Banks, Direct Speech, Estonia, Financial Services

International Internet Magazine. Baltic States news & analytics

Thursday, 25.04.2024, 15:43

The end of the emergency situation saw Estonians go shopping

Print version

Print version |

|---|

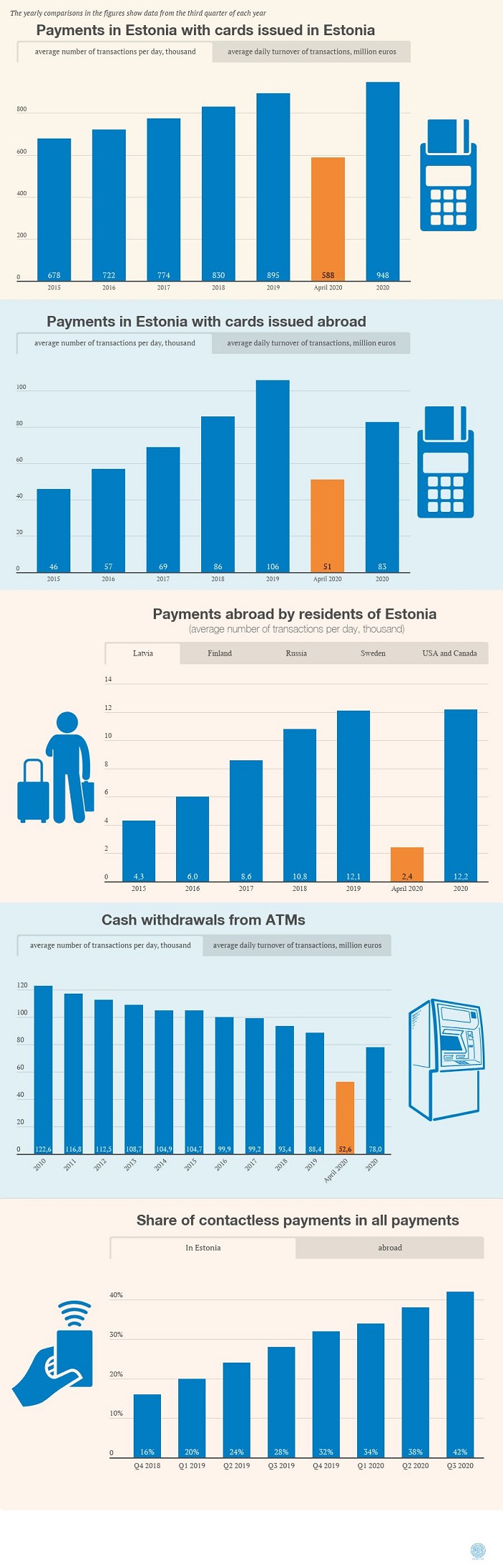

- The end of the emergency situation saw a new record as residents of Estonia made an average of 960,000 card payments a day in Estonia, which is the highest figure ever.

- In the third quarter on average, 6% more card payments were made in Estonia than a year earlier, while the number of card payments in foreign points of sale was down by more than a fifth at the same time.

- Estonian residents spent an average of 18 million euros a day on card purchases in Estonian and foreign points of sale in the third quarter, which is more than last year. The turnover of Estonian merchants increased in consequence by as much as 8.

Estonians spent an average of 15.9 mln euros a day on purchases and card payments at Estonian merchants in the third quarter, which is 8% more than a year earlier. In contrast, around a third less than last year was spent at foreign points of sale, which received 2.1 mln euros a day.

This shows that residents and companies in Estonia spent more this summer using cards than ever before, and particularly so at Estonian merchants. Unfortunately the picture for merchants is not one of unalloyed good news, as purchases by foreigners in Estonia were a long way down on a year earlier. A year ago foreigners made card payments of 2.4 mln euros a day on average in Estonia, but this year that was down 39% at only 1.5 mln euros.

Those merchants that have set up online stores also saw their turnover increase during the emergency situation, as an average of 2.2 mln euros a day was spent in Estonian online stores, which is 15% more than a year earlier.

