Analytics, EU – Baltic States, Modern EU, Taxation

International Internet Magazine. Baltic States news & analytics

Sunday, 28.12.2025, 12:49

Combating tax evasion: urgent task for EU governments

Print version

Print version |

|---|

Addressing base erosion and profit shifting (beps) is becoming

a key priority of governments around the world. In 2013, the OECD and G-20

countries adopted a 15-point Action Plan to address BEPS. Beyond securing

revenues by realigning taxation with economic activities and value creation,

the BEPS project aims to create a single set of consensus-based international

tax rules to address profit shifting and, finally, to protect tax bases while

offering increased certainty and predictability to taxpayers.

In 2016, the OECD and G20 established an Inclusive Framework on BEPS to allow

interested countries and jurisdictions to cooperate with OECD and G-20 member states

in developing some BEPS standards and monitoring its implementation; over 100

countries and jurisdictions have joined the “inclusive framework”.

More in: https://www.oecd-ilibrary.org/taxation/oecd-g20-base-erosion-and-profit-shifting-project_23132612

On OECD’s Action plan on BEPS from 2013 in: https://read.oecd-ilibrary.org/taxation/action-plan-on-base-erosion-and-profit-shifting_9789264202719-en#page40

BEPS as a national strategy to combat tax havens

Main feature

behind the BEP is tackle the corporate executes’ intention to address “tax

inversion” into a tax haven by “managing” the profit shifting (or earnings

strip); it is the latter that is actually represent the untaxed profits moved to

the tax haven.

The BEPS’ techniques

have been used extensively by the US companies during 2004-17, mainly MNCs, to create

enormous untaxed offshore cash reserves in size of $1-2 trillion in numerous tax

havens (there are about 40 presently around the world, including some in

Europe).

The OECD

estimated in 2017, that BEPS technique (despite the OECD’s project during

2012-16) helped “shielding” about $100-200 bn in annual corporate profits from

tax (some say that the figures are closer to S $250 bn per annum. Apple

executed in 2015 the largest recorded BEPS transaction in history when it moved

$300 bn of its profits to Ireland; at that time it was called a hybrid-tax inversion.

Due to multinational

enterprises exploiting gaps and mismatches between different countries' tax

systems, a proper domestic/national tax base

erosion and profit shifting laws and regulations can affects all other

countries.

MNCs and big

corporations operating internationally, must act together with the national

governments to tackle BEPS and restore trust in domestic and international tax

systems.

It has been

estimated by OECD that BEPS practices cost countries about $100-240 bn in lost

revenue annually, which is the equivalent to 4-10% of the global corporate

income tax revenue.

Working together the

OECD member states (of which the Baltic States are members) have to implement BEPS

Inclusive Framework and 15 Actions to tackle tax avoidance, improve the

coherence of international tax rules and ensure more transparent tax systems.

Table I: Key

figures

- Over 130 countries around the world agreed to cooperate on the BEPS’

package implementation;

- More that $240 bn are lost annually due to tax avoidance by multinational

companies, and = More than 85 countries and jurisdictions have signed the

Multilateral Instrument on BEPS.

|

Three Baltic

states (Estonia, Latvia and Lithuania) have several “cooperation lines” with

OECD’s Beps: on exchange of

information on request (EOIR), on automatic exchange of information (AEOI),

as well as reporting on existing harmful tax practices (Action 5), exchange

of information on tax rulings and preventing treaty abuse, etc. Source: https://www.oecd.org/tax/beps/ However, the biggest offshore jurisdictions for the EU

states are, actually within the European shores: five main EU offshore states

attract annually over € 3 bn, the money which could be otherwise used for

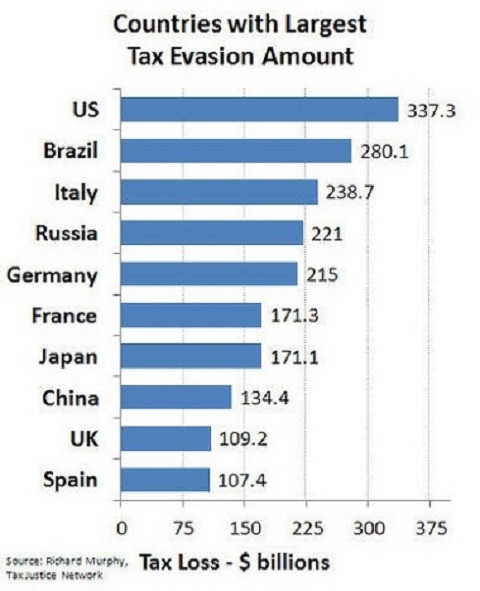

increased social-economic growth in the EU member states. Table II: Largest tax “evaders”

