Analytics, Banks, Estonia, Financial Services, Statistics

International Internet Magazine. Baltic States news & analytics

Saturday, 20.12.2025, 13:11

The Estonian external economy was in balance in the first quarter

Print version

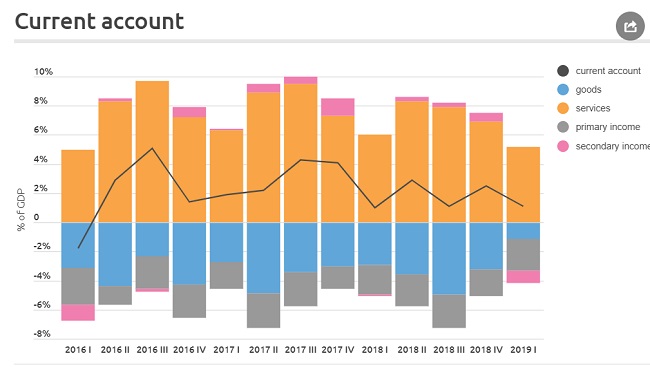

Print versionThe surplus in services was 327 mln euros, which was 6% less than a year earlier. The surplus narrowed primarily because of a fall in exports of production services and goods transport by rail. The goods deficit decreased by 60% over the year to 70 million euros. The deficit in goods shrank principally because of increased exports of wood and wood products, machinery and mechanical equipment, and furniture. The net outflow of investment income grew by 14% from the previous year. The surplus on the capital account was 70 mln euros, which was 43 mln euros more than a year earlier. The surplus increased because of sales of emissions quotas and trademarks.

The net total of the current and capital accounts, or net lending or borrowing, saw a surplus of 140 mln euros in the first quarter of 2019, meaning that the Estonian economy continued to be a net lender to the rest of the world, so the country as a whole invested more financial assets abroad than it received from there.

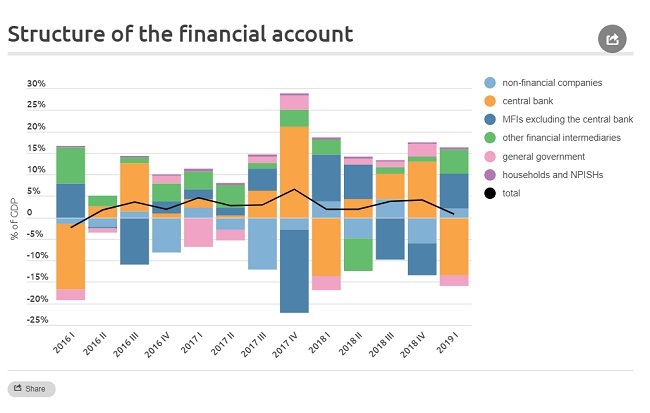

The financial account of the balance of payments shows that investment abroad from Estonia was 45 mln euros larger than investment in Estonia from abroad. The net outflow of capital was caused primarily by trade credit to non-financial companies, repayments of loans by other financial intermediaries and investments by pension funds in foreign securities. The reserve assets of Eesti Pank increased by 178 mln euros over the quarter. The inflow of direct investment was 172 bn euros bigger than outflow. The major feature in the fourth quarter of 2018 was intra-group loans to companies, but in the first quarter of 2019 investment went into the share capital of Estonian non-financial companies and real estate. Structural changes meant that the direct investment assets and liabilities of credit institutions increased by more than one billion euros. The changes saw Latvian and Lithuanian units that had earlier been owned by a Swedish parent company move under an Estonian unit.

The net international investment position at the end of the first quarter of 2019 showed that the external liabilities of Estonian residents exceeded their external assets by 6.7 bn euros, or 25% of GDP. During the quarter the investment position moved in the direction of balance by 567 mln euros, mainly because of investments in foreign securities and a rise in their prices.

Statistics for the external debt show that at the end of the quarter, the debt claims of Estonian residents on non-residents were 4.9 bn euros, or 19% of GDP, larger than their debt liabilities. Both debt assets and debt liabilities increased during the quarter.

For more detail on the financial account, the international investment position and the external debt see the external sector statistics.

Net flow is inflow minus outflow. If the inflow exceeds the outflow, there is a net inflow, if the outflow exceeds the inflow there is a net outflow.

Eesti Pank will release the preliminary balance of payments, international investment position and external debt for the second quarter of 2019 together with an economic policy and statistical comment on 10 September 2019 at 08.00. Eesti Pank will also publish the revised time series from the first quarter of 2003. Major recalculations of the national accounts and balance of payments time series are made under the benchmark revision policy of the European Commission every five to ten years.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!