Analytics, Banks, Direct Speech, Latvia

International Internet Magazine. Baltic States news & analytics

Wednesday, 07.01.2026, 20:52

The ice age in lending is approaching an end

Print version

Print version |

|---|

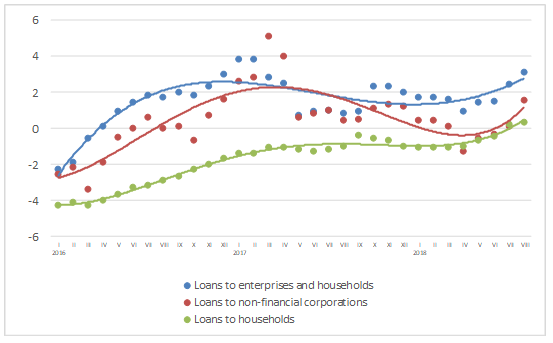

In August, the annual rate of decline in the domestic loan portfolio improved to reach –7.6%(excluding the effects of the transfer of part of the loan portfolio of Nordea Bank Finland Plc to its parent bank outside Latvia and the cancellation of the licence of JSC ABLV Bank, the domestic loan portfolio grew by 3.1% y-o-y). The annual rate of decrease of the loan portfolio of non-financial corporations amounted to –13.8% (excluding the above effects, the annual growth rate of the loan portfolio was +1.5%) and the annual rate of change in the household loan portfolio stood at –5.6% (+0.3% respectively). The volume of new loans granted in August exceeded the level recorded in July by more than one third, with non-financial corporations and households receiving more of them.

In August, domestic bank deposits increased by 0.6%, with corporate and household deposits growing by 1.3% and 0.1% respectively. Latvia's contribution to the monetary aggregate M3 of the euro area expanded by 0.5% in August, with overnight deposits of euro area residents with Latvia's monetary financial institutions rising by 7.8%, but deposits with an agreed maturity of up to two years and deposits redeemable at notice decreasing by 1.0%.

The annual rate of change in domestic loans* (%)

* To ensure comparability, the one-off effects due to the transfer of part of the loan portfolio of Nordea Bank Finland Plc to its parent bank and the cancellation of the licence of JSC ABLV Bank are excluded as of September 2017 and July 2018 respectively.

To sum up, it should be noted that lending is still quite sluggish, both loan demand and supply remain wary and external risks to Latvia's economic development also do not recede; however, there is some scope for a more positive assessment. For the first time in the last ten years, both corporate and household lending has recorded positive annual growth for the second consecutive month. The expansion of the domestic loan portfolio in recent months suggests that the freeze period experienced at the beginning of the year is gradually coming to an end and bank lending could again play an increasing role in financing the much needed investment into the economy and in providing funds for housing construction.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!