Baltic States – CIS, Banks, EU – Baltic States, Financial Services, Investments, Latvia, Legislation

International Internet Magazine. Baltic States news & analytics

Monday, 17.11.2025, 10:39

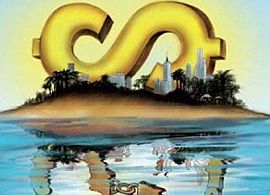

ECB warns Latvia against taking in Russian money fleeing Cyprus

Print version

Print version |

|---|

"It was made clear to our Latvian friends that if they want to join the euro, they should not provide a haven for Russian money exiting Cyprus," a eurozone central banker said.

As new President Nicos Anastasiades hesitated over an EU bailout that has wrecked Cyprus's offshore financial haven status, money was oozing out of his country's closed banks.

In banknotes at cash machines and exceptional transfers for "humanitarian supplies", large amounts of euros fled the east Mediterranean island before and after Cypriot lawmakers stunned Europe by rejecting a levy on all bank deposits.

EU negotiators knew something was wrong when the Central Bank of Cyprus requested more banknotes from the European Central Bank than the withdrawals it was reporting to Frankfurt implied were needed, an EU source familiar with the process said. "The amount the Cypriots mentioned... on a daily basis was much less than it was in reality," the source said.

Confusion over just how much money was pulled out of Cyprus' banks is illustrative of the confusion surrounding the negotiations as a whole. Representing just 0.2% of the eurozone economy, Cyprus nevertheless threatened to reignite the bloc's debt crisis. Cyprus' problems began in Greece – it is heavily exposed to the eurozone's first bailout casualty.

No one knows exactly how much money has left Cyprus' banks, or where it has gone. The two banks at the center of the crisis – Cyprus Popular Bank, also known as Laiki, and Bank of Cyprus – have units in London which remained open throughout the week and placed no limits on withdrawals. Bank of Cyprus also owns 80% of Russia's Uniastrum Bank, which put no restrictions on withdrawals in Russia. Russians were among Cypriot banks' largest depositors.

While ordinary Cypriots queued at ATM machines to withdraw a few hundred euros as credit card transactions stopped, other depositors used an array of techniques to access their money.

Companies that had to meet margin calls to avoid defaulting on deals were granted funds. Transfers for trade in humanitarian products, medicines and jet fuel were allowed.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!