Analytics, EU – Baltic States, Financial Services, Modern EU

International Internet Magazine. Baltic States news & analytics

Thursday, 01.01.2026, 15:01

Commission President’s last official message: appeal for strong and united Europe

Print version

Print version |

|---|

In his State-of-the Union-address, SoU (in 14 pages), he

managed to cover most pressing for the EU’s integration issues. He started with

the appeals for unity and solidarity among different European nations,

especially when it comes to trade deals, geopolitics and migration.

As soon as the EU member states continue to squabble over

the best way to tackle the migrant and refugee crisis, the issues of “borders”

was important as well.

Instead of “condemning populism” (a recurring theme in

recent elections across EU states), the Commission President concentrated on

the states’ "sovereignty" and the EU’s and states’ obligations and responsibilities

on the international stage.

"The geopolitical situation makes this Europe's hour:

the time for European sovereignty has come. It is time Europe took its destiny

into its own hands," he said.

Euronews

underlined other note-worthy words in the speech: - "elections" (the

EU Parliament election will take place next year); and - "Africa" (he

described the continent as "the future" and pushed for deeper

partnership).

See more in: http://www.euronews.com/2018/09/12/juncker-s-state-of-the-union-the-words-to-remember

Previous SoUs

Seemingly, the 2017 and 2016 speeches have been rather similar:

hence, such issues as “unity” and “solidarity” were among the main themes, as

well as the economic ones. There were slightly different themes in SoU- 2015,

which included such issues as refugee crisis and asylum seekers, Greece and

eurozone problems.

Quite notable, that recently Greece had voted in a

referendum to decide whether to accept the bailout conditions laid down by its

creditors. The country was still in the midst of a persistent recession that

continued to threaten the survival of the euro single currency.

Addressing money-laundering

While the EU has strong anti-money laundering rules in

place, recent cases involving money laundering in some EU banks have raised

concerns that those rules are not always supervised and enforced effectively. This

creates risks for the integrity and reputation of the European financial sector

and can damage financial stability for specific banks.

As part of the broader efforts to complete Banking Union by

risk reduction and risk sharing and develop Capital Markets Union, decisive

action must be taken to ensure that anti-money laundering rules are effectively

supervised across the EU, and different authorities cooperate closely with each

other.

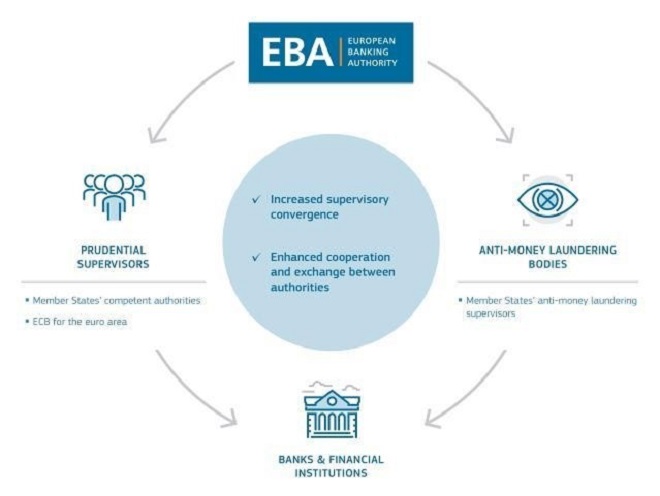

The Commission proposed amendments to the Regulation on the

European Banking Authority (EBA) in order to strengthen the EBA's role and give

it the necessary tools and resources to ensure effective cooperation and

convergence of supervisory standards.

This is part of a broader strategy to strengthen the EU

framework for prudential and anti-money laundering supervision for financial

institutions. It consists of legislative and non-legislative measures to make

anti-money laundering supervision more effective and improve the cooperation

between prudential and anti-money laundering supervisors.

These measures will contribute to promoting the integrity of

the EU's financial system, ensuring financial stability and protection from

financial crime.

The supervisory framework for combating money laundering is

based in the EU on the Anti-Money Laundering Directive, which also applies to a

number of actors outside the financial services sector. While the rules are set

at European level, their enforcement is carried out by national

authorities.

