Analytics, Baltic States – CIS, Direct Speech, Energy, EU – Baltic States, Gas

International Internet Magazine. Baltic States news & analytics

Sunday, 01.02.2026, 09:30

Who’s afraid of Russian gas?

Print version

Print versionDisagreements are natural in a broad alliance with diverse interests and perspectives. But it is now almost impossible to discuss Russian gas with any sense of calm (increasingly true for all things related to Russia). Russian initiatives are infused with perceptions and fears that range from the simple and legitimate to the obscure and far-fetched. In reality, arguments about Russian gas are rarely about Russian gas; they are about history, strategy, and geopolitics. Gas is just the spark. The end result is confusion and discord at a time when the transatlantic alliance has enough problems—without needing to add gas to the fire.

It is time to separate Russian gas from the broader Russia agenda. Doing so will boost energy security, protect and strengthen the transatlantic alliance, and allow us to focus where the West can resist Russian power more meaningfully. This argument rests on three propositions. First, that energy does not give Russia as much power as we usually assume; second, that an antagonistic strategy is unlikely to be sustained or succeed in bringing about change, whether in energy or geopolitics; and third, that the best response to Russian gas is a set of policies that Europe should pursue anyway and that are unrelated to Russia. In short, we need to radically rethink Russian gas; how much it matters; and what the United States and Europe should do about it.

Energy Superpower?

Russia is often referred to as an “energy superpower.” The term is catchy but also vague. What does it mean? What is the link between energy and Russian power? Is the power real or merely perceived? Is the power easy to wield or not? Is it ephemeral or durable? Does it vary, for instance, according to the price of oil or a country’s reliance on Russia (usually meaning Russian gas)? How might a country try to curtail that power? Under what conditions might that power be diminished or neutralized? To answer these questions, we must begin with this one: how is energy connected to power?

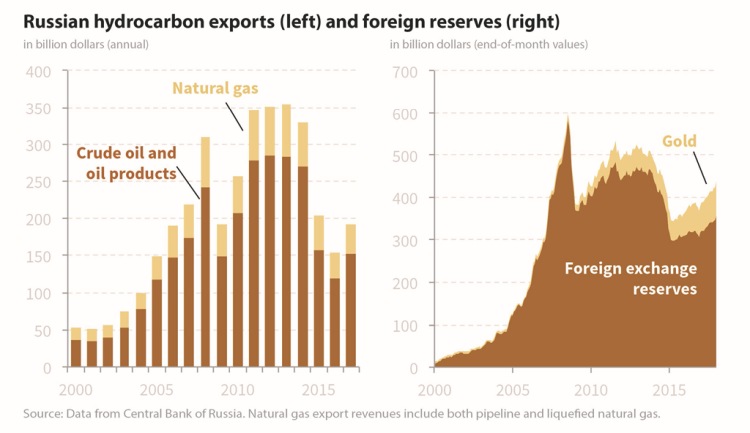

First, the Russian economy is fueled by hydrocarbons. Since 1998, the economy has more than doubled, and it is hard to imagine this happening without the $3.6 trillion that Russia earned by exporting oil and gas. Growth has been strong when oil and gas prices are high; when prices have fallen—in 1998, in 2009, and from 2014 to 2016—the economy has either stagnated or been in recession. The government has relied on oil and gas for more than a quarter of its revenues1 and it has used hydrocarbons to reduce its public debt from 56 percent of gross domestic product in 2000 to 7 percent in 2008 (17 percent in 2017). The country has also run steady current account surpluses since 1997 and had accumulated international reserves of almost $600 billion in mid-2008 ($448 billion at year-end 2017). Hydrocarbons power the Russian economy and, hence, Russia’s political and geopolitical ambitions.

Second, energy is a primary interface for Russia’s relations with other countries. Oil and gas are the country’s main exported goods, accounting for over 60 percent of the total. For most European countries, trade with Russia means largely trade in oil and gas. Even Russian imports, which European companies lobby their governments to support or at least insulate from political conflict, are paid for by oil and gas exports. Investment too: Russian companies own refineries, pipelines, storage facilities, and other assets across many European countries. Since Russia’s largest oil and gas companies are majority owned by the state, those investments have inevitable political overtones.

Third, energy is a strategic commodity, which means that countries attach to energy an importance they do not attach to other goods. Russia is a major oil and gas producer and exporter, so its strategy and activities attract widespread interest. And reliance on Russian hydrocarbons, especially gas, is politically sensitive: for over 60 years, countries that have imported Russian oil and gas have wondered if Russia will cut supplies to make a political point, and there is a widespread assumption that countries would be more assertive toward Russia absent that fear.

