Analytics, Banks, Direct Speech, Estonia, Financial Services

International Internet Magazine. Baltic States news & analytics

Friday, 26.04.2024, 11:36

The value of car leases in Estonia taken is up one fifth on a year ago

Print version

Print version |

|---|

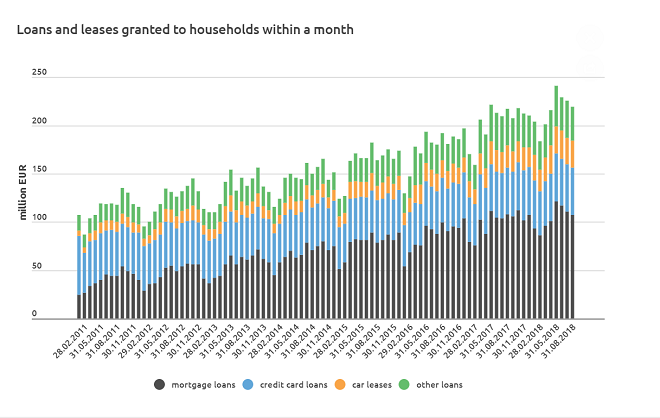

The demand from households for loans is supported by the rapid rise in incomes. New loans of 107 million euros in value were taken out, which was about the same amount as in August last year, but less than in May, June and July. The stock of housing loans has grown by 6.8% over the year. The value of new car lease contracts signed was more than one fifth higher than last year and the growth in the total volume of car leases over the year has been about the same. The portfolio of other loans increased by 4.5%.

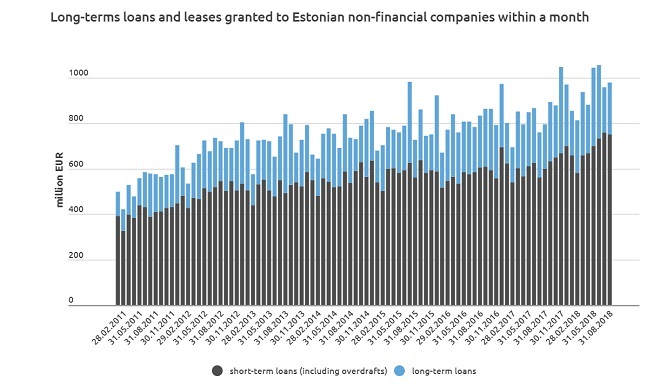

The value of new corporate loans and leases issued this year is up 16% on a year earlier, with long-term loans up 20%. New loans were issued to almost all sectors. Some of the new loans taken have been used to refinance old loans, and so the yearly growth in the stock of corporate loans and leases picked up a little to nearly 7% in August, if a one-off sharp reduction in the loan stock in autumn 2017 is disregarded [1].

A lively real estate market with strong demand for loans has seen the average interest rate on new housing loans rise in 2018, and the growth rate reached 2.6% in August. Interest rates for corporate loans have not changed though. The average interest rate on new long-term corporate loans was 2.7% in August, as it was in July.

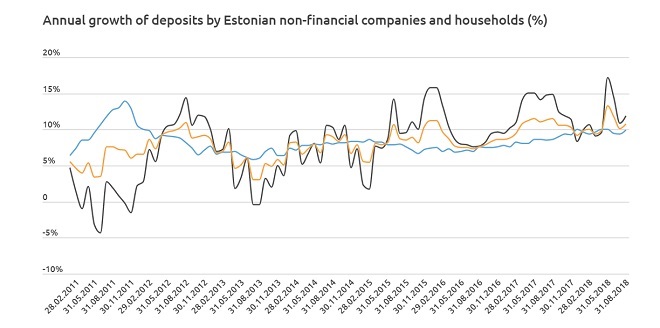

Growth in corporate and household deposits remained fast. The total volume of corporate deposits in banks operating in Estonia increased by 12% over the year. Household deposits were up 10% on the year, meaning they have grown at about the same rate throughout 2018. Non-resident deposits fell by 25% over the year however, and at the end of August they were equal to 7.5% of the stock of corporate and household deposits.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!