Analytics, Banks, Direct Speech, Financial Services, Latvia

International Internet Magazine. Baltic States news & analytics

Friday, 26.12.2025, 01:18

Latvia: Household deposits continue on a stable upward path

Print version

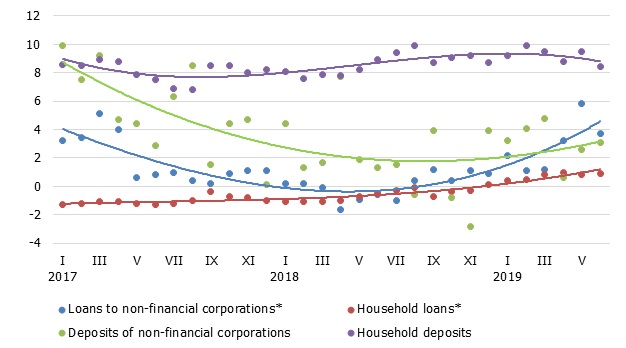

Print versionHousehold deposits grew by 67 mln euro over the month (the steepest monthly rise this year), thereby contributing to an upward trend in the aggregate domestic deposits, with the annual growth rate of domestic deposits reaching 7.3%. Meanwhile, the domestic loan portfolio declined somewhat in June due to uneven dynamics of corporate lending.

Domestic bank deposits increased by 0.7% in June, with household deposits and corporate deposits growing by 0.9% and 0.4% respectively. Latvia's contribution to the monetary aggregate M3 of the euro area increased by 0.6%, with overnight deposits of euro area residents with Latvia's monetary financial institutions, deposits with an agreed maturity of up to two years and deposits redeemable at notice expanding. As a result, the annual growth rate of M3 rose to 14.5% in June, and the above deposits posted increases of 16.8%, 9.6% and 1.1% respectively.

With household loans expanding (loans for house purchase and consumer credits posted increases of 0.3% and 0.5% respectively) and loans to non-financial corporations declining by 1.3%, the annual growth rate of the domestic loan portfolio, the effect from the banking sector restructuring excluded, stood at 2.6% in June. The annual rate of increase in loans to non-financial corporations reached 3.7%, while that in household loans was 0.9%.

Annual changes in domestic loans and deposits (%)

* For the sake of comparability, the one-off effects related to the restructuring of Latvia's banking sector have been excluded.

Although the economic growth is likely to gradually decelerate in the near future, we should not be expecting any significant changes in the dynamics of deposits. Looking ahead with caution, both households and businesses will continue increasing their savings.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!