Analytics, EU – Baltic States, Forum, Modern EU

International Internet Magazine. Baltic States news & analytics

Tuesday, 16.12.2025, 19:53

OECD suggestion: “better life for all” is real

Print version

Print version |

|---|

The MCM discussed

the need for inclusive growth to improve well-being for all in open, digitally

advanced economies and work to define a more people-centered approach to

international regulations. It highlighted the importance of continuing

countries’ focus on developing more integrated, and inclusive economies and

societies. This MCM echoes the pledge of the UN-2030 Agenda for Sustainable

Development to “Leave No One Behind”.

Making globalisation work for better lives for all was the main message at the OECD forum.

Bridging divides

The central focus

of the forum will be on “bridging divides” apparent presently. Divides

have become apparent globally and regionally on a number of fronts; among main

divides are: increasing populism and nationalism, historically low levels of

trust, rapid pace of technological development, and continued effects of the

crisis. These and some other “divides” are having a disruptive impact on

societies and countries’ economies.

Ministers were discussing, notably: global general economic outlook, the

opportunities and challenges of economic integration, the challenges of

globalisation; domestic policies to ensure people, firms, regions and cities

can thrive in an open and digitalised environment; building inclusive

globalisation; as well as international trade and investment for the benefit of

all.

http://www.oecd.org/general/oecd-week.htm

Economic outlook

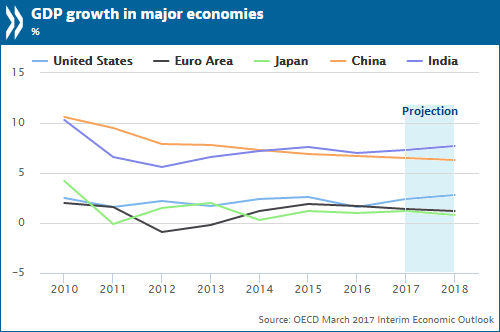

Global economic

growth is expected to pick up modestly in 2018 to around 3.6 % from a projected

3.3% in 2017 but risks of rising protectionism, financial vulnerabilities,

potential volatility from divergent interest rate paths and disconnects between

market valuations and real activity have been underlined in the OECD’s 2017

outlook.

Table: GDP in major global economies

The projected

improvement largely reflects continuing and expected combined fiscal and

structural initiatives in the major economies - notably China, Canada and the

United States - together with a slightly more expansionary stance in the euro

area, which could be more ambitious. Such policies are needed to catalyse

private demand to boost global activity and reduce inequalities.

Global economic outlook

The global

economy portrayed by the Interim Economic Outlook

remains beset by sub-par GDP growth and high inequality, calling for policy

responses that advance inclusive growth in the context of increased economic

integration.

Commenting on the

Outlook, OECD Secretary-General Angel

Gurría said: “Growth is still too weak and its benefits too narrowly

focused to make a real difference to those who have been hit hard by the crisis

and who are being left behind. Now, more than ever, governments need to take

actions that restore people’s confidence while at the same time resisting

turning inwards or rolling back many of the advances that have been achieved

through greater international co-operation.”

The OECD’s

Interim Economic Outlook examines some of the many risks that could derail the

projected modest upturn in global growth.

Foremost

among these there is the risk of rising protectionism that would hurt global

growth and impact the large number of jobs that depends on trade. The rapid

growth of private sector credit and the relatively high level of indebtedness

is a key risk in a number of emerging markets, above all in China, and housing

valuations are a matter of concern in some advanced economies.

The

strength of financial market valuations appears disconnected to the outlook for

the real economy, where the growth of consumption and investment remains

subdued. There is also a risk of global financial market tensions as interest

rates adjust and diverge across the major economies. The social cost

of the crisis and the increased inequalities need to be addressed to make growth

more inclusive and to reduce pressures for protectionism and other populist

responses.

OECD Chief

Economist Catherine L. Mann said:

“The pick-up in growth from countries taking fiscal initiatives is broadly

welcome, but we cannot ignore the danger that the recovery gets knocked off

track by policy errors or financial risks and vulnerabilities. Coherent and

committed policy action is needed to simultaneously raise growth rates and

improve inclusiveness.”

Citations from: www.oecd.org/economy/economicoutlook.htm

Situation in some countries

In the United

States, domestic demand is set to strengthen, helped by gains in household

wealth and a gradual upturn in oil production. GDP growth is expected to pick

up to 2.4% this year and 2.8% in 2018, supported by an anticipated fiscal

expansion, despite higher long-term interest rates and a stronger dollar.