Europe and Russia account for 98% of cross-border card payments by Estonians

The emergency situation has left clear traces in travel by residents of Estonia. In the third quarter of 2019, an average of 106,000 card payments a day were made outside Estonia, but in April 2020 only 51,000 were.

The figures started to rise after the emergency situation, but have not yet reached the level of last year. The situation is very different for different countries though. The number of card payments made by Estonians in Finland during the emergency situation was about the same as before since there are Estonians living and working in Finland, while travel restrictions had a powerful impact in Latvia and Russia, where Estonians made only a quarter or a fifth as many payments during the emergency situation as they did earlier. When it became possible to travel freely to Latvia, a new record was set there too, as more than half a million card payments were made in Latvia in July by Estonians.

Estonians made 98% of all of their cross-border card payments in the third quarter in Europe, including Russia, while the percentage made in other regions was smaller than before the emergency situation. A year ago, cards issued in Estonia were used for an average of 2000 purchases a day in the USA, but this year for a little below 1000. The changes in other areas were even more dramatic, as an average of 1000 card payments a day were made in Asia a year ago, but only 200 this year.

Cash transactions in ATMs

Estonian residents and businesses made an average of 78,000 withdrawals of cash a day in the third quarter for a total of 10 mln euros. The average withdrawal from ATMs in Estonia was 126 euros.

There has been a clear trend in recent years for residents of Estonia to take cash out from ATMs less often but in ever increasing sums, and so the amount withdrawn from ATMs has steadily increased from year to year.

The emergency situation saw changes to this relatively stable trend of the last decade. There was still no return to earlier amounts in the third quarter as the number of cash withdrawal transactions was 12% lower than a year earlier, and the turnover was 10% down.

The emergency situation also affected the turnover of cash depositing transactions, as an average of 5.4 mln euros a day was paid into accounts through ATMs in the third quarter, which was 11% less than a year earlier. Residents of Estonia paid cash in through ATMs an average of 15,000 times a day, which was 4% less than a year earlier.

Contactless payments

A daily average of 397,000 contactless payments were made in Estonia in the third quarter, accounting for 42% of all card payments, while 35% of all payments made abroad were contactless. A year earlier, 28% of domestic payments were contactless and 29% of payments abroad were. At the end of September, 88% of all POS terminals could handle contactless payments, and 89% of all bank cards issued could make them.

The rapid rise in the share of contactless payments has certainly been helped by the banks raising the limit for each payment to 50 euros during the emergency situation, with this limit remaining after the emergency situation ended, and also by the constantly increasing share of contactless cards and of POS terminals that can accept them. The risk of viral infection has not gone away, and so the recommendation from banks and merchants remains to use contact-free payment whenever possible. The banks estimate that 95% of card payments fall within the 50-euro limit, which means that those payments can be made contactlessly.

Although contactless capability is quite widespread in Estonia and around the world, people in Estonia could still use it even more. How can fears be overcome so that faster payments can be made?

- Contactless cards should be held securely like cash in a safe place. If your contactless card or any other bank card is lost, you should contact the bank that issued it immediately to deactivate the card. This can also be done through a mobile banking app.

- You can increase security by setting immediate notifications in the mobile bank. Then you will be able to react quickly if you know that a payment has been made by someone other than you.

- The safest method is to use a smartphone or smartwatch for contactless payments. These allow contactless payments for more than 50 euros as well.

- 25.01.2021 Как банкиры 90-х делили «золотую милю» в Юрмале

- 29.12.2020 В Rietumu и в этот раз создали особые праздничные открытки и календари 2021

- 29.12.2020 Lithuanian president signs 2021 budget bill into law

- 29.12.2020 Number of new companies registered in Estonia up in 2020

- 29.12.2020 Президент Литвы утвердил бюджет 2021 года

- 28.12.2020 Рынок недвижимости Эстонии осенью начал быстро восстанавливаться

- 28.12.2020 Tartu to support students' solar car project

- 28.12.2020 Owner of Kunda Nordic Tsement to install full-scale CCS facility in Norway

- 28.12.2020 New Year Cards and Calendars of Rietumu Bank presented

- 23.12.2020 В 2019 году выросли прибыль и оборот Eesti Pagar

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!