Analytics, Baltic States – CIS, Banks, EU – Baltic States, Financial Services, Loan, Wages

International Internet Magazine. Baltic States news & analytics

Thursday, 01.01.2026, 21:29

Moody’s outlook on the Baltic banking system revised to negative from stable

Print version

Print versionSummary Opinion

We have revised our outlook on the Baltic banking system to negative from stable, mainly to reflect the upcoming implementation of a bail-in regime across Europe under the Bank Recovery and Resolution Directive (BRRD) and the Single Resolution Mechanism (SRM) regulation. The negative credit implications of this package outweigh the positive developments within the Baltic banking system, such as robust economic growth, declining problem-loan levels and stable profitability prospects for the banks.

Adopted by the European Parliament on 15 April 2014, the BRRD establishes a new framework for managing troubled banks in the European Union (EU). The new framework has negative credit implications that exceed the benefits of improved stability for senior unsecured creditors of EU banks, including Baltic banks.1 Our negative outlook is also consistent with the negative outlook we currently assign the Nordic banking groups, which have a dominating presence in the Baltic banking system.

The BRRD/SRM package seeks to alleviate the cost of bank failures for tax payers at the expense of shareholders and unsecured creditors, with a very clear expectation that ‘bail-in’ will be used, if needed, as part of bank resolutions.

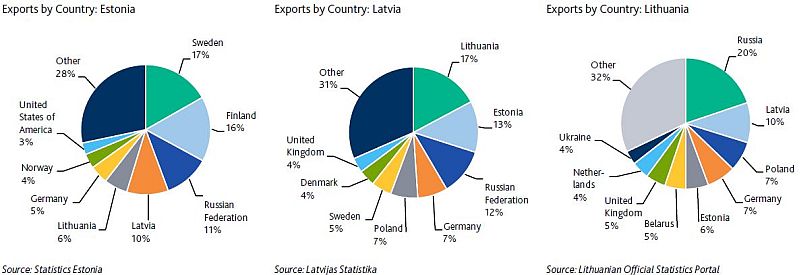

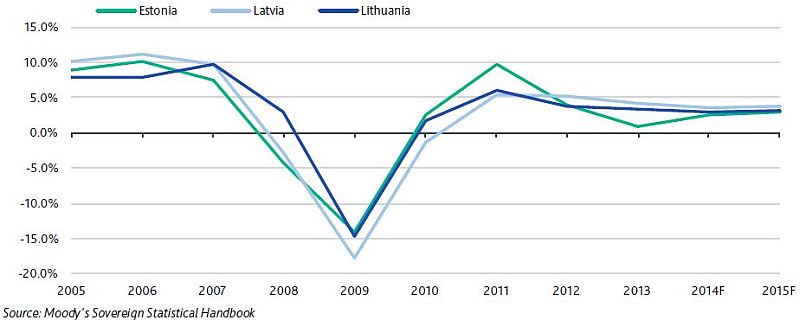

However, we recognise that aside from the shift in regulatory environment, Baltic banks are benefiting from strengthening economic fundamentals, underpinned by the countries’ fiscal health and ongoing adoption of the euro. Our baseline scenario assumes annual real GDP growth of 2.5%, 2.6% and 2.9%, respectively, in the region’s three constituent countries – Estonia, Latvia and Lithuania in 2014, which reflects our expectations of continued export growth to Europe and domestic demand recovery, helped by low interest rates. This should support stronger loan demand and performance in the corporate segments, and bring about more uniform improvements across the region. Thus far, Estonia and Lithuania remain ahead of Latvia in term of credit conditions, with the latter continuing to report credit contraction on a net basis.

That said, an escalation of tensions between Russia and the European Union is the key downside risk to this scenario, as Russia is an important trade-partner to the region, especially in the agriculture and transportation sectors.

We expect stronger loan growth, together with a likely increase in interest rates towards the end of this outlook, to help support bank profitability in the region. Moreover, Baltic banks’ funding profiles will likely remain stable over the outlook period, as they become less reliant on external funding, including that supplied by Nordic parent-banking-groups to their subsidiaries in the region.

Overview of Key Drivers for Baltic Countries Negative Banking System Outlook

|

Operating environment |

Stable |

+ Continued economic recovery and low indebtedness in Baltic countries provide a favourable backdrop for returning credit demand − Baltic economies remain open and vulnerable to external shocks, especially to current tensions between EU/US/Russia. Unemployment is high, although trending downwards. |

|

Asset quality and capital |

Improving / Stable |

+ Stronger economic growth in Latvia and Lithuania will prompt a decrease in problem loan ratios. Estonian banks’ NPL ratios have already fallen to NPL levels close to Nordic banks. Baltic banks are generally well capitalised although capital ratios vary greatly. |

|

Funding and liquidity |

Stable |

+ Baltic banks’ funding is increasingly independent from their Nordic parents and deposit based. − Almost half of all Latvian bank deposits are from non-residents. However, these deposits have thus far proven sticky notwithstanding the current tensions between EU/US/Russia. |

|

Profitability and efficiency |

Stable |

+ Profitability is in line with Nordic countries and will improve slightly once net lending turns positive in Latvia (already positive in Estonia and Lithuania). |

|

Systemic support |

Deteriorating |

− We expect Baltic countries to implement a bail-in framework along with other European countries in order to reduce the reliance on taxpayer bail-outs. |

Several elements limit downside pressure on Baltic operating conditions from ongoing political tensions

The ongoing political tensions between Russia, the EU and the US are unlikely to have a material impact on the operating environment in the Baltic countries, despite Russia’s important trading links with all three Baltic countries (Exhibit 3). We base our view on the following elements:

1) Baltic countries could re-direct some of their exports elsewhere

2) Domestic demand is playing an increasingly important role in economic growth in these countries.