The

moderate pace of growth is expected to continue in the euro area but is being

held back in some countries by stubbornly high unemployment and underemployment

(particularly of youth) as well as by

banking sector weakness. GDP for the area as a whole is expected to expand at

an annual rate of 1.6% in both 2017 and 2018.

In Japan, fiscal easing and improvements to women’s labour force participation will help GDP growth pick up this year to 1.2% from 1.0% in 2016. Prospects will depend on the extent to which labour-market duality is reduced and wage growth picks up.

Growth in

China is projected to slip further to 6.5% this year and to 6.3% in 2018 as the

economy makes a necessary transition away from a reliance on external demand

and heavy industry toward domestic consumption and services.

Higher

commodity prices and easing inflation are supporting a recovery from deep

recessions in Brazil and Russia, underlines OECD report.

The OECD

says governments need to manage risks, enhance economic resilience and

strengthen the environment to boost growth, with improvements in both

productivity and inclusiveness. Focusing on policies that build structural

elements into fiscal initiatives would reduce the burden on monetary policy in

the advanced economies and help to boost trade, investment, productivity and

wages.

The Interim

Economic Outlook and additional information is on the following web link: www.oecd.org/economy/economicoutlook.htm.

Economic and financial conditions for growth

The Economic

Outlook forecasts and accompanying analyses are conditional on a consistent set

of assumptions about policies and underlying economic and financial conditions,

including fiscal and monetary policy settings, exchange rates, commodity prices

and international financial markets.

- Macroeconomic policies. Macroeconomic policies are typically

assumed to be "unchanged" over the projection period and on the basis

of current fiscal and monetary policies. This does not mean that the OECD

necessarily assumes that governments will – or should - achieve their stated

objectives, or that policies themselves may not adapt to differing economic

circumstances. Rather the OECD forecasts represent the likely outcomes for

growth, inflation, employment and other key economic variables for given

unchanged policy settings.

- Fiscal policies. Fiscal policy assumptions are based as closely as possible on legislated tax and spending provisions. Where government plans have been announced but not legislated, they are incorporated if it is deemed clear that they will be implemented in a shape close to that announced. Otherwise, in countries with impaired public finances, a tightening of the underlying primary balance by a certain percentage of GDP is built into the projections.

- Domestic monetary policies. The monetary policy assumptions take into

account a range of monetary and financial indicators, including policy

announcements with respect to the choice of monetary targets, associated target

ranges and policy instruments, by the national authorities. Policy

controlled short-term interest rates are typically assumed to be set in line

with the stated objectives of the relevant monetary authorities, conditional

upon the OECD projections of activity and inflation, which may differ from

those of the monetary authorities. The resulting interest rate profiles

should therefore not to be interpreted as a projection of central bank

intentions or market expectations thereof.

The resulting

paths of short-term interest rates are assumed to feed into long term interest

rates in a manner consistent with the usual expectations hypothesis of the term

structure of interest rates, by which long-term interest rates are an average

of future short-term rates. In addition, account is taken of the term premia,

the extra amount of yield that investors in longer-term bonds in each economy

require as compensation for the risk of capital losses and/or lack of

liquidity.

For countries

with government gross debt exceeding 75 percent of GDP, the term premium is

assumed to rise with the level of debt.

- Exchange rates. Nominal exchange rates against the US dollar are

set by technical assumption to remain constant over the projection period, at

levels prevailing on a pre-specified cut-off date. The corresponding profiles

of nominal and effective exchange rates beyond the current year are therefore

typically constant for all countries and regions.

There are two

reasons for using such a simple technical assumption. Firstly, specific

exchange rate forecasts continue to be politically and market sensitive for many

countries and areas. At the same time, short-term exchange rate movements are

typically quite difficult to predict and, in practice, a naive random-walk

model – one assuming nominal rates to remain broadly at current levels - is

often found to be no less accurate than predictions based on more complex

econometric or statistical relationships.

Nonetheless, to

the extent that underlying economic conditions or associated risks may at times

suggest possible systematic upward or downward pressures on major currencies,

the wider economic consequences of such movements are routinely explored as

alternative scenarios, based upon macro-econometric simulations.

- Oil and non-oil commodity prices. The price of a barrel of Brent crude oil

is assumed to increase at a rate of $5 per year ($1.25 per quarter) from its

observed level when the projections close. Non-oil commodity prices are assumed

to be constant over the projection period at their observed levels when the

projections close.

References in: http://www.oecd.org/eco/economicoutlook.htm

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!