Banks, Direct Speech, Economics, Financial Services, GDP, Latvia

International Internet Magazine. Baltic States news & analytics

Wednesday, 17.12.2025, 10:48

Latvia's economy demonstrates modest growth against the background of global turbulences

Print version

Print version |

|---|

Hence, there is no reason for rejoicing, yet no reason for crying either: as could be expected, it's nothing outstanding, but it could have been worse. Amid crisis allegations, tariff wars, Australian forest fires, outbreak of coronavirus and other global turbulences, anything with a positive sign seems nearly a prize-worthy achievement.

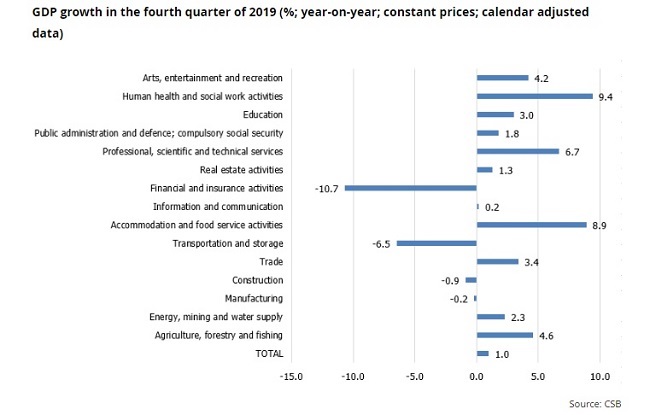

According to updates of the Central Statistical Bureau of Latvia, GDP increased by 0.1% q-o-q and 1.0% y-o-y in seasonally and calendar adjusted terms in the fourth quarter of 2019. The year 2019 has been quite interesting from the point of view of economic analysis, as the demand and supply factors have undergone significant changes in the period from the beginning to the end of the year. The previously-observed challenges posed by insufficient capacity of the supply side, i.e. shortage of labour and level of capacity utilisation, have largely disappeared in the course of the year, with insufficient demand becoming the main factor limiting growth.

Nevertheless, some things are quite unchanged: for example, private consumption has remained solid and has been the main expenditure component contributing to GDP growth. The rise of private consumption was primarily underpinned by higher average net wages and an improved financial situation of households: they could retain their spending and saving habits, without hoarding up significant precautionary savings in fear of a gloomy future. This is exactly what happened ten years ago at the crisis onset, making it even deeper. With some volatility, consumer confidence has overall remained above the long-term average throughout the year. Private consumption was and will remain the main stabiliser of the economy also in 2020, despite a slight deceleration.

At the same time, the growth of investment decreased significantly in the course of 2019, entering a negative territory in the fourth quarter. For purposes of comparison, the growth rate ranged from 13% to 18% in 2018. Investors became more cautious in 2019 and in some cases put their previously-made investment plans on a hold. In the circumstances of high external uncertainties and weakening external demand, exports have also decelerated, particularly those of goods.

Looking at sectors, the domestic consumption-oriented sectors like healthcare, education and professional services have managed to perform better, as could be expected. The growth of sectors more depending on exports (e.g. manufacturing, transit and the non-resident business segment of financial services) has decelerated. Tourism, which is also export-oriented, is an exception to the rule and demonstrates excellent growth.

In the circumstances of persistently high external uncertainties, similar GDP growth can be expected in 2020, with private consumption remaining the main contributor. Investment poses a more significant downside risk to growth, as it is more sensitive to cyclical economic changes.

Judging by the current commotion over the coronavirus, this factor could really have an effect on both global and Latvia's economic development and represent a downside risk to the outlook. As to any medical assessment and comparisons with the impact and mortality rates of other viruses, this should be definitely left to health experts. It is, however, clear that the virus has already left an imprint on global trade. Moreover, it can also affect any individual's decisions to travel, attend public events etc., and that, no doubt, will be reflected in macroeconomic data and the performance of individual sectors (for example, tourism and entertainment industry).

- 28.01.2022 BONO aims at a billion!

- 25.01.2021 Как банкиры 90-х делили «золотую милю» в Юрмале

- 30.12.2020 Накануне 25-летия Балтийский курс/The Baltic Course уходит с рынка деловых СМИ

- 30.12.2020 On the verge of its 25th anniversary, The Baltic Course leaves business media market

- 30.12.2020 Business Education Plus предлагает анонсы бизнес-обучений в январе-феврале 2021 года

- 30.12.2020 Hotels showing strong interest in providing self-isolation service

- 29.12.2020 В Латвии вводят комендантский час, ЧС продлена до 7 февраля

- 29.12.2020 В Rietumu и в этот раз создали особые праздничные открытки и календари 2021

- 29.12.2020 Latvia to impose curfew, state of emergency to be extended until February 7

- 29.12.2020 18-19 января Наталия Сафонова проводит семинар "Управленческий учет во власти собственника"

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!