Analytics, Banks, Covid-19, Crisis, Direct Speech, Estonia, Financial Services

International Internet Magazine. Baltic States news & analytics

Friday, 26.04.2024, 05:07

Eesti Pank: The buffers built up previously will help the banks to cope with larger loan losses

Print version

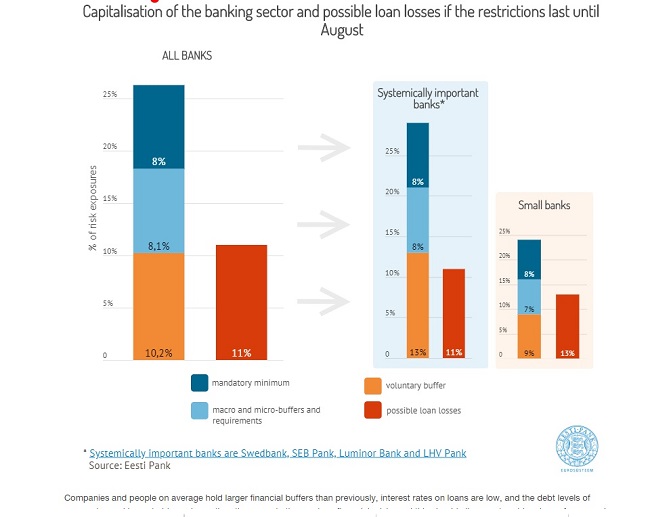

Print versionEesti Pank has just published a financial stability review in which the main emphasis is on how the coronavirus crisis is affecting the financial sector. The risks to the financial sector will be elevated in future because of the coronavirus, as companies and individuals will be less able to repay their loans. The restrictions affect companies focused on both domestic demand and exports.

Although the risks to the financial sector will be large, the general message from Governor of Eesti Pank Madis Müller was encouraging. “The loan losses of the banks in Estonia will increase sharply, but they have sufficient capital to allow grace periods, provide new loans and bear their loan losses. Grace periods make it easier for companies and people to get through the crisis. The capital buffers that the banks have built up during the good times should now prove useful”, he said.

Companies and people on average hold larger financial buffers than previously, interest rates on loans are low, and the debt levels of companies and households are lower than they were in the previous financial crisis, and this should all prevent problem loans from growing even more. The economy as a whole is also being supported by the government’s package of assistance and the guarantees offered by the state through KredEx, which are intended to ease the problems of companies in making loan payments and in accessing credit from banks.

Mr Müller said that a second point alongside capital buffers is the liquidity of the banks, and Eesti Pank is able to provide the banks with liquidity support on favourable conditions if necessary. The liquidity support from the central bank will help to give people and companies in Estonia access to loans on favourable terms. Eesti Pank, like other central banks in the euro area, is ready to provide additional loans for up to three years to the banks for the same reason.

The banks in Estonia fund themselves from local deposits, and this makes them quite independent in their lending. Two of the large banks in Estonia are part of Swedish banking groups though, and around half of the funding of those banking groups comes from financial markets. If it becomes harder or notably more expensive for the Swedish banking groups to access funding from the financial markets, it may have a harmful impact on the lending by their subsidiaries in Estonia.

The strength of the Estonian financial sector is affected not only by the Swedish economy but also by the performance of Latvia and Lithuania, as the systemically important Estonian bank Luminor operates in those two countries through branches, and so the risks from all the Baltic states directly affect the Estonian financial sector. It is currently forecast that the recessions in Latvia and Lithuania will be quite similar to the one in Estonia.

Eesti Pank has reduced the systemic risk buffer for the commercial banks from 1% to 0% from the start of May. This freed up 110 million euros for the banks, which they can use to cover possible loan losses or to make new loans. The banks operating in Estonia have confirmed that they will not pay out dividends at least until the autumn, as doing so would reduce their ability to cope with loan losses. As the risks from the current crisis have increased for all the participants in the financial sector, the owners of savings and loan associations and of other creditors need to act responsibly.

- 25.01.2021 Как банкиры 90-х делили «золотую милю» в Юрмале

- 30.12.2020 Hotels showing strong interest in providing self-isolation service

- 30.12.2020 EU to buy additional 100 mln doses of coronavirus vaccine

- 30.12.2020 ЕС закупит 100 млн. дополнительных доз вакцины Biontech и Pfizer

- 29.12.2020 В Латвии вводят комендантский час, ЧС продлена до 7 февраля

- 29.12.2020 В Rietumu и в этот раз создали особые праздничные открытки и календари 2021

- 29.12.2020 Latvia to impose curfew, state of emergency to be extended until February 7

- 29.12.2020 Number of new companies registered in Estonia up in 2020

- 29.12.2020 Президент Литвы утвердил бюджет 2021 года

- 29.12.2020 В Риге можно изолироваться в трех гостиницах

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!