Analytics, Banks, Direct Speech, Financial Services, Latvia

International Internet Magazine. Baltic States news & analytics

Thursday, 25.12.2025, 07:47

Lending continues on a gradual upward trend in Latvia

Print version

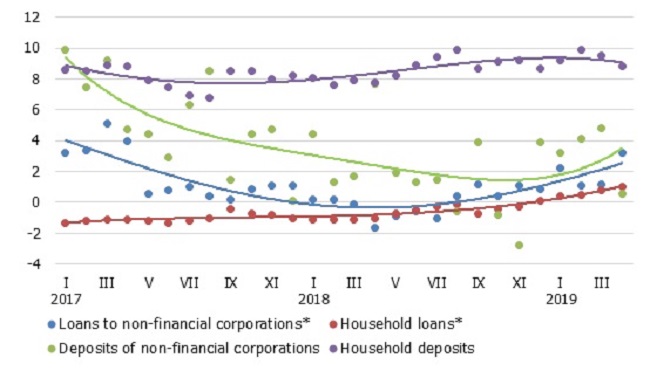

Print versionIn April, the loan portfolio of non-financial corporations expanded by 0.4%, while loans to households grew by 0.2%, with household loans for house purchase and consumer credit recording 0.2% and 0.9% increases respectively. Consequently, the annual rate of change in domestic loans also improved to –3.1%, with the respective rates of loans to non-financial corporations and household loans rising to –2.9% and –4.6% respectively. At the same time, the effect from the banking sector restructuring excluded, the annual rate of change in loans remained overall positive at 2.4%, including 3.2% and 1.0% increases in loans to non-financial corporations and households respectively. In April, new corporate loans increased, while household loans remained at the same level as in March. Thus, the total amount of new loans rose by 11.1% year-on-year in the first four months of 2019.

Domestic bank deposits decreased by 0.1% in April, with the annual growth rate of deposits declining to 5.8%. The annual rate in increase of deposits of non-financial corporations and those of households shrank to 0.6% and 8.8% respectively. Latvia's contribution to the monetary aggregate M3 of the euro area remained unchanged, with overnight deposits of euro area residents with Latvia's monetary financial institutions remaining almost the same, deposits with an agreed maturity of up to two years increasing slightly and deposits redeemable at notice shrinking: the annual rate of change in M3 was 12.4%, whereas the respective rates for the above deposit categories were 14.5%, 6.1% and –0.3%.

Annual changes in domestic loans and deposits (%)

* For the sake of comparability, the one-off effects related to the restructuring of Latvia's banking sector have been excluded.

The expansion of household deposits reflects a decline in unemployment and a continued rapid rise in wages. However, if the wage rise observed in the first quarter moderates further, the expansion of household deposits may also decelerate. Meanwhile, the fluctuations of corporate funds in bank accounts may point to irregular use of savings to make investments and settle import transactions. Lending trends confirm expectations as subdued growth continues both in the household and corporate sectors. With risk factors persisting, a steeper rise in corporate lending observed in some months could be explained by one-off larger-value transactions, whereas the household lending growth is expected to be moderate and stable.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!