Analytics, Budget, Estonia, EU – Baltic States, Financial Services

International Internet Magazine. Baltic States news & analytics

Friday, 26.04.2024, 17:27

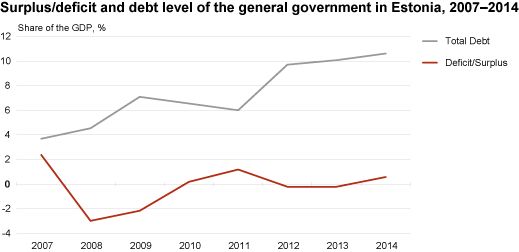

General government balance back in surplus in Estonia in 2014

Print version

Print version

At the end of 2014, the total revenues of the general government exceeded the expenditures by 112.7 million euros*, accounted as the Maastricht deficit criteria. Both the balance of the central government and those of local governments improved. By the end of 2014, the surplus of revenues of the central government sub-sector was 55 million euros*. The deficit of the local government sector decreased over the year, amounting to a deficit of only 4.5 million euros at the end of 2014. The budget surplus of social security funds was 62.2 million euros, remaining on the same level as in 2013.

The consolidated debt of the general government (Maastricht debt) amounted to 2.1 billion euros by the end of 2014, having risen 10% compared to 2013. The local governments as well as the central government contributed to the growth of the debt level. The loan liabilities of the central government rose by 11%, while the volume of long-term securities issued by the public-legal institutions and foundations belonging to the central government decreased by 28%. The share of foreign debt in the central government’s loan liabilities was nearly 84%.

The Estonian involvement in the European temporary rescue mechanism, EFSF (European Financial Stability Facility) increased by 26.4 million euros in 2014. At the end of 2014, the liabilities towards the EFSF totalled 485 million euros, 81% of which went for the participation in the rescue package for Greece, 12% for Portugal and 8% for Ireland.

The overall debt level of the local governments grew by 12% compared to 2013 and nearly a quarter of the loans were financed by foreign capital. While the volume of long-term loans increased 13% over the year, the volume of short-term loans decreased nearly three times. The volume of the securities other than shares increased 8%. As at the end of 2014, social security funds did not contribute to the debt of the general government sector.

Unlike earlier years, the results of the economic activities of central stockholding agencies and deposit guarantee funds are now added as estimations to the central government balance according to Eurostat’s decisions on accounting harmonisation. The corresponding recalculations will be published in the Statistical Database of Statistics Estonia together with the results of regular revisions in September 2015.

In Estonia, the general government sector comprises three sub-sectors: 1) central government (state budget units and extra-budgetary funds, foundations, legal persons in public law); 2) local governments (city and rural municipality governments with their subsidiary units, foundations); 3) social security funds (Estonian Health Insurance Fund, Estonian Unemployment Insurance Fund).

Eurostat is going to publish the data on the preliminary debt and deficit levels of the Member States on 21 April.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!