Analytics, Direct Speech, Financial Services, Latvia

International Internet Magazine. Baltic States news & analytics

Monday, 15.12.2025, 15:55

Stable monetary aggregate dynamics persists

Print version

Print version |

|---|

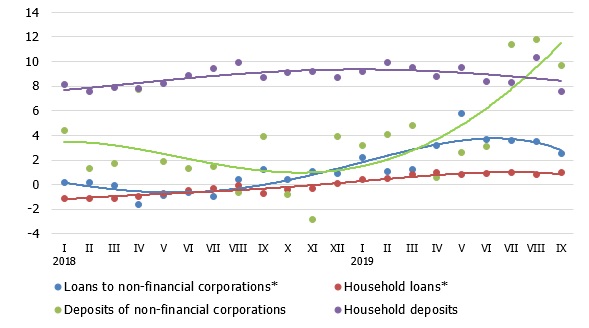

In September, the domestic loan portfolio shrank by 0.1% on account of a 0.2% drop in loans to non-financial corporations and a 0.1% increase in the household loan portfolio, with loans for house purchase and consumer credit edging up slightly. The annual growth rate of loans to non-financial corporations decreased to 2.5%, while that of loans to households rose to 1.0%. In September, new loans showed a slight improvement: those granted to both businesses and households exceeded the volumes registered both in August and previous September; the amount of total new loans granted in the first nine months of 2019 also posted a 0.9% increase compared to the same period a year ago.

As regards domestic deposits, they shrank by 3% in September, with both corporate and household deposits declining at a similar pace. Since the decline partly resulted from the impact of the banking sector restructuring on the statistical data, the actual monthly fall in deposits was slower, i.e. slightly below 1%. Latvia's contribution to the monetary aggregate M3 of the euro area decreased by 1.9% in September, with overnight deposits of euro area residents with Latvia's monetary financial institutions and deposits with an agreed maturity of up to two years contracting, but deposits redeemable at notice expanding. The annual growth rate of M3 reached 9.4% in September, whereas the above deposits posted increases of 9.7%, 13.3% and 4.1% respectively.

Annual changes in domestic loans and deposits (%)

* For the sake of comparability, the one-off effects related to the restructuring of Latvia's banking sector have been excluded.

External risks and growth deceleration will continue to weigh down on the loan portfolio growth. With bank risk appetite abating and businesses becoming more cautious with respect to attracting external funding, the contribution of factors supporting lending will not be sufficient to ensure more dynamic lending growth in the near future. Nevertheless, the accommodative monetary policy of the European Central Bank, consumer sentiment supporting household lending, and statements by several banks (previously mostly working with foreign customers) on changing their business model and focusing on lending to the Latvian economy is likely to make some contribution to loan portfolio growth in the future as well.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!