The fifth revision of the Anti-Money Laundering Directive is an important step forward

towards a stronger supervision of money-laundering issues in the EU. The

Directive sets up a system for better cooperation and exchange of information

between money-laundering and prudential supervisors. It also provides for the

conclusion of a Memorandum of Understanding between the money laundering

supervisors and the European Central Bank for the exchange of

information.

See more on the Directive in:

https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32018L0843

Additional actions on supervision

Despite existing strong legislative framework, several

recent cases of money laundering in European banks have given rise to concerns

about weaknesses and gaps in the implementation of the legislative framework by

the EU's network of different supervisors, in relation to three issues in

particular:

- Delayed

and insufficient supervisory actions to tackle weaknesses in financial

institutions' anti-money laundering risk management;

- Shortcomings

with respect to cooperation and information sharing both at domestic

level, between prudential and anti-money laundering authorities, and

between authorities in different Member States;

- Lack

of common arrangements for the cooperation with third countries in

relation to the anti-money laundering supervision of financial

institution.

It was agreed in the EU, that the supervision of compliance

with anti-money laundering legislation is carried out at the national level.

However, in the EU’s Banking Union, the Single Supervisory Mechanism (SSM) is

tasked with the direct supervision of significant banks. At the same time, for

the prudential aspects relevant to money laundering supervision, it has to

apply and rely on national legislation transposing EU Directives in the member states.

At EU level, the European Supervisory Authorities (the

European Banking Authority, the European Securities and Markets Authority, the

European Insurance and Occupational Pensions Authority) have the mandate to

ensure that the Union's prudential and anti-money laundering rules are applied

consistently, efficiently and effectively. However, this is just one of the

many tasks these authorities have to carry out. In addition, supervisors are

subject to differently transposed national rules, as prudential requirements in

legislation have not been supplemented with harmonised guidance.

Changes in the anti-money laundering framework

In order to reduce risks in the EU financial system, the

updating of the European Supervisory Authorities is introduced with a set of

targeted amendments to the existing legislation on prudential supervision. Anti-money

laundering responsibilities in the financial sector will be entrusted

specifically to one of the three European Supervisory Authorities, namely the

European Banking Authority (EBA), as it is in the banking sector that

money-laundering is having a “systemic impact”: the EBA's mandate will be more

explicit and more comprehensive, accompanied by a clear set of tasks, with corresponding

powers and adequate resources.

Besides, the Commission will give the EBA a mandate to

ensure that risks of money laundering in the Union's financial system are

effectively and consistently incorporated into the supervisory strategies and

practices of all relevant authorities.

The amended Regulation will:

- ensure

that breaches of anti-money laundering rules are consistently

investigated: the EBA will be able to request national anti-money

laundering supervisors to investigate potential material breaches and to

request them to consider targeted actions - such as sanctions;

- provide

that the national anti-money laundering supervisors comply with EU

rules and cooperate properly with prudential supervisors. The

EBA's existing powers will be reinforced so that, as a last resort if

national authorities do not act, the EBA will be able to address decisions

directly to individual financial sector operators;

- enhance the

quality of supervision through common standards, periodic reviews

of national supervisory authorities and risk-assessments;

- enable

the collection of information on anti-money laundering risks and trends

and fostering exchange of such information between

national supervisory authorities (so-called data hubs);

- facilitate

cooperation with non-EU countries on cross-border cases;

- establish a

new permanent committee that brings together national anti-money

laundering supervisory authorities.

These amendments will bring major improvements to the supervisory framework of anti-money laundering risks and contribute to risk reduction in the financial sector, as seen in the table below.

Three European Supervisory Authorities combating money laundering

A dedicated committee will be established within the EBA to

prepare decisions relating to money laundering and terrorist financing measures

(comparable to the existing EBA bank resolution committee). It will be composed

of heads of national supervisory authorities responsible for ensuring

compliance with laws against money laundering and terrorist financing. The EBA

will also cooperate closely with the ESMA and the EIOPA in the framework of the

existing Joint Committee of the European Supervisory Authorities (ESAs).

More in: http://europa.eu/rapid/press-release_MEMO-18-5725_en.htm?locale=en

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!