The first

recognized European tax haven hub was the Zurich-Zug-Liechtenstein

triangle created in the mid-1920s; later joined by Luxembourg in 1929. Privacy

and secrecy were established as an important aspect of European tax havens. Modern European

tax havens also include corporate-focused tax havens, which maintain higher

levels of OECD transparency, such as the Netherlands and Ireland. European

tax havens act as an important part of the global flows to tax havens, with

three of the five major global OFCs being European (e.g. the Netherlands,

Switzerland, and Ireland). Four European-related tax havens appear in the

various notable “top 10 tax havens” lists, e.g. the Netherlands, Ireland,

Switzerland and Luxembourg. Source: https://en.wikipedia.org/wiki/Tax_haven |

Global and European

Traditional tax

havens function by about zero rates of taxation through limited bilateral tax

treaties. However, present base erosion and profit shifting (beps) enable MNCs to

achieve "effective" tax rates closer to zero, not just in the haven

but in all countries with which the haven has tax treaties; putting them on tax

haven lists. According to modern studies, top 10 tax havens include

corporate-focused havens like the Netherlands, Singapore, Ireland, the U.K.,

Luxembourg, Hong Kong, the Caribbean (the Caymans, Bermuda, and the British

Virgin Islands) and Switzerland; the latter four jurisdictions are regarded as both

major traditional tax havens and major corporate tax havens. Corporate tax

havens often serve as channels to traditional tax havens.

The first

recognized European tax haven hub was the Zurich-Zug-Liechtenstein

triangle created in the mid-1920s; later joined by Luxembourg in 1929. Privacy

and secrecy were established as an important aspect of European tax havens.

Modern European

tax havens also include corporate-focused tax havens, which maintain higher

levels of OECD transparency, such as the Netherlands and Ireland. European tax

havens act as an important part of the global flows to tax havens, with three

of the five major global OFCs being European (e.g. the Netherlands,

Switzerland, and Ireland). Four European-related tax havens appear in the

various notable “top 10 tax havens” lists, e.g. the Netherlands, Ireland,

Switzerland and Luxembourg.

Source: https://en.wikipedia.org/wiki/Tax_haven

Table III: EU’s offshore

tax jurisdictions as recipients (one year -2016, in Euros)

Ireland – over a bn

(!);

The Netherlands –

800 million;

Luxembourg – 700 million;

Malta – 400 million,

Belgium – 300 million;

Switzerland –

about 300 million.

All other jurisdictions (including, Bermuda, Caribbean

Islands, Singapore, BVIs, etc.)

–

about 2,5 bn totally.

Note: a trillion

is a thousand bn, and a bn is a thousand million; this makes one trillion as one

million million. That is almost an inconceivable number to imagine.

More in: http://datagenetics.com/blog/april12019/index.html

Data from 2016 showed, for example, that multinational

companies (MNCs) have “moved” about € 4,5 bn only from Denmark; if corporate

taxes were paid in Denmark, the national budget would have acquired

additionally about bn euros (i.e. loss of tax revenues).

Tax havens managed to make great holes in national budgets:

Germany is losing yearly about 29% of GDP, France – 24%, the UK

-21% and Denmark -12%; to compare, China is losing only 4%(due to strict transparency rules!).

Lux-leaks: just one example

In November 2014,

the International Consortium of Investigative Journalists (ICIJ) released

28,000 documents (about 4.4 gigabytes of confidential information) about

Luxembourg's confidential private tax rulings which gave PricewaterhouseCoopers’ clients during 2002-10 enormous tax benefits

in Luxembourg. This ICIJ investigation disclosed 548 tax rulings for over 340

multinational companies based in Luxembourg. The LuxLeaks' disclosures attracted international attention about

corporate tax avoidance schemes in Luxembourg; the scandal contributed to the

implementation of measures aiming at reducing tax dumping and regulating tax

avoidance schemes beneficial to multinational companies.

In March 2019,

the European Parliament voted by 505 in favour to 63 against of accepting a new

report that likened Luxembourg, Malta, Ireland, the Netherlands and Cyprus to

"tax havens facilitating aggressive tax planning". However, despite

this vote, the EU Commission did not make proper steps to include these EU

jurisdictions on the blacklist.

Conclusion. In my

view, tax havens as parasitic

to national jurisdictions with normal tax regimes and could dramatically damage

their economies. In addition, IMF research in 2018 have shown that much of the foreign

direct investments, FDIs have been coming from tax havens, i.e. resources being

stolen from the national budgets. Widely contested modern economic theories do

not see the damaging effects of corporate taxation (generally and in MNCs) on

economic growth. Looking at contemporary global tax havens’ system, one can’t

get rid of the impression of a highly injustice system covered by legal means

with lack of moral corporate responsibility.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!