Analytics, Budget, Financial Services, GDP, Lithuania

International Internet Magazine. Baltic States news & analytics

Thursday, 22.01.2026, 17:27

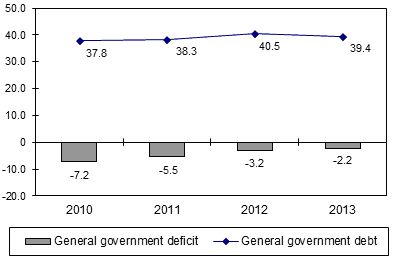

In 2013, general government deficit in Lithuania stood at 2.15, debt – 39.4% of GDP

Print version

Print version

In 2013, general government revenue amounted to LTL 38 541.4 million, expenditure – LTL 41 111.8 million1. The decrease in general government deficit was determined by a 3.6% increase in general government revenue. Tax revenue amounted to LTL 19 155.7 million (49.7% of the total general government revenue). In comparison to 2012, it increased by 5.4%, or LTL 980.2 million. Social contributions amounted to LTL 13 424 million (34.8% of the total general government revenue). In comparison to 2012, it increased by 4.5%, or LTL 577.2 million.

Over the year, expenditure of the general government increased by 0.5%, or LTL 204 million. The bulk of the general government expenditure consisted of expenditure on social protection, education and health care.

In 2013, the central government deficit amounted to LTL 1 013.4 million (0.85% of GDP). The local government deficit amounted to LTL 330.2 million (0.28% of GDP). In 2013, the deficit of social security funds amounted to LTL 1 226.8 million (1.03% of GDP). Over the year, the largest decrease was recorded for the deficit of social security funds – by LTL 756.7 million, which in 2012 stood at 1.7% of GDP. In 2013, the central government deficit decreased by LTL 414.1 million. In 2012, the central government deficit made up 1.3% of GDP.

At the end of 2013, the general government debt at nominal value amounted to LTL 47 111.6 million, or 39.4% of GDP (LTL 16.0 thous. per capita). In 2013, the general government debt increased by LTL 1 075.1 million.

__________________

1 According to the

Maastricht criteria, when calculating the general government deficit, net

interest payments made on financial derivatives are included in the

expenditure; therefore, general government expenditure in 2013 is by LTL 59.5

million lower than that provided in the ESA 95 Data Transmission Programme

Table 2 "General government revenue and expenditure".

|

| Lithuanian general government deficit and debt as a percentage of GDP |

At the end of 2013, the general government consolidated debt comprised the central government debt (LTL 43 645.7 million), local government debt (LTL 2 130.9 million), and social security funds' debt (LTL 1335 million). At the end of 2013, the non-consolidated debt of central government amounted to LTL 43645.7 million, local government debt – LTL 2382.4 million, and social security funds' debt – 11050.6 million (at the end of 2013, the outstanding amount of central government loan to social security funds amounted to LTL 9715.6 million).

The bulk of the general government debt consisted of outstanding securities – LTL 36 718.7 million (80% of the total general government debt). Outstanding loans at the end of the year amounted to LTL 9 543 million, deposits – LTL 849.9 million.

In 2013, the long-term debt accounted for 94.4%, while short-term debt – 5.6% of the general government debt. Over 2012, the long-term debt grew by LTL 1 431.5 million, while the short-term debt decreased by LTL 356.4 million; at the end of the year, they stood at, respectively, LTL 44 459.2 million and LTL 2 652.4 million.

The bulk of the borrowed funds were used to settle the general government debt and debt liabilities of social security funds, as well as to balance their cash flows and to finance public investments.

The April 2014 Excessive Deficit Procedure (EDP) notification included revised data on the general government deficit (2012).

The dynamics and main components of the general government deficit and debt

|

|

LTL million |

|||

|

2010 |

2011 |

2012 |

2013 |

|

|

Deficit (-) / surplus (+) |

-6868.9 |

-5848.9 |

-3694.0 |

-2570.4 |

|

central government |

-4459.0 |

-3457.9 |

-1427.5 |

-1013.4 |

|

local government |

65.9 |

-402.3 |

-283.0 |

-330.2 |

|

social security funds |

-2475.8 |

-1988.7 |

-1983.5 |

-1226.8 |

|

Deficit-to-GDP ratio, % |

-7.2 |

-5.5 |

-3.2 |

-2.2 |

|

General government

consolidated gross debt |

36127.4 |

40961.6 |

46036.5 |

47111.6 |

|

Currency and deposits |

16.6 |

26.2 |

679.7 |

849.9 |

|

Securities other than shares, excl. financial derivatives |

29619.8 |

33508.5 |

36843.1 |

36718.7 |

|

short-term |

1249.5 |

912.6 |

1211.4 |

1129.7 |

|

long-term |

28370.3 |

32595.9 |

35631.7 |

35589.0 |

|

Loans |

6491.0 |

7426.9 |

8513.7 |

9543.0 |

|

short-term |

1023.1 |

1527.2 |

1501.9 |

1489.7 |

|

long-term |

5467.9 |

5899.7 |

7011.8 |

8053.3 |

|

Debt-to-GDP ratio, % |

37.8 |

38.3 |

40.5 |

39.4 |

|

GDP (at current prices) |

95676.0 |

106893.4 |

113734.7 |

119469.0 |

Detailed data on the general government deficit and debt are available in the EDP notification, published on the Official Statistics Portal. According to the results of this notification, the state's conformity to the criteria of the general government deficit and debt set in the Maastricht Treaty is assessed.

Each year, before 1 April, Statistics Lithuania, in cooperation with the Ministry of Finance of the Republic of Lithuania, prepares the EDP notification, following the requirements of the European System of National and Regional Accounts (ESA 95). As soon as the Commission approves the notification, statistical information on the general government deficit and debt is released to the public. Statistics Lithuania submits the revised EDP notification to the European Commission by 1 October.

The Statistical Office of the European Union (Eurostat) will publish the results of the provisional 2014 EDP notifications of all the EU member states on 23 April 2014.

Concepts

General government sector – a sector covering institutional units financed by compulsory payments, whose main activity comprises the provision of non-market services and/or redistribution of national income and wealth.

General government sector includes entities financed from the state, municipal and social security funds' budgets, as well as non-budget funds and other non-market producers (part of public institutions and enterprises controlled by the state and municipalities).

General government deficit (-) / surplus (+) refers to general government revenue minus expenditure, plus net streams of interest payments resulting from financial derivatives. These indicators are calculated pursuant to the requirements for excessive deficit procedures, which are based on the provisions of the European System of National and Regional Accounts 1995 (ESA 95).

More information on the issue is available on the Official

Statistics Portal.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!