Try…Everything

For over 60 years, the West has tried almost every approach toward Soviet or Russian hydrocarbons. In April 1959, the United Kingdom banned Soviet oil imports, although archival research shows that this policy was far from unanimously endorsed and reflected the wishes of domestic industrial interests rather than grand strategy and foreign policy concerns.2 Yet at the same time, Italy and West Germany were selling equipment to the Soviet Union, and Italy, in particular, was importing increasing quantities of Soviet oil—causing consternation across the Atlantic

In November 1962, the United States led the North Atlantic Treaty Organization (NATO) to impose an embargo on large diameter pipeline exports to the Soviet Union. The goal was to delay or even stop the Druzhba pipeline that would increase Soviet oil exports. The embargo split the alliance, with the United Kingdom being most vocal against it; the pipeline was completed with only a slight delay, and the embargo was removed in 1966. As Angela Stent put it, “one could argue that the pipe embargo caused more damage to US-European relations than to the Soviet economy.”3 That assessment applies to almost every overt transatlantic effort against Soviet and, later, Russian hydrocarbons.

During the détente years in the 1970s, energy was important in East-West trade, driven in part by Western economic growth that lifted energy demand; by a slowdown in the Soviet economy, which led Soviet leaders to seek to import Western technology to overcome the innovation gap that they were confronting; by Western industry seeking an outlet for its goods; and by a sense that trade might improve political relations. Trade boomed, but the impact on politics was unclear. As Stent, again, concluded in her seminal work on West German Ostpolitik: “It is in general illusory to believe that the West can significantly change Soviet political behavior through the use of economic levers.”4 Here too, the lesson seems to apply more broadly.

In the early 1980s, the policy shifted back to confrontation. In December 1981, the United States imposed an embargo on equipment exports to the Soviet Union in order to slow down or prevent the construction of another gas pipeline that would further increase Soviet exports to Western Europe. Unlike in 1962, the United States found not only a cold reception across Western Europe but also a clear willingness to resist. The embargo was lifted less than a year later; one of its results was to stimulate Soviet industry toward greater self-sufficiency, and the pipeline was eventually built with minor delays.

When countries clash over gas, they are often clashing over different conceptions about how energy and politics are connected.

In the 1990s, Western firms invested in oil and gas in Russia, although their role shrank as the state reasserted its prominence. The incorporation of Eastern European countries into the Western alliance further diluted its already shaky cohesion toward Russia, and consensus became even harder to reach. The focus slowly shifted toward either a search for alternative supply sources via pipeline or liquefied natural gas (LNG) or explicit efforts to block individual projects such Nord Stream, South Stream, Yamal LNG, and now Nord Stream 2—the last one causing the most turmoil these days.

What can we conclude from this history? In broad terms, we might make two observations. First, no amount of political pressure has succeeded in altering or curtailing the nearly irresistible urge to trade. Russia has vast oil and gas resources, Europe needs energy, and Russia can deliver that energy at a competitive price. Any alternative would be either more costly for Europe or less profitable for Russia. Trade will occur and has occurred almost irrespective of politics for over 60 years. Everything else is auxiliary to this fundamental geoeconomic reality.

Second, the United States and Europe have different takes on the merits of economic coercion versus cooperation. The United States is often pushing for sanctions, while much of Europe prefers contact. Grand strategy is certainly shaped by parochial interests, of course. The United States was keen to limit Soviet energy exports to Europe but happily sold grain to the Soviet Union. (Grain embargos against the Soviet Union were short-lived and muted by a global trading system that ensured U.S. food exports were not hit.) Europe has faced similar industrial pressures either in pushing for closer ties or in sounding an alarm that is barely concealing narrow business interests. But there seems to be a broader philosophical divide that recurs and has been difficult to bridge.

Deflating Energy?

The grander lesson from that history might be more radical still: that energy is not a central character in the broader story of the bilateral relationship. Too many observers tend to think that energy shapes far more than it actually shapes. And energy being the major source of economic collaboration between Russia and the West leads policymakers to turn to energy to fight political battles. This tendency to connect energy and geopolitics is a recurrent undercurrent of all discussions. When countries clash over gas, they are often clashing over different conceptions about how energy and politics are connected.

