Banks, Direct Speech, Financial Services, Fintech, Lithuania

International Internet Magazine. Baltic States news & analytics

Monday, 23.02.2026, 13:28

Bank of Lithuania: Electronic money and payment institutions managed to withstand the shock of COVID-19

BC, Vilnius, 16.09.2020. Print version

Print version

Print version

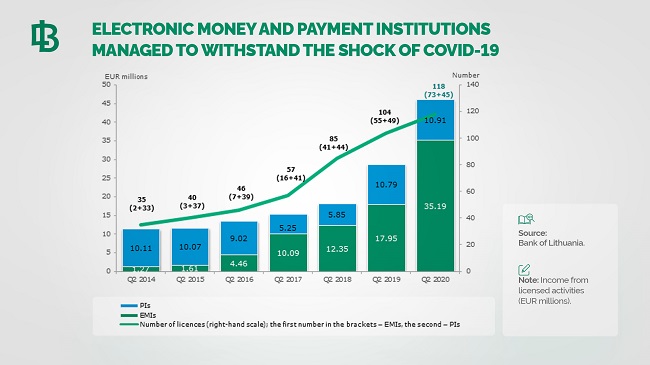

Print versionIn the first half of 2020, the number, payment transactions and income of electronic money and payment institutions (EMIs/PIs), which hold a significant share of the Lithuanian fintech sector, continued to grow at a rapid pace.

“The trends observed in the first half of the year show that the EMI/PI sector has withstood the shock of COVID-19. On top of that, the sector’s performance has even improved along with the digitalisation of payment services,” said Rūta Merkevičiūtė, Head of the Electronic Money and Payment Institutions Supervision Division at the Bank of Lithuania.

In the first half of 2020, the total amount of payment transactions executed by EMIs and PIs stood at €22.4 bn. On a y-o-y basis, this amount grew 1.4 times, while during the reporting quarter – by nearly 17%. EMIs and PIs received €46.1 mln in income from licensed activities – an increase of €17.4 mln (1.6 times) compared to the first half of 2019: income generated by PIs remained broadly unchanged (up by 1%), while the share earned by EMIs has almost doubled.

At the end of the first half of 2020, the public list of electronic money and payment institutions included 118 licensed entities. Lithuania remains the leader in continental Europe in terms of licensed EMIs and PIs, and the interest in the country is still not fading – the Bank of Lithuania is currently examining a total of 38 licensing applications. In 2021, it is expected to receive up to 100 new applications for an EMI or PI licence.

The Bank of Lithuania notes that EMIs and PIs must find balance between compliance with legal requirements and their business development, yet keep in mind that compliance should always be prioritised. The financial performance indicators for the first half of 2020 show that 3 institutions (compared to 9 out of 117 institutions in the first quarter of the year) failed to comply with the minimum own funds requirements. 2 of them have already taken steps to ensure a sufficient amount of own funds by accumulating additional capital buffers and taking decisions to increase their authorised capital. In the first half of 2020, 84% of EMIs and PIs that are subject to the own funds requirement exceeded its minimum threshold by reaching a ratio of more than 1.1 (which must be at least 1). In the first quarter of the year, the share of such institutions comprised 78%.

On a regular basis, the Bank of Lithuania publishes information on key annual and quarterly performance indicators of each EMI and PI as well as on their compliance with prudential requirements.

Other articles:

- 25.01.2021 Как банкиры 90-х делили «золотую милю» в Юрмале

- 29.12.2020 В Rietumu и в этот раз создали особые праздничные открытки и календари 2021

- 29.12.2020 Linde Gas открывает завод в Кедайняйской СЭЗ

- 29.12.2020 Lithuanian president signs 2021 budget bill into law

- 29.12.2020 Президент Литвы утвердил бюджет 2021 года

- 28.12.2020 Рынок недвижимости Эстонии осенью начал быстро восстанавливаться

- 28.12.2020

- 28.12.2020 Tartu to support students' solar car project

- 28.12.2020 New Year Cards and Calendars of Rietumu Bank presented

- 23.12.2020 LTG Infra gets green light to build Rail Baltica section from Kaunas to Latvian border

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!