Analytics, EU – Baltic States, Financial Services, Good for Business, Investments, Markets and Companies

International Internet Magazine. Baltic States news & analytics

Friday, 26.04.2024, 14:35

German companies operating in Baltics once again very optimistic

Print version

Print version

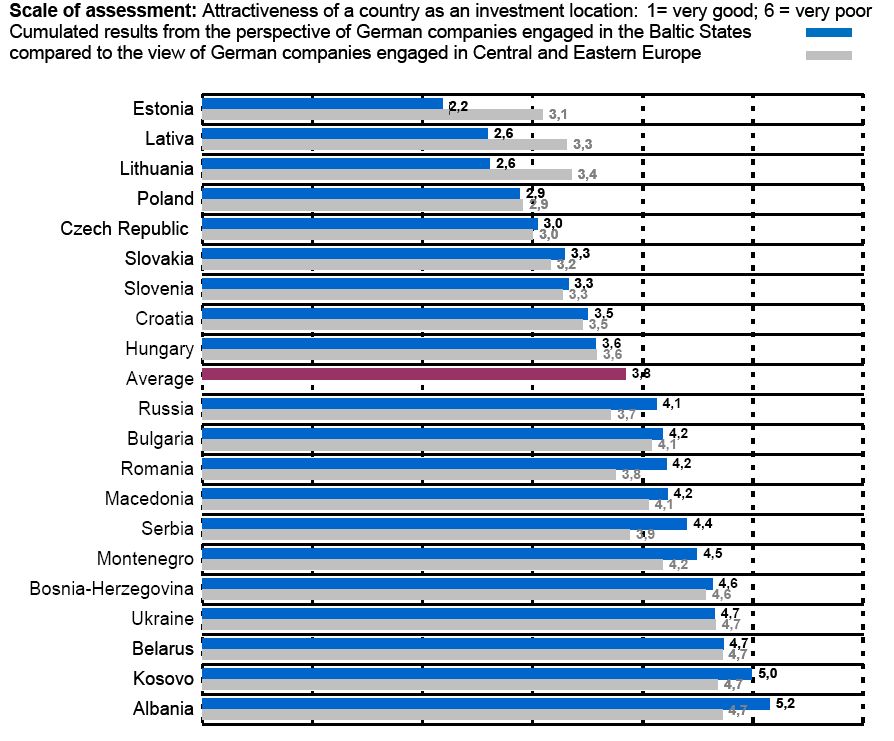

This optimistic assessment also shows in their plans regarding creating of new jobs and increasing their investments in the current year. According to the participants in the survey, Estonia, Latvia and Lithuania are also considered to be attractive business and investment locations in comparison to other countries in the region. But, according to them, the vocational training system still urgently requires political action.

These are the main results of this year's survey of the German-Baltic Chamber of Commerce in Estonia, Latvia and Lithuania (AHK Baltic States) in which 119 companies participated.[1]

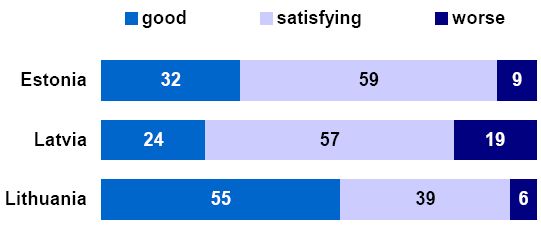

The current economic situation in the Baltic States continues to be assessed as good or satisfactory by the majority of the German companies operating here – just like in the previous three years. Nevertheless the results turn out to be very different in direct national comparison as well as in comparison to last year. While the German companies operating in Estonia evaluate the economic situation as slightly worse than last year, the mood is clearly more positive in Latvia and Lithuania. In Estonia just one third of the participants appraised the current situation of the local economy as good, but also only 6% estimated it to be bad. In Latvia, 22% had a positive opinion about the current situation, which is double the number of last year.

|

| Attractiveness of business location in international comparison |

At the same time, here almost the same number of participants is dissatisfied with the current economic situation. The opinion of the participants turns out to be most optimistic in Lithuania. Almost 60% of the companies are satisfied with the economic situation in spring 2014. This is not only a clear plus in comparison to last year, with only every fourth company rating the economic situation as good, but it also surpasses the mood of all the previous surveys in the past ten years.

[1] Please note: The survey was conducted in February 2014, before the discussions about possible economic sanctions against Russia, caused by the crisis in the Ukraine, started. Hence, this topic was not part of the survey.

