Baltic States – CIS, EU – CIS, Financial Services, Investments, Markets and Companies

International Internet Magazine. Baltic States news & analytics

Sunday, 21.12.2025, 20:52

Kazakhstan continues working to attract foreign investments

Print version

Print version |

|---|

Recently, more and

more European investors prefer to let their money work in Central Asia and

primarily in Kazakhstan. We have made an attempt to find out the reasons for investment

attractiveness of this relatively young state, as well as the sectors of

economy most profitable for business in this regard.

Back in 2011, Ernst & Young studied the investment

attractiveness of Kazakhstan by interviewing more than 200 investors from 20

countries of the world, both potential ones and already working in the

republic.

Even at that time, 32%

of respondents distinguished Kazakhstan as one of the three countries most

attractive for investment in the Central Asian region. Approximately the same

number of study participants predicted an increase in the investment

attractiveness of the republic.

Many experts state

that years later, the investment climate in the country has become more

favorable. In 2018, Kazakhstan was ranked 36th out of 190 countries of the

world by the “investment attractiveness” criterion in the Doing Business

rating. Figures indicate this as well: in the first half of 2018, the volume of

foreign direct investment in Kazakhstan amounted to more than USD 12 billion.

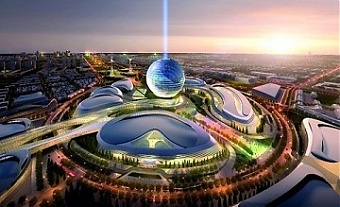

As we reported

earlier, the Astana International Financial Center (AIFC) had recently begun to

operate in the country becoming the main financial platform for investment attraction

and protection of the investors’ interests. According to the head of

professional development department, member of the standards development

department, chief investigator of the Accounting and Auditing Organization for

Islamic Financial Institutions (AAOIFI) ethics code Farhan Nur, this financial

center will play a decisive role in the region in a few years.

A member of the arbitrator

group at the AIFC international arbitration center, member of the AIFC advisory

board on Islamic finance, lawyer of senior courts of England and Wales Sheikh

Bilal Khan noted the appropriate time to create such a center in Kazakhstan. Today,

the country is moving away from energy dependence seeking to diversification.

|

|---|

According to the expert, financial services are probably the most flexible sector to pay attention. It is also noteworthy that organizations from the United States, Great Britain and other countries are now buying asset shares of Kazakhstan giant companies such as Samruk Kazyna, KazMunayGas and Kazakhtelecom through IPO.

Today, one of the major investment sectors in Kazakhstan is agriculture: stock raising, crop and grain production.

However, according to Sheikh Bilal Khan, the lawyer of senior courts of England and Wales, there are many other sectors and areas for investment in Kazakhstan including industrial and financial technologies, microfinance, small business, etc.

By the way, about small business. In Kazakhstan, authorities pay special attention to young scientists and their innovative ideas; therefore, investing in start-ups is a promising investment option. In addition, the areas for development of such projects are quite different: ecology, energy, finance, online trading, mobile applications, services, etc.

However, the main economic sector for investment in Kazakhstan is still raw material production. The country is rich in natural resources and all kinds of minerals, so other states lacking the raw materials are interested in it.

According to Forbes Kazakhstan, the interest of international investors in the uranium industry has revived due to the IPO of Kazatomprom since uranium used in nuclear reactors for the production of electricity has become one of the best-selling raw materials in 2018.

Over the last 12 years, USD 264 billion of direct investments have been attracted to Kazakhstan. The major investors are the Netherlands, the USA, France, Switzerland, Russia and China, they invest mainly in the raw materials sector of the economy. The goods exported from Kazakhstan include oil, copper, zinc, slags, ore, mineral fuels, ferrous metals, etc.

European experts note another nuance here: under the availability of such a quantity of natural raw materials, the country exports most of them for processing and later buys them back in the form of finished products. Due to this situation, businessmen and investors have vast opportunities for the construction of plants and enterprises processing the natural resources in Kazakhstan. This will reduce the cost of products for domestic buyers and improve their quality for exporting.

Kazakhstan also provides the investors with substantial legal and other guarantees. They include full protection of rights and interests secured by the republic’s national laws and ratified international treaties; stability of contract terms concluded between the investors and government agencies; in case of nationalization or requisition, the investors are fully compensated for the losses incurred; the investors also have free access to all necessary information regarding their activities in the republic.

Kazakhstan also provides investment preferences: exemption from customs duties and import VAT, government grants, investment subsidies, exemption from import customs duties and taxes.

In general, it is possible to note stability and confidence in the future as important components of the investment market in Kazakhstan, which are among the main indicators of the investment attractiveness for any country.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!