It is hard to list all the questions and assumptions that consciously or subconsciously shape policy, but this is a sample; if policymakers agreed on these questions, they would be more likely to agree on policy. Did energy exports during the Soviet times prop up the Soviet economy and give the Soviets leverage either toward the West or toward other socialist countries? Did trade bring about real change in Soviet or European behavior? Did the fall in oil prices in the 1980s make a material contribution to the fall of the Soviet Union? Did the rebound in oil prices in the 2000s accelerate Russia’s authoritarianism? Did the rise in oil and gas revenues produce military adventurism? How about the fall in revenues? Does economic warfare against Russia yield dividends in actual battlefronts, whether physical or virtual?

These questions cannot be answered here, but one can imagine a spectrum of answers that ranges from energy playing a central role over the past 60 years to one where energy is a footnote in a grander narrative. Today’s disputes spring from differences along that spectrum. Will greater diversification in European gas dilute Russia’s energy weapon—or, more provocatively, does that weapon even exist? Will the desire to export more oil and gas to Europe lead Russia’s leadership to make political concessions? Can Russia’s grand strategy be shaped by economic engagement or coercion? Will falling hydrocarbon revenues make Russia less adventurous or more democratic? Might they weaken Russia, and what does a weaker Russia mean for the West?

Once again, the answers to these questions are unknowable. But history is a guide, and there is support for the thesis that maybe energy is not so central after all. One can write the history of the Soviet economy without delving too much into hydrocarbons.5 The Soviet economy stopped catching up to the United States just as hydrocarbon revenues rose in the 1970s, suggesting more “Dutch disease” than petro-power, although the windfall clearly helped. And falling oil prices in the 1980s were one of many shocks for an economic system that was unraveling (unlike Russia, the Soviet economy did not go into recession when oil prices fell in the 1980s, although growth was low)

It is far easier to explain Russian foreign policy through core geopolitical interests than it is by dissecting energy prices and their impact on the economy.

On the political front, one can similarly see energy on the sidelines of a broader narrative. As Stent observed, it is hard to argue that closer economic collaboration led to real changes in Soviet behavior, although it opened up some space for cooperation and lubricated détente when the mood favored détente. At times, the trade relationship suffered from politics, although what is surprising is how little the rivalry between the Soviet Union and the West affected the energy trade. It is almost like geopolitics and geoeconomics operated on separate planes.

Energy was more important for trade within the socialist world. One can see the Soviet Union trying to balance between competing goals: the need to earn hard currency by selling oil and gas to the West and the desire to earn high prices for its hydrocarbons sold within the socialist world versus the need to maintain alliance cohesion and avoid the centrifugal counterreaction from any overt acts of economic coercion. One can also see the Soviet leadership gradually coming to regard the cost of empire as being too much to bear—a view that was partly shaped by energy relations.6

In the post-Soviet era, the fall in oil prices in 1998 exacerbated a decade-long collapse. That nadir haunts Russia, and it is not hard to see today’s behavior as partly a reaction to that low point. Russia has been integrated into the global economy and has leveraged hydrocarbons to propel its economy. Yet the political effects of that economic story are harder to discern. Russia’s slide into authoritarianism preceded the oil price increase in the 2000s, and it persisted no matter what happened to hydrocarbon revenue. Same on foreign policy: Russia has been aggressive when the economy has been good and when it has been bad. It is far easier to explain Russian foreign policy through core geopolitical interests than it is by dissecting energy prices and their impact on the economy.

Leveraging energy to achieve Russia’s grander goals has been similarly elusive. Energy is a blunt weapon and difficult to wield. A comprehensive study on the energy weapon, broadly defined, in the post-Soviet era concluded that “usage of the energy levers appears to have generated little or no gain for Russia in terms of political concessions, at least from what can be seen in open sources.”7 This is not surprising, of course; it fits neatly with the literature on economic sanctions more generally, which is that they tend to work only in limited cases and under special circumstances. Or to phrase it differently: if energy was a good weapon to use, Russia would not need to engage in actual war to achieve its goals.

A New Strategy

Where does this leave the West? The West has a Russia problem, and that problem springs from Russian power and ambitions, not energy. At the same time, a divided West does not have a well-articulated strategy toward Russia. Energy debates are likely elevated precisely because the West does not have a Russia strategy—without having a clear idea of how to handle Russia, policymakers and analysts devolve into arguments about pipelines, routes, prices, supply and demand, and similar topics. Thus, arcane or narrow subjects acquire an existential quality despite being, for lack of a better word, totally pointless arguments. Energy is often targeted because it is tangible and can satisfy the urge to “do something,” even if that something is not very useful or effective.

So what is the West to do? First, it would help to have more honest debates. The fundamental source of friction rests not on whether Europe needs Russian gas; or whether Europe should depend on Russia for 25 or 30 or 35 percent of its gas needs; or whether the gas should come through one route or another. The key questions are the historical and political ones stated above. There is a side that argues that Russia is a threat and that economic isolation is the best way to deal with this threat. That’s an intellectually honest position and one worth arguing over. No need to muddy the waters with Nord Stream 2 or LNG.

