Analytics, Banks, Estonia, Financial Services

International Internet Magazine. Baltic States news & analytics

Wednesday, 31.12.2025, 08:39

Estonia: Banks’ net profit fell in the first quarter

Print version

Print version |

|---|

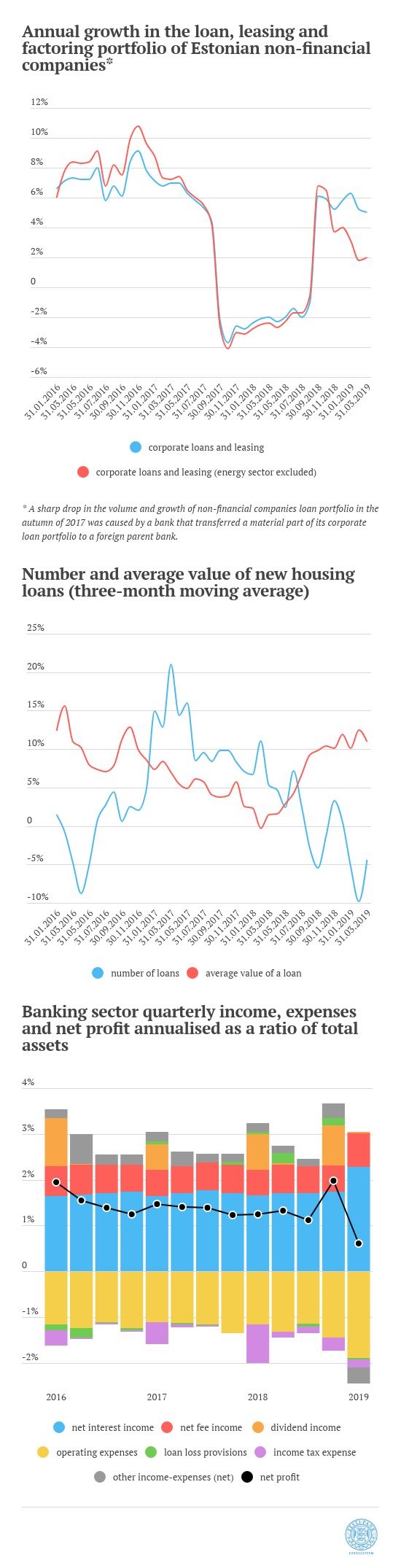

The stock of housing loans grew quite fast in March, but the number of new loan contracts signed has been smaller recently than it was a year ago. Corporate loans increased mainly because of energy companies, while demand for credit remained muted among other companies. Bank deposits continued to grow faster than loans. The net profit of the banking sector decreased by 47% in the first quarter because of expenses related to structural changes in the market.

The stock of housing loans was 7% larger in March than a year earlier. The volume of housing loans did grow too, but mainly because of an increase in the average loan sum. The number of loans taken out has been smaller recently than it was a year ago. Activity in the housing market has also decreased somewhat. Growth in car leases and other household loans and leases has decelerated as well,[1] although the volume of car leases is still increasing quite rapidly.

The stock of corporate loans and leases grew 5% y-o-y. Energy companies in particular took out new long-term loans in the last quarter of 2018 and in the first quarter of 2019, but borrowing remained subdued among all other companies.

The average interest rate on housing loans issued in March was 2.5%, which is close to the average rate of the previous year. The average interest rate on new long-term corporate loans is very volatile, because corporate loan projects are much more diverse than household loans, for example. The average interest rate on new long-term corporate loans issued in March was 3.1%, which is considerably higher than last year’s average.

At the same time, corporate and household deposits continued to grow at a fast pace. Corporate deposits increased by around 8% in March compared to last year, while private deposits increased by 10%. By the end of the month, the total volume of corporate and private bank deposits grew to 14.3 bn euros. This means that total deposits still increased faster than the loan stock, and corporate as well as private financial buffers were larger than before.

In the first quarter of 2019, the income and expenses of the banking sector were mainly affected by structural changes in the banking market. The net profit of the sector was 41 mln euros, which is down 47% from a year ago. Since the Latvian and Lithuanian entities of Luminor were joined under headquarters in Estonia, all main income and expense categories went up. However, profit decreased due to expenses related to closing the business of one bank who is about to leave the market.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!