Analytics, Banks, Financial Services, Lithuania, Society

International Internet Magazine. Baltic States news & analytics

Sunday, 28.12.2025, 20:01

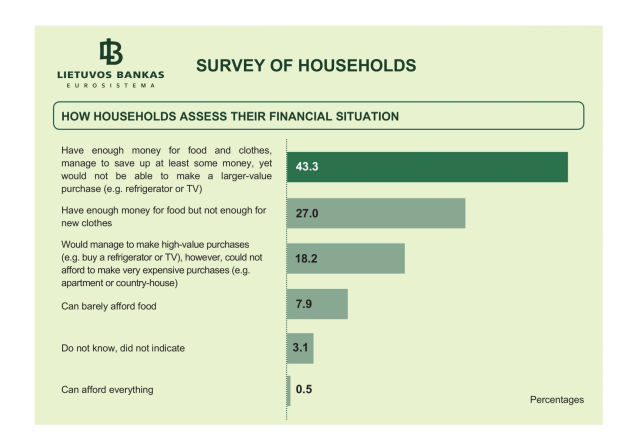

Majority of Lithuania`s households state that their financial situation is average or good

Print version

Print version |

|---|

Two out of three households own the housing they live in. More than every third (38%) younger resident (aged 18–29) indicated living in a rented housing. Respondents from major cities (12%) usually live in own housing for which they are still repaying a loan, while younger respondents (21%) are more likely to live in their relatives’ housing. Residents aged 50 and older (85%) largely live in their own housing with no loans to repay.

Resident saving habits remained basically unchanged – every second household still manages to save at least part of its income. The monthly amount put aside usually ranges from EUR 31 to EUR 150 – this was reported by approximately half of households that managed to save in the previous half-year.

If their income increased by more than 20 per cent, three out of eight (38%) surveyed would save the bulk of their additional income, while almost one out of four (24%) would spend them. Almost two out of three (63%) residents stated that, having lost their main source of income and without having to borrow, they would manage for no more than three months.

Facing financial difficulties, the majority (almost 46% of the surveyed) would cut their expenses, almost 18 per cent would borrow from their relatives, whereas almost 15 per cent would seek additional work.

Three fourths of the surveyed (76%) believe that their income will remain unchanged over the upcoming half-year. Every second (49%) household believes that its expenditure will increase, whereas only 7 per cent expect a rise in income. As previously, residents (almost every second respondent) are mostly worried that food prices will rise over the upcoming half-year.

The latest Survey of Households also included a question on emigration trends.

‘Results show that emigration has had a direct or indirect effect on almost two thirds of Lithuanian families. Among reasons for emigrating, economic ones prevail’, states Milda Šeškutė.

Three out of five (61%) households have relatives that left the country to work or live abroad. Main reasons for emigration, according to the surveyed, are the unsatisfactory level of income in Lithuania (35%), search for better living conditions (31%) and poor economic situation in the country (29%). Households stating that the main reason why their relatives emigrated was high social disparities account for 11%, long, fruitless job search – 14%.

Surveys of Households are conducted on a biannual basis; they aim to define the saving and borrowing habits of households and the reasons for doing so, as well as find out how households assess their current financial situation. Surveys also include questions related to future expectations of households – developments in their financial situation, saving or borrowing plans.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!