Analytics, Business, EU – Baltic States

International Internet Magazine. Baltic States news & analytics

Friday, 26.04.2024, 19:46

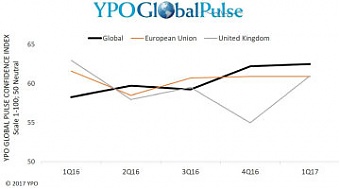

YPO Global Pulse Survey: Confidence among EU business leaders holds firm in Q1

Print version

Print version |

|---|

While overall sentiment remained steady, there were

significant shifts in confidence within the major EU economies. France saw a

sharp decline in confidence in the weeks preceding the tightly-contested

presidential election on 23 April. The Index for France slumped 8.1 points to

54.5, its lowest level since January 2015.

Greece also reported a severe loss of confidence, following

its weak economic performance, crashing 11.9 points to 46.2, its lowest point

since July 2015 and back in pessimistic territory. Italy saw a more moderate

decline, slipping 1.5 points to 59.8.

Germany, on the other hand, enjoyed a strong surge in

confidence in the first quarter, gaining 6.4 points to 62.7, its highest level

since January 2011. This followed stronger than anticipated growth at the end

of 2016 and in the first three months of this year.

The United Kingdom also reported a more positive outlook,

jumping 6.0 points to 61.0, its highest level in the past twelve months, and

prior to the referendum decision to leave the EU.

"Despite concerns of an economic slowdown, most

economies in the EU have continued to strengthen and, in some cases, outperform

predictions," said Juan Carlos Fouz Silva, YPO member and CEO of

Global Assets Buyout.

"Chief executives in Europe are facing unprecedented

levels of uncertainty, both within the region and beyond, and are operating in

an economic and political landscape that is changing by the day. While the

climate for business remains relatively favourable at present, chief executives

will remain somewhat cautious, particularly with important elections on the

horizon in Germany, France and the United Kingdom."

Non-EU Europe reported the lowest level of confidence in the

world, falling 2.5 points to 51.8.

Globally, the YPO Global Pulse Index for the first quarter

of 2017 edged up 0.3 point to 62.5, its highest level since January 2015. For

the second consecutive quarter, the United States reported the highest level of

confidence in the world, inching up 0.3 point to 64.9. Confidence in Asia climbed

2.1 points to land at 63.3, its highest level since April 2015. Africa is

the second-least confident region globally, edging down 0.3 point to 54.4.

Elsewhere, confidence in Latin America dropped by 1.2 points to 57.1, while

confidence in the Middle East and North Africa (MENA) region showed the biggest

decline, sliding 4.3 points to 55.2.

Brighter outlook on short-term economic conditions

When asked to assess the economic landscape over the next

six months, almost half (49%) of EU chief executives believed that conditions

would improve, whilst 42% felt that there would be little or no change. Only 9%

expected the economic landscape to deteriorate over the next six months. This

was a more positive outlook than in the previous survey, conducted in January,

when only 40% predicted an improvement and 13% predicted a deterioration in the

economic climate over the following six months.

Sales forecasts improve, but hiring and fixed investment forecasts downgraded

EU business leaders remained optimistic about the prospects

for revenue growth within their own organisations over the next 12 months. The

YPO Sales Confidence Index edged up 0.4 point to 66.9, as nearly two-thirds of

CEOs (64%) predicted increased revenue in 2017, compared with only 5% who

predicted a decline in sales.

However, business leaders were less optimistic when it came

to their hiring intentions. The majority (70%) expected the size of their

workforce to remain unchanged over the next 12 months, while 26% expected to

increase headcount, and 4% expected to cut staff numbers.

The majority (57%) of CEOs also expected fixed investment

levels to remain flat over the next year, while38% expected to increase fixed

investment, and 5% predicted a decline.

Confidence slumps in France

Business leaders in France were less optimistic during the

quarter under review, amid growing uncertainty surrounding the country's

presidential election and the potential for significant shifts in economic

policy.

More than a quarter (29%) of French CEOs stated that

economic conditions had deteriorated in the previous six months, a significant

increase on the previous survey, when only 11% reported worsening conditions.

French business leaders were also notably more cautious

about the prospects for their own organisations in the next 12 months. Only 29%

predicted increased revenue, down from 66% in the previous quarter. As few as

7% predicted increased headcount, down from 40% in the January survey, and only

29% expected to boost fixed investment levels, down from 55%. The majority of

French CEOs expected revenue, employment numbers and fixed investment levels to

remain flat over the next year.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!