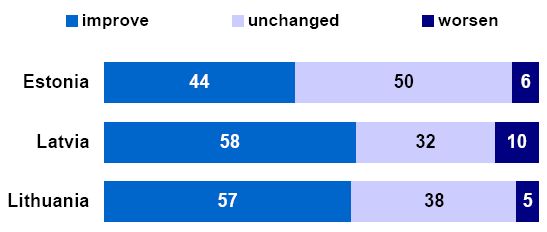

Continuously best prospects for the economy

These survey results can also be backed up by the actual economic development and the current forecasts by economic researchers. Even though the economic development of all three Baltic States was once again clearly above the EU average in 2013, Estonia reported a comparatively stable growth of only 0.8%. This is perhaps the reason for the slightly reserved assessment of the companies in Estonia in spring 2014, which can mainly be noticed in their expectations towards the current year. But still the significant majority of the survey participants expect an improvement or at least an unchanged development. The economic analysts of the European Commission estimate a growth in the Estonian gross domestic product of 2.3% for 2014, with which Estonia should reach a new peak of its gross domestic product.

|

| Evaluation of the current economic situation within own industrial sector (in %) |

The confident mood in Lithuania on the other hand can be explained not by short-term, but by the very stable economic development of the previous two years and the forecast for the upcoming two years with a yearly growth rate of a minimum of 3%. Two thirds of the participants therefore expect a continued improvement in the entire economic situation in the current year in Lithuania as well. Here also, the economic development is expected to reach a new record level this year.

In Latvia, the expectations are also comparatively high for the current year. More than half of the surveyed German company representatives are counting on continued improvement, for the first time in years nobody is expecting deterioration. Latvia will be the strongest member of the European Union in terms of growth in 2014 as well, with a predicted gross domestic product growth of 4.2%.

Good mood in the building sector and in the service sector

The assessment of the present situation of the own industrial sector nearly coincides with the assessment of the overall economic situation in Estonia, Latvia and Lithuania. The significant majority of participants evaluate the current situation in their respective sectors as good or satisfactory. Just like in the previous three years, the estimation of the continued development in their own sector also turns out to be mostly positive although slightly more cautious than regarding the economy as a whole. However, the situation as well as the medium-term perspective varies significantly from sector to sector in the assessments.

With respect to the sectors associated with the participating companies, there is an indication of high satisfaction and optimism mainly in the building sector and the service sector in all three countries. On average more than half of the participants from these two sectors evaluate the current situation to be good and almost every second person expects a further improvement in the current year. Both of these sectors, except for the building sector in Estonia, actually belong to the most dynamic ones of the previous year. In Lithuania the manufacturing sector is also very optimistic. About 55% of the participants from this industrial sector expect continued improvement, nobody expects deterioration. In trade, the mood of the German companies in all three Baltic States is rather balanced and no significant changes are to be expected in the current year.

Trust in the own business

The mood amongst the surveyed company representatives in the Baltic States regarding their own business has remained unchanged in comparison to the survey carried out last year. The companies once again assess their capacity to compete as higher than that of the entire economy or of their sectors. Practically nobody has estimated his own business situation as bad. In Estonia and Latvia, every second survey participant evaluates the economic situation of his own company as good and in in Lithuania even 72% of the participants are of this opinion. Moreover, the participants in all three countries expect, irrespective of their estimation of further overall economic development and the development of their own sector, that the current year will bring a further improvement in their own business situation. This confidence is supported by the positive expectations towards the turnover of their own company. In Estonia, 59% of the companies expect higher turnovers; in Latvia and Lithuania the assessments are even more optimistic, with 68%.

|

| Expected development of own business situation in the current year (in %) |

Impact of the export business slightly declining

A look at the current expectations of German companies operating in the Baltic States regarding their own export activities shows that the influence of the foreign markets regarding the success of the business could decrease in the nearer future. This is because although almost 60% of the participants in Estonia expect increasing sales in the current year, only every fifth company representative substantiates it with increasing export sales. In Latvia, 30% of the participants expect an increase in their exports in the current year, yet more than double the number of companies expect increasing sales at the same time. In Lithuania this difference is lower. More than half of the surveyed companies here are counting on continued increasing sales in the export business.

The assessment of the companies can also be backed up by the actual macro-economic development in the last year, in which the total exports of Estonia and Latvia almost stagnated in comparison to previous years, due to less dynamic demand on the European markets among other factors. In Lithuania, however, the high growth rate continued at almost the same pace. In all three countries, the companies profited mainly from increasing domestic demand. Especially in Estonia and Latvia private consumption turned out to be the growth engine number one; in fact, it surpassed the overall economic growth rate in all three countries. Nevertheless, the economic development of the trade partners within the European Union will influence the business success of Estonia, Latvia and Lithuania in the future as well. The close relations with the European Union is demonstrated by the fact that almost 90% of the surveyed German companies mainly export their goods and services produced in the Baltic States to EU countries, with the Scandinavian countries and Germany leading the way.