3) A significant proportion of Baltic exports to Russia are re-exports, originating from other countries, implying that the Baltic countries act as a transit-route for these exports.

However, if tensions escalate further, resulting in higher

trade-barriers, the banks’ operating environment could come under pressure due

to lower exports and GDP growth could slow.

20% of Lithuania exports go to Russia. More than 10% of Latvian and Estonian exports go to Russia

Real GDP growth to show extended recover.

|

| Real GDP growth (%) in Baltic countries |

Key growth drivers for the Baltic economies will be:

• Strong exports. We expect a continuous recovery in Europe to support the Baltic region’s export performance. As example of their importance, in 2013 exports amounted to 88%, 60% and 87% of Estonia’s, Latvia’s and Lithuania’s GDP per our calculations.

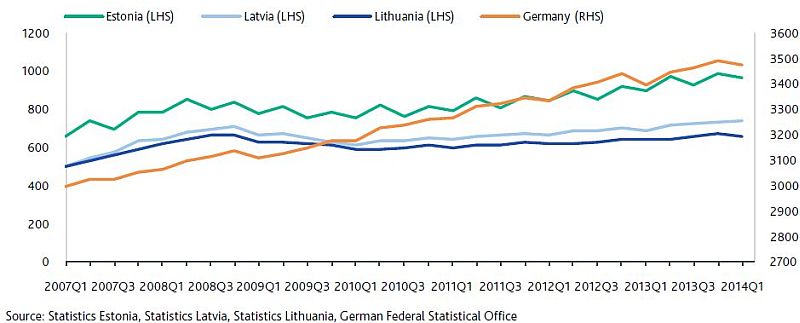

• Domestic consumption, supported by continued wage growth and falling unemployment (Exhibit 5 & 6). In our baseline scenario, as the Baltic economies strengthen, unemployment levels will likely decrease to 7.5% and 9.6%, respectively, in Estonia and Latvia, by year end-2015.

Wages remain

considerably lower in the Baltic countries compared to some developed countries

in Europe.

|

| Average monthly wage compared to Germany |

The region’s macroeconomic policies remain largely accommodative

On monetary policies, Estonia joined the euro area in January 2011, and Latvia in January 2014, with Lithuania expected to join in 2015. This implies strong alignment in the region’s monetary environment with the eurozone, which we expect to remain very accommodative over the outlook period.

Fiscal policies will retain a neutral-to-slightly tightening bias, in association with the fiscal consolidation efforts these countries have been making to qualify themselves for euro adoption. Yet this will also mean that their economies will not be susceptible to the threat of sharp fiscal spending cuts as other industrial economies retrench from their heavy pump-priming during the crisis.

Asset quality will improve in all three Baltic countries, most notably among Latvian and Lithuanian banks. Baltic banks are well capitalised compared with banks in other European countries.

Asset quality likely to improve more in Latvia and Lithuania than in Estonia

Asset quality will improve in all three Baltic countries as their economies and housing markets continue to recover. Continued improvement in asset markets will also support the quality of banks’ real estate loans, which are the largest segment in their corporate loan portfolio, based on data from Estonia and Latvia. Moreover, roughly half of total lending in Estonia and Latvia is household lending, mainly in the form of mortgages, also representing an exposure to a recovering housing market.

Corporate operating conditions

(recovering export markets in Europe and low wages) have improved much faster

than household conditions (high amid decreasing unemployment and low wages). We

expect household loan performance to continue whilst the region’s unemployment

remains high (albeit decreasing) throughout the outlook period. Consequently,

we expect corporate problem loan ratios to likely decline faster than household

loans, continuing the recent trends.

We expect future asset quality

improvements to be largest in Latvia and Lithuania, where problem loans remain

elevated. In contrast, Estonia’s NPLs are already low compared

to NPL peaks in 2010. Indeed, corporate NPLs are almost comparable with Nordic

countries, where asset quality is consistently strong.

As the gains accruing to companies begin to be passed on to workers, the performance gap between corporate and household loans will narrow. However, this trend will take time given our expectations of slow unemployment decreases and limited wage growth.

Overall loan-loss reserves among Baltic banks remain ample. Based on reported reserve coverage, Estonian and Latvian banks are at the stronger end of the European spectrum. Lithuanian banks do report lower loan-loss reserves of only 41%, but this is primarily due to their more conservative problem loan classification. The Lithuanian Central Bank classifies loans overdue by over 60 days as problem loans, compared to the more typical 90+ day threshold

Banks’ capitalisation remains strong and will slightly improve over the outlook period

Banks in the Baltic countries

are well capitalised and our base case assumption is that lower impairment

charges and recovering profitability will act to strengthen the banks’ capital

levels. That said, we expect capital levels to only increase modestly because

they are already high compared with other jurisdictions.

Our expectation that the region will return to broadly positive net loan growth by the end of this outlook will support, rather than strain, bank capitalization by returning some loan pricing powers to banks and support their profitability, which they can use to bolster their capital cushions.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!