A well-functioning market that allows gas to move around freely would lessen many legitimate concerns that exist in Central and Eastern Europe about depending on Russian gas.

Second, it is quite clear, from the analysis above, that neither engagement nor isolation is likely to bring about the desired political effects (to be fair, isolation has not been tried to any considerable extent, so this is partly a statement about its feasibility as well as its likely effectiveness). The West needs a more robust strategy that counters Russian influence overseas; that fills the vacuums that Russian policy exploits; that buttresses the physical and virtual defenses that are vulnerable to Russian attacks; that closes the social and political cleavages that Russia’s propaganda has excelled at amplifying; and that targets the wealth that Russians park overseas. This is a hard agenda; but until the West does these things, no amount of energy spent on energy will really make any difference.

Third, there is an energy agenda that Europe could pursue and that could dilute whatever influence Russia might enjoy from energy. A speedier transition to low-carbon energy and greater efforts toward energy efficiency are worth pursuing anyway, but they are also likely to impact the relationship with Russia. Some more clarity on Europe’s gas trajectory would help too: Europe wants to diversify its gas supplies but also decarbonize, which means it wants companies to invest billions to bring gas to Europe while trying to ensure that Europe does not consume this gas. These contradictions confuse markets and undermine energy security.

The most important task, however, is to complete the internal energy market. A well-functioning market that allows gas to move around freely would lessen many legitimate concerns that exist in Central and Eastern Europe about depending on Russian gas. This is not just about new projects, which seem to attract the most attention and which politicians like because ribbon-cutting ceremonies are good photo ops. It is also not fundamentally an external strategy but an internal one. It means stronger regulation and combating special interests; going to court and fining incumbents who block the free movement of gas. The European market has opened up as much due to antitrust action as due to legislation, which is why the European Commission’s antitrust case against Gazprom’s activities in Europe is so promising—it could really resolve many long-standing deficiencies in the European market. A stronger internal market could render moot the vast majority of concerns that today preoccupy and divide the transatlantic alliance.

In the end, the West should rethink the link between Russian energy and geopolitics. We tend to overstate how much energy matters. Writing about the Arab world after the 1970s, Fouad Ajami talked about the “the peculiar nature of Arab wealth—its inconvertibility to real power, that frustrating difference between power as resources and power as the ability to affect outcomes.”8 That is a far better starting point for thinking energy power in general and Russia in particular, and one that should make it easier to deal with an energy relationship that has bedeviled the transatlantic alliance for decades.

Nikos Tsafos is a senior associate with the Energy and National Security Program at the Center for Strategic and International Studies in Washington, D.C.

CSIS Briefs are produced by the Center for Strategic and International Studies (CSIS), a private, tax-exempt institution focusing on international public policy issues. Its research is nonpartisan and nonproprietary. CSIS does not take specific policy positions. Accordingly, all views, positions, and conclusions expressed in this publication should be understood to be solely those of the author(s).

© 2018 by the Center for Strategic and International Studies. All rights reserved.

[1] This number refers to the general government. For

the federal government alone, the figure is over 45 percent for the last

decade.

[2] See Niklas Jensen-Eriksen, “‘Red Oil’ and Western

Reactions: The Case of Britain,” in Cold War Energy: A Transnational History

of Soviet Oil and Gas , ed. Jeronim Perović (New York: Palgrave

Macmillan, 2017).

[3] Angela Stent, From Embargo to Ostpolitik:

The Political Economy of West German-Soviet Relations, 1955–1980 (New

York: Cambridge University Press, 1981).

[4] Ibid.

[5] See Philip Hanson, The Rise and Fall of

the Soviet Economy: An Economic History of the USSR 1945–1991 (New

York: Routledge, 2003).

[6] See Margarita M. Balmaceda, “The Fall of the

Soviet Union and the Legacies of Energy Dependencies in Eastern Europe,”

in Cold War Energy, ed. Jeronim Perović.

[7] Robert Larsson, Russia’s Energy Policy:

Security Dimensions and Russia’s Reliability as an Energy Supplier(Stockholm:

Swedish Defense Research Agency, March 2006).

[8] Fouad Ajami, The Arab Predicament: Arab Political

Thought and Practice Since 1967 , 2nd ed. (New York: Cambridge

University Press, 1992), 196.

https://www.csis.org/analysis/whos-afraid-russian-gas-bridging-transatlantic-divide

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!