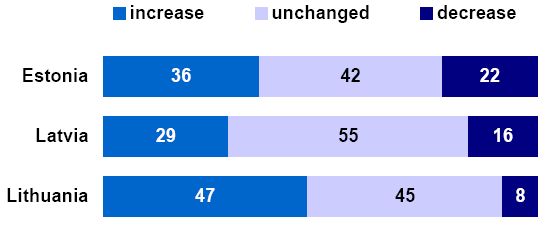

Unchanged high investment tendency

Besides the close trade relations between Germany and the Baltic states, the German economy is also counted as one of the biggest investors. The share of German companies in foreign direct investments was 10.1 % in Lithuania, 4.8 % in Latvia and 2.0 % in Estonia at the end of 2013. In all three Baltic States, the current investment tendency coincides with the results of the survey of last year. The majority of the surveyed German companies expect a consistent development of their investments in the current year. In Estonia, once again more than every third company plans to extend its investment activities. 29% of the company representatives in Latvia and even 47% of those in Lithuania expect increasing investments. The previous surveys have shown time and again that the companies base their investment decisions not only on short-term positive sales expectations, but also on long-term analysis of the operative business sector, the market and the economic and political conditions. Therefore, individual consideration of these criteria is also necessary.

|

| Current propensity to invest (in %) |

Good marks for the business environment

The current optimism in Lithuania regarding the further development of the overall economy and of the own business also shows in this year’s assessment of the criteria determining the attractiveness of Lithuania as a business location. In all the criteria there is noticeably higher satisfaction shown than in previous years. The positive assessment of the business environment, especially with regard to infrastructure, the payment discipline in the private sector as well as the quality and availability of the local suppliers are to be emphasised here. The same goes for Estonia and Latvia, here the companies are also very much satisfied with the business environment.

Need for action in economic policy

However, it becomes once again obvious in all three countries this year that there still is urgent need for action from the governments of Estonia, Latvia and Lithuania regarding the transparency of the administrative institutions and the processes of the public procurement, the tax burden and the efficiency of the tax authorities. Apart from this, Latvia and Lithuania very much desire energy security or rather independence and in Latvia there is also a demand for more legal security and faster court proceedings. Since the Baltic States are placed in an international and regional competition for foreign investments, a comparison of the survey results of the simultaneously carried out economic surveys in 13 more countries of Central and Eastern Europe is interesting. Here, in spring 2014 the companies in Estonia, Latvia and Lithuania give their respective own location the best marks. Apart from this, it is very noticeable that Estonia and Lithuania occupy the top positions in almost all the business environment criteria and Latvia is also outstandingly attractive from the point of view of the companies operating here. Once again the most positively evaluated location factor for the three Baltic States this year is membership in the European Union, which is celebrating its tenth anniversary this year.

No relaxation on the labour market

However, the company representatives state the labour market to remain problem number one in all three Baltic States. In Estonia and Latvia, the companies give the worst marks to the availability of skilled labour and the vocational training system, in Lithuania to the flexibility of the labour law. Introducing a more practical and future-orientated dual vocational training system is still the most common suggestion made by the German companies operating in the Baltic States to the respective governments. Some have already pioneered with good examples and have started dual training forms with their own pilot initiatives in their companies. But they demand a comprehensive reformation of the professional education system, for which the involvement of the responsible political policy makers is urgently needed.

They welcome the first concrete steps of the Latvian government in this sphere. In summer 2013, Germany and Latvia signed a Memorandum of Understanding on cooperation in the field of professional education and training. An important component of this MoU is an expert working in the AHK (German-Baltic Chamber of Commerce) office in Latvia, who is aiming at helping the local partners and German-Latvian companies to introduce elements of a dual education system following the German model. A vocational training system of this nature could ensure sustainably that an adequate number of well-trained specialists will be available to the economy. In spring 2014, the work of the new project team in the AHK office in Riga started.

Clear commitment to the location “Baltic states”

Like in previous years, the question of satisfaction with past investment decisions of German companies operating here is especially interesting. This gives an overall assessment of the attractiveness of Estonia, Latvia and Lithuania as business locations because it refers not only to the current situation, but also to previous experiences and long-term expectations for the future. In Estonia, 94% of the German companies would presently opt for its respective country as an investment location again – the same result as in the previous year. In both Latvia and Lithuania, the commitment is also clear with 81 and 90%. This estimation has remained constant to the greatest extent over the past ten years, i.e. also in times of crisis and this speaks for the long-term involvement of German companies here.

