing the proportion

of foreign bank deposits, in part because it had the largest amount of NRDs in

its banking sector. Efforts in Latvia began in 2015, when over 50% of deposits

in its financial system were from nonresidents (See Exhibit 4). A stronger

legal framework and increased penalties in Latvia led to the reduction of NRDs,

which accelerated across the sector following the ABLV liquidation in 2018. As

of October 2019, foreign client deposits shrank to 19.5% of the total,

excluding non-resident bank funding like intragroup deposits from parent banks.

There has also been a compositional change of NRDs remaining in the Latvian

banking system. Deposits from EU countries now represent most of the NRDs.

Foreign deposits from customers based in non-EU jurisdictions that are more

likely to pose ML/FT risks now constitute less than 10% of total customer

deposits, compared to 36% in 2015. The NRD sectors in Estonia and Lithuania,

while never as large as in Latvia, have each declined to around 10% of total

(See Exhibit 4).

Exhibit 4: Non-Resident Deposits to Total Deposits

Fallout from events in Latvia and Estonia have not weighed

on regional financial stability. While the extent of the breakdown in Swedbank’s

and SEB’s governance and control of measures to combat money laundering in

their subsidiaries in the Baltic countries is not yet known, DBRS

Morningstar does not expect them to abandon the Baltic region. Swedbank

and SEB consider the Baltics as part of their home market. The region has

provided profitable business for the Nordic banks.

Appendix: Recent Allegations of Illicit Activity Among Banks Operating in the Baltic Region Recent financial sector developments have caused some reputational damage to banking groups operating in the Baltics. Allegations in early 2018 were initially directed at banks servicing foreign clients. Latvia’s third largest bank, ABLV AS, was accused by the US Treasury of noncompliance with anti-ML/FT rules, forcing the bank into liquidation. Also in early 2018, the Estonian supervisor and the ECB withdrew authorisation of the small Estonian NRD bank Versobank AS due to breaches of legal requirements concerning ML/FT. Allegations subsequently spread to larger Nordic banks operating in the region. Last Autumn, news broke that over €200 bn in money of questionable origins had flowed through Danske Bank’s Estonian branch from 2007-2015. Danske has since closed its Baltic operations. Since earlier this year, Swedbank is under scrutiny for alleged involvement in €135 bn of high-risk money flowing through the Baltics for over a decade. This forced the resignation of Swedbank’s chief executive and chairman at the group level and its chief executive and finance director of Estonian operations. In November 2019, SEB published historical transaction data where roughly €26 bn of “low transparency non-resident” funds flowed through the SEB Estonia branch between 2005 and 2016.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!