Banks, EU – Baltic States, Financial Services, Latvia, Legislation

International Internet Magazine. Baltic States news & analytics

Saturday, 07.03.2026, 03:42

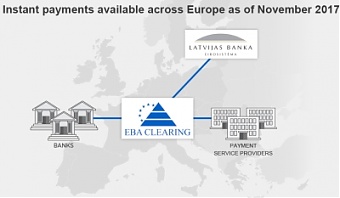

Pan-European instant payments infrastructure launched

Print version

Print version |

|---|

This

pan-European solution is connected to the instant payments infrastructure

introduced by Latvijas Banka in

August. This means that, as of November 21st, instant payments are available

between the customers of Citadele Bank

and the customers of the European banks that have joined the above-mentioned

RT1 system (these include ABN AMRO,

Bankia, Erste, Intesa Sanpaolo, Raiffeisen, SEB, Unicredit banking groups).

"This is a big step forward in introducing

instant payments throughout Europe. It is an important innovation, as previously

transfers of money between different euro area countries took a relatively long

period of time. Moreover, it was impossible to make a transfer on weekends and

holidays. As of now, a transfer, for example, between Germany and Latvia will

happen in a matter of seconds," said Harijs Ozols, Member of the Board of the

Bank of Latvia.

Today instant payments are being launched throughout

Europe and are gradually becoming available also between the customers of two

major Latvian commercial banks, Citadele Bank and SEB Banka, which connected

to the RT1 system today. "Customers will no longer have to wait for hours

to get their money, transactions will be completed within a flash of an

instant, on any day and any hour of the day," he said.

Kaspars Cikmacs, Member of the Board of Citadele Banka said that as of today, the customers of Citadele Banka will be able to make instant payments to many European banks and

to SEB Banka accounts in

Latvia. The initial limit for an instant payment is set at EUR 30. This limit

will be gradually raised to reach EUR 15 000 which is the maximum limit for

instant payments. "The fee applied to instant payments will be the same as

the one applied to regular payments, as we want our customers to benefit from

the advantages of the new system and enjoy fast interbank transfers," he

said.

Arnis Skapars, Member of the Board of SEB Banka said that according to the bank’s estimates,

over 98 percent of payments will be completed immediately once Latvia's major

banks have connected to the instant payments system. „We are happy to be among

the frontrunners offering their customers an opportunity to make fast money

transfers to other banks in Europe. As of today, the customers of SEB Banka in Latvia

and Estonia can already receive instant payments from other banks that have

connected to the instant payments system. We are also running parallel tests on

making instant payments: this service will be available to our customers as of

the beginning of December. Initially, the customers of SEB Banka will be able

to make instant payments via the internet bank and the mobile application, but

the service will be also available through other electronic channels soon

thereafter," he said.

Swedbank, the largest

Latvian commercial bank in terms of the value and volume of customer payments,

also intends to offer this service as of the beginning of 2018, following the

completion of infrastructure and functionality tests.

Instant payments are funds transfers provided 24 hours

a day, 7 days a week, 365 days a year, including holidays and weekends.

Customer payments are executed within a few seconds and the money received can

be reused immediately. This is a very significant change as previously payments

between European banks were only available on business days and a transfer took

several hours.

The electronic clearing system (EKS) of the Bank of

Latvia has been providing an opportunity for Latvian credit institutions to

offer instant payments to their customers since August. Citadele Banka was the first to connect to the instant payments system.

The Bank of Latvia organizes and maintains the payment

infrastructure in Latvia, including two automated payment systems helping to

ensure interbank settlements in euro. TARGET2-Latvija is one of the component

systems of the Trans-European Automated Real-time Gross Settlement Express

Transfer system, whereas the EKS is used for the processing of retail interbank

payments, including instant payments.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!