Promising business prospects

Thanks to the consistently positive economic and business development in the last three years and the confidence of company representatives regarding the further development of the significant success indicators, German companies also plan to create new jobs this year in Estonia, Latvia and Lithuania. Almost every second company wants to hire new employees in Lithuania, which is more than ever in previous surveys. In Latvia also, this proportion of 37% lies clearly above the rate of last year. While the clear vote for staff expansion in one’s own company is applicable in all sectors in Latvia and Lithuania, in Estonia it is predominantly restricted to positions in the service sector and in trade. Among the company representatives surveyed in Estonia, a cautious attitude regarding the expected change in their number of employees is generally seen in comparison to the previous years. It is almost balanced. While more than a quarter of the companies plan an increase in their number of employees in the current year, 18% also expect a reduction in the number of their staff. From the point of view of the surveyed German company representatives, noticeable wage increases are to be expected again this year, which could have an effect on staffing decisions. While in Estonia, the companies assume an average wage increase of 5.8% in comparison to other costs, in Lithuania it is estimated at 7.1 % and in Latvia even at 7.9 %. Some companies even assume a much higher increase.

Investments in the future at the location “Baltic states”

An expression of commitment of German companies and their long-term involvement in the Baltic States are also the investments into their own employees in Estonia, Latvia and Lithuania. This year, taking into consideration the AHK focus topic in 2014, “innovation”, German company representatives operating here were also asked about the relevance of innovations in general and the use of instruments for an active promotion of employees and innovations in their companies. In all three countries, more than two thirds of the companies stated to carry out regular employee training programmes. These are as high as above 80% in Estonia and Lithuania. For at least half of the companies, regular training exchanges with the German head offices and rewarding systems are also important. They are aware that these measures are, on the one hand, important to remain permanently attractive for their employees, but, on the other hand, can also actively improve their business success. In all three countries, the participants consider innovations important or even very important for the future performance of their companies. Investments in the ability to develop innovations are worthwhile because every second company did introduce product or process innovations or reforms in the organisational structure in the past two years, of which almost 70% were developed on-site in the Baltic States. This innovation and adjustment capability is one of the factors for the success of their operations in Estonia, Latvia and Lithuania and their permanent competitiveness and stability even in a crisis.

Clear vote for the introduction of the euro in Lithuania

With regard to the currently very concrete plans for the euro introduction in Lithuania on 1 January 2015 and following up on the focus topic of the AHK business survey 2013 regarding Latvia’s adoption of Euro in 2014, this year German companies in Lithuania have been asked about their expectations regarding Lithuania’s introduction of the Euro. According to the information of the Lithuanian ministry of finance, Lithuania currently meets the Maastricht criteria and already made the first concrete preparations for the introduction of the Euro. It would be the third Baltic State after Estonia (01.01.2011) and Latvia (01.01.2014) to become a member of the Eurozone. The final decision on the acceptance of Lithuania will be based on the report of the European Commission and the European Central bank expected in June.

At the beginning of this year more than a quarter of all participants in Lithuania would approve a positive decision from Brussels. Only 7% oppose the introduction of the euro in Lithuania. For 13% of the companies, it is too early. The findings of this year permit two comparisons. On the one hand, it is good to find that the mood in Lithuania today, as the target day is getting closer, is a bit more positive than last year. In the beginning of 2013, only 71% of the participants spoke clearly in favour of the adoption of the Euro. In fact, every fourth company was against it or considered the planned time of entry was too early.

On the other hand, the current vote of the questioned company representatives, one year before the planned entry to the Eurozone, turns out to be less euphoric than in Latvia, where almost 90% of the participants spoke clearly for the Euro in spring 2013.

Regarding the expected effects of the adoption of the Euro by Lithuania on the own business activities of the participating company representatives in Lithuania, there are hardly any differences in comparison to the previous year. The majority of the participants still mentions positively influencing factors like a decrease in transaction costs and more price transparency. Just 30% of the companies operating in Lithuania fear extra conversion costs. Market share losses, to which the participants attributed a lot of importance last year, are hardly feared any more. According to all participants the common currency in all three Baltic States will have a positive effect on the business success of the German companies operating here and thus the Baltic States will become even more attractive. In general, the very positive “psychological” aspects of the Euro adoptions by all Baltic States for partners and potential investors should not be underestimated, as the region is moving stronger into the sight of foreign investors.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!