Financial Services, Innovations, Latvia, Markets and Companies, Technology

International Internet Magazine. Baltic States news & analytics

Friday, 26.04.2024, 20:01

Loans worth over EUR 100 mln financed through Mintos marketplace

Print version

Print version |

|---|

M-o-m, loans worth more than EUR 18 mln were financed through Mintos in December 2016 – 38% more than the month before when the total amount of loans was EUR 13 mln.

Compared to December 2015, when loans financed via Mintos amounted to EUR 2.8 mln, the amount has increased more than sixfold.

The month-by-month growth in the amount of loans financed through Mintos has made it one of the largest peer-to-peer lending platforms in continental Europe.

“We are happy to reach the EUR 100 mln milestone, yet our ambition is far greater – with the help of technology, we want to ensure free capital flows between countries and regions, connecting those where capital has been accumulated with those where funding is needed today,” emphasizes peer-to-peer lending marketplace Mintos head Martins Sulte, adding that, according to the Mintos team’s predictions, the amount of loans financed through Mintos could reach EUR 1 bln in three to five years.

Speaking of development plans, the Mintos team is currently doing active work on setting up local offices in several European countries, which will further consolidate Mintos positions in several European regions. At the same time, Mintos is looking at the opportunities to expand operations beyond Europe, analyzing market potential in Africa and Asia.

In order to strengthen its presence on the international market and with investors’ comfort in mind, Mintos peer-to-peer lending platform offers non-bank lenders to place their loans in the marketplace in different currencies – according to the currency in which a given loan has been granted. As a result, investors and lenders alike are spared currency fluctuation risks on the Mintos lending market.

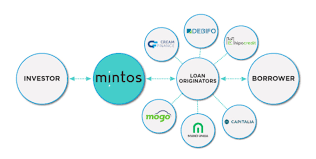

Peer-to-peer lending marketplace Mintos is a fintech company that started operations in January 2015 in Riga. Mintos connects investors with borrowers of non-bank lenders, offering private individuals as well as institutional investors to finance loans issued by non-bank lenders.

At the moment, over 17,000 investors from more than 50 countries around the world use the Mintos loan market, with loans by 15 non-bank lenders from eight European countries placed on the lending marketplace.

Investors that have financed loans placed on the Mintos peer-to-peer lending marketplace have so far received almost EUR 3 mln in interest.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!