Analytics, Budget, EU – Baltic States, Financial Services, GDP, Latvia

International Internet Magazine. Baltic States news & analytics

Saturday, 27.04.2024, 06:06

ESA 2010: Latvia's budget deficit reached 1.3% of GDP in 2015

Print version

Print versionApril 2016 general government budget deficit and debt notification: main indicators

|

|

2012 |

2013 |

2014 |

2015 |

|

Budget deficit (-) / surplus (+), mln EUR |

||||

|

General government |

-179.2 |

-203.4 |

-366.1 |

-306.2 |

|

Central government |

-83.1 |

-25.6 |

-402.9 |

-434.4 |

|

Local governments |

-52.1 |

-100.2 |

-51.0 |

92.6 |

|

Social security fund |

-44.0 |

-77.6 |

87.8 |

35.6 |

|

General government consolidated gross debt at nominal value at the end of year, mln EUR |

9 020.0 |

8 892.7 |

9 616.3 |

8 871.7 |

|

Gross domestic product at current prices, mln EUR |

21 810.5 |

22 762.9 |

23 580.9 |

24 377.7 |

|

As% over GDP |

||||

|

General government budget deficit (-) |

-0.8 |

-0.9 |

-1.6 |

-1.3 |

|

General government consolidated gross debt at nominal value at the end of year |

41.4 |

39.1 |

40.8 |

36.4 |

As compared to the operating cash flow data of the Treasury, where general government consolidated budget deficit in 2015 was EUR 372.3 mln, general government budget deficit calculated by the CSB in accordance with the methodological requirements of ESA 2010 is EUR 66.1 mln or 0.3 percentage points of GDP less.

Most significant adjustments with positive effect on general government budget (decrease of deficit):

-

adjustments for balancing foreign financial aid flow (data of institutions

involved in administration of foreign funds) – by EUR 120.8 mln or 0.5% of GDP;

- adjustments to obligations against

creditors (data of the Treasury) - by EUR 50.1 mln or 0.2% of GDP;

- adjustments for exclusion of transactions

of derived financial instruments (data of the Treasury) – by EUR 42.6 mln or

0.2% of GDP;

- adjustments between accrued and paid

interest (data of the Treasury) – by EUR 27.4 mln or 0.1% of GDP;

- adjustments of expenditure on

construction of the Southern Bridge (data of Riga City Council) – by EUR 22.1

mln or 0.1% of GDP.

At the same time also adjustments with negative effect on general government budget have been made (deficit increase):

-

adjustments due to purchase of the State Revenue Service building from a

private partner (data of the Ministry of Finance and the State Real Estate

Agency) - by EUR 67.8 mln or 0.3% of GDP;

- adjustments for claims against debtors

(data of the Treasury) – by EUR 65.1 mln or 0.3% of GDP;

- tax adjustments using the time adjustment

method (data of the Ministry of Finance) – by EUR 22.2 mln or 0.1% of GDP;

- adjustments due to government investments

in enterprises (data of the Treasury) – by EUR 21.5 mln or 0.1% of GDP;

- adjustments of lump sum payments

for pension schemes (data of the State Social Insurance Agency) – by EUR

19.2 mln or 0.1% of GDP.

|

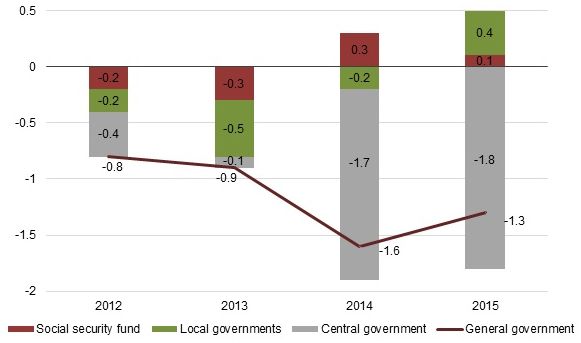

| General government budget deficit by subsector in 2012 - 2015, as % of GDP |

In 2015, as compared to 2014, general government deficit decreased by EUR 59.8 mln or 0.3 percentage points of GDP. As contrasted with the budget deficit of EUR 51.0 mln in 2014, last year the local government subsector showed a budget surplus of EUR 92.6 mln. The positive changes were promoted by the increase in revenues from personal income tax, reduction of capital expenditure, and improved financial results of the enterprises reclassified to the government sector. Compared to 2014, central government subsector budget deficit in 2015 grew by EUR 31.5 mln or 0.1% of GDP. Since expenditure on social benefits increased due to legislative amendments, the budget surplus of the social security fund subsector decreased by EUR 52.2 mln or 0.2 percentage points of GDP.

General government consolidated gross debt in 2015 dropped by EUR 744.6 EUR as compared to 2014. Debt reduction can be explained with the repayment of the loan to the European Commission in the amount of EUR 1.2 bln.

In the calculations of the April 2016 notification, data of the Ministry of Finance, the Treasury, the State Social Insurance Agency, the CSB, Riga City Council, the State Real Estate Agency and institutions involved in administration of foreign funds have been used.

On April 21 Eurostat, the Statistical Office of the European Union, will release information on the results of the April 2016 notification in all EU Member States.

More information on General Government Budget Deficit and Debt Notification is available in the CSB website section Government Finances.

Methodological explanations:

1 In accordance with the requirements of Regulation (EC) No. 479/2009, general government budget deficit and debt notification is submitted to the European Commission twice a year – by 1 April and 1 October. The results of the notification are used for assessing how the EU Member States ensure the compliance of the respective economic indicators with the criteria established by the Maastricht Treaty; that is, the ratio of the planned and actual general government budget deficit to gross domestic product (GDP) at current prices must not exceed 3.0% and the ratio of government debt to gross domestic product at current prices must be no more than 60.0%.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!