Analytics, Baltic, Financial Services, Loan, Real Estate

International Internet Magazine. Baltic States news & analytics

Saturday, 03.01.2026, 09:30

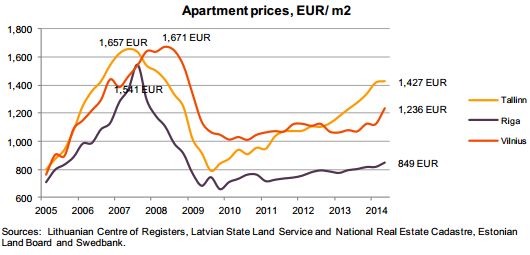

Swedbank: among the Baltic capitals the housing in Riga is the most affordable

Print version

Print version

In Tallinn, affordability diminished by 16.3 points in the second quarter this year compared with the same period in 2013, due to a 16.3% annual increase in apartment prices.

In Riga, the HAI declined marginally (by 0.3 point) because of a 10 basis point increase in mortgage interest rates. Contrary to other Baltic countries, wages in a year rose faster than apartment prices in Riga.

In Vilnius, the HAI fell by 10.7 points because of a 14.4% annual increase in apartment prices. The time needed to save for a down payment increased over the past year by almost three months in Tallinn, to 28.3 months and by more than three months in Vilnius, to 37.4 months. It decreased in Riga by more than one week, to 24.8

months.

Apartment prices continued their rapid pace of growth in Tallinn. Prices jumped in Vilnius as well. In Riga, prices continued increasing but at a more modest pace.

Activity in the Tallinn real estate market cooled down in the second quarter of 2014, when the number of deals decreased by 11% in annual comparison, while annual price growth decelerated to 16%. Price growth decelerated the most in a large bedroom community area (Lasnamäe) and in the city centre. Growth is slowing due to the strong increase in the supply of dwellings. This year, numerous new developments have been completed and many of them have been sold beforehand. This also increases the supply of old apartments, as most buyers have to sell their old apartments in order to buy new ones. The growth of housing loan stock accelerated very modestly, to 1.7% year on year (YoY) and the growth of new loans decelerated to 11.6% YoY, the latter due to the slowdown of activity in the real estate market.

In Riga, activity in the residential real estate market was flat – the number of deals in the second quarter declined by 0.6% annually due to a one-off fall in April (returning to growth afterwards). Demand has not, however, melted away. Particularly, it increased somewhat amongst nonresidents due to a rise in the minimum value of property for which an investor can get a residence permit for five years. On September 1, this threshold was raised from EUR 142, 300 to EUR 250,000. The amendments were adopted by the parliament in the beginning of May, thus facilitating non-resident activity before the benchmark changes. The nonresident activity supported price growth, which in the second quarter reached 6.8% in annual terms. The swiftest price growth was for new projects in the suburbs – an alternative for nonresidents, since the supply of upper-scale apartments in the centre is limited. Prices of other apartment types grew more moderately. We believe that the activity increase amongst nonresidents is temporary and will slow as the law amendments come into force. At the same time, local buyers are expected to be cautious due to geopolitical uncertainty and the somewhat worsened economic outlook. As a result, real estate price growth will remain modest.

In Vilnius, annual activity growth in the real estate sector decelerated from 53% in the first quarter of this year to 6.2% in the second quarter, while price growth accelerated from 5.6% to 14.4%. Such price growth was above our expectations, and continued price increases at such a pace would be unsustainable. Prices were rising in new and old apartment segments; however, prices of new apartments increased by only 6.6% in the second quarter. Activity growth remained high in the new apartment segment – the number of transactions increased by 66.7% in the second quarter. According to the most recent Bank of Lithuania survey, 53.8% of households expect an increase in the price of housing. Half a year ago, only 35.9% of households were expecting higher prices. In addition, 18.6% of households expect that prices will increase by 10–20%. Rising price expectations might have had a negative effect on supply and a positive effect on demand. Demand for real estate also increased due to historically low interest rates, which encouraged people to buy instead of rent an apartment. The higher demand could in part be attributed to the planned adoption of the euro as of January 1 next year. In the second quarter of this year, only 44% of all apartment purchases were made through loans. This means that part of the savings are invested in real estate rather than changed into euros. Part of these savings might be earnings from the shadow economy. The lack of alternative investments and rising real income are also increasing demand.

In June-July apartment prices in two major cities, Vilnius and Kaunas, were by 20% higher than a year ago and apartment sales slowed down, reports LETA/ELTA.

According to Vaiva Seckute, Chief Economist at Swedbank, the ratio between apartment prices and salaries in Vilnius is currently below the historic average. This means there ino price bubble. Rental yield and housing affordability rates show the same. In the last quarter prices in major cities grew faster than salaries, therefore, apartment price to salary ratio is nearing closer to its historic average. However, further fast price growth would not be sustainable and might be a sign of a new real estate bubble.

Swedbank economists believe that the demand is partially affected by the nearing euro adoption. In the second quarter 56% of apartments were purchased without using loans, it is by 10% more prior to the crisis. It is a sign that some residents are investing their life savings into real estate. Origin of some people's savings may be opaque, perhaps some think that it is "safer" not to exchange them into the euro but to buy real estate instead. Because in the second quarter of 2014 salary growth was significantly slower than price growth, apartment affordability reduced. A family earning average income was able to purchase a 65 square metre apartment, whereas in 2013 the figure stood at 71 square metres.

Apartments in Vilnius would become unaffordable if their prices rose by more than 18.1% or interest on housing loans rose by more than 3.9%. Now the average interest on a housing loan stands at 2.6% and is the lowest in the Baltic States.

Mortgage interest rates increased slightly on an annual basis in Latvia. They declined marginally in Lithuania and Estonia. The three-month euro interbank offered rate (EURIBOR) increased from 0.295% in the first quarter of this year to 0.298% in the second quarter.

Annual wage growth decelerated in Tallinn, and growth remained the highest in Riga.

The HAI value of 148.5 in Tallinn means that household net wages in this city are 48.5% higher than required to afford an apartment, according to our norm (mortgage costs account for 30% of net wages of a household that earns 1.5 of the average net wage). In Riga, meanwhile, household net wages are 57.4% higher – and, in Vilnius, 18.1% higher - than required to fulfil this norm.

The housing affordability index (HAI) is calculated for a family whose income is equal to 1.5 of average net wages with an average-sized apartment of 55 square meters. The HAI is 100 when households use 30% of their net wages for mortgage costs. When the HAI is at least 100, households can afford their housing, according to the established norm. The higher the number, the greater the affordability.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!