Analytics, Banks, Direct Speech, EU – Baltic States, Financial Services

International Internet Magazine. Baltic States news & analytics

Thursday, 25.12.2025, 22:14

Better Asset Quality and Lower Share of NonResident Deposits Drives Positive Outlook for Baltic Countries

Print version

Print version |

|---|

Operating Environment.

A rebound in exports to other European countries, combined with accommodative

monetary conditions, will support corporate investment, job creation and

household consumption, causing real GDP to expand in all three Baltic countries

over the next two years. We forecast GDP growth of 2.5% and 2.9% in 2017 and

2018 respectively in Estonia (A1 stable), 3.1% and 3.9% in Latvia (A3 stable),

and 3.3% and 3.5% in Lithuania (A3 stable). We expect lending to grow between

5% and 10% annually. Downside risks remain from continued tensions with Russia.

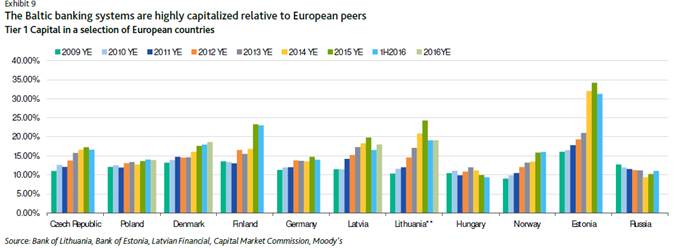

Asset quality and

capital. We expect asset quality to improve in Latvia and Lithuania as

higher employment levels and higher real wages will continue to support

recoveries in legacy loans. Asset risk will remain stable in Estonia, with

problem loan ratios already on par with the low levels found in the Nordic

countries. Additionally, local banks will maintain or improve their already

solid capital metrics despite the relatively strong growth of their balance

sheets, as increases in minimum regulatory requirements and solid internal

capital generation will support capital retention. In contrast, we expect the

subsidiaries and branches of Nordic banks operating in the Baltics to upstream

capital to their parents, while nevertheless remaining well capitalized.

Funding and liquidity.

Baltic banks will continue to strengthen their funding and liquidity profiles

through a substantial reduction in volatile non-resident deposits, which will

be offset by strong growth in domestic deposits. The decline in non-resident

deposits will also lead to a reduction in the equally volatile short-term

liquid assets they tended to acquire with those foreign deposits. Meanwhile, we

expect Nordic banking operations in the Baltics to slightly reduce their reliance

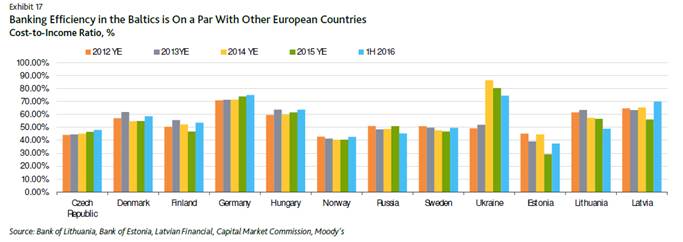

on parental funding. Profitability and efficiency. Overall, the favourable

macroeconomic environment will lead to stable profitability in the system, with

potential opportunities for domestic banks to increase both market shares and

profits as the merger between the subsidiaries

Government support. Baltic banks are

subject to the EU's Bank Recovery and Resolution Directive (BRRD), a resolution

regime under which losses are primarily borne by equity and debt holders. The

institutions we rate do not benefit from government support uplift.4

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!