Direct Speech

International Internet Magazine. Baltic States news & analytics

Saturday, 20.12.2025, 13:40

How developments in global food commodity prices affect consumer prices in Latvia

Print version

Print version |

|---|

In this article we employ Latvijas Banka short-term inflation projection model (STIP) to estimate the impact of global food commodity prices on Latvian consumer prices.

Food commodities (cereals, meat, milk, sugar etc.) are important cost components in producing foodstuffs. Food commodities are internationally tradable goods, and their price dynamics is quite similar in different countries. Thus, food consumer prices in Latvia can be affected not only by domestic events, but also by incidents which take place several hundreds and even thousands of kilometres away.

For instance, in Spring 2019 an outbreak of a pig disease in China considerably decreased pig meat supply in this country, promoting pig meat export from the European Union to China. As a result, excess demand for EU pig meat exerted an upward pressure on meat prices in the EU (Latvian pig meat consumers were worse off, but pig meat producers were better off). Another example: Russian sanctions in 2014 banned imports of several food products, particularly apples, from EU countries. Thus, Polish apples became available in bigger quantity in the Latvian market and lowered apple prices (Latvian apple consumers benefited from that, but apple producers were worse off).

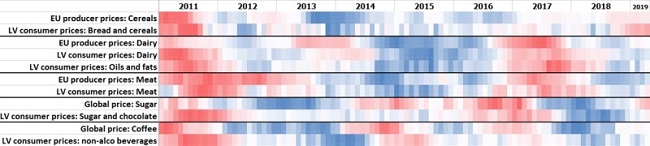

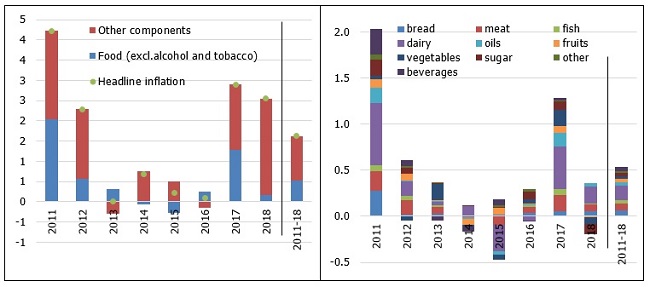

There exists a close relation between global prices of food commodities and food consumer prices in Latvia. When global food commodity prices change considerably, Latvian consumer prices follow with a lag of a few months. For instance, food consumer prices in Latvia were significantly affected by the general global appreciation of food commodity prices in 2011, an increase in global dairy prices affected dairy consumer prices in 2017, or sugar and coffee consumer prices were affected by a fall in global sugar and coffee prices at the turn of 2017/2018 (Figure 1).

Figure 1. "Heat map" of global food prices and food consumer prices in Latvia (2011–2019)

Sources: Authors' calculation based on EC, Bloomberg and CSB data.

Notes: Red colour denotes inflation above long-term trend.

Blue colour denotes inflation below long-term trend.

The brighter the colour, the bigger the inflation deviation from the long-term trend.

We normalize the annual inflation rate to take into account differences in long-term trends and volatility across series by subtracting the component-specific mean and dividing by its standard deviation.

The contribution of food products to headline inflation in Latvia is about one third (excluding alcohol and tobacco). Fluctuations of dairy product prices tend to affect headline inflation the most. For instance, the prices of dairy products have strongly affected headline inflation by 0.7 and 0.5 percentage points in 2011 and 2017 respectively, as well as negatively affected it by 0.3 percentage point in 2015 (see Figure A1).

Our research results imply that a 10% increase in global prices of food commodities raises Latvian consumer prices by 0.9% in the medium term. This estimate is slightly higher than in other EU countries[1] since food products in Latvia have a bigger share in the consumption basket. Two thirds of the pass-through of global food commodity prices to consumer inflation in Latvia takes place during the first year.

Dairy products

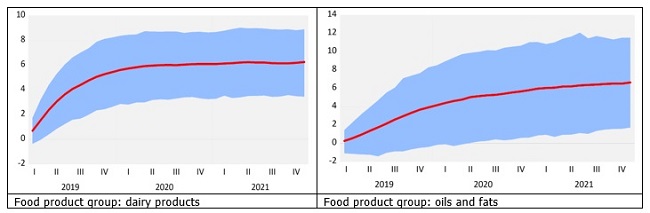

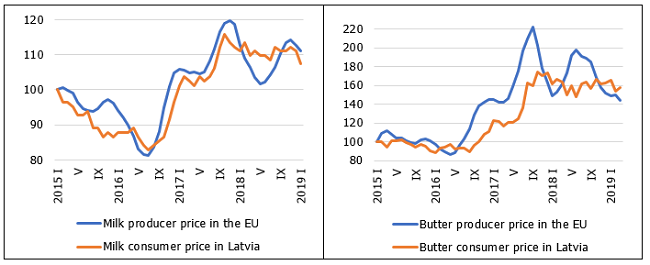

When EU producer prices of dairy products increase by 10%, Latvian consumer prices of dairy products (milk, sour cream, curd etc.), as well as consumer prices of oils and fats (a product category in which butter has a big share) rise by about 6%. The speed of the pass-through is faster for dairy products compared to fats and oils, reflecting the fact that the expiry date for the largest part of dairy products is considerably shorter than for butter (Figure 2; Figure A2).

Figure 2. Pass-through of a 10% increase in the global dairy product prices to consumer prices in Latvia (percentage points)

Notes: Econometric models were estimated over the 2005–2018 period using monthly data; simulation assumes a 10% increase in global dairy prices starting in January 2019.

The red line shows the average and the bands show a 68% confidence interval.

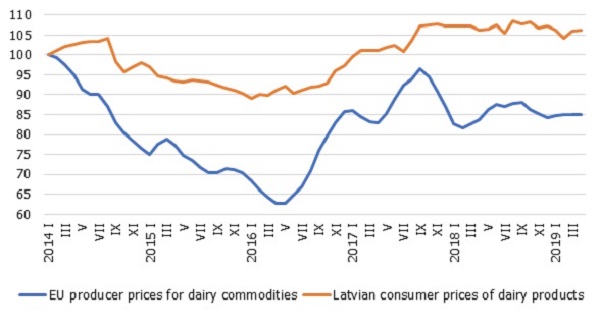

In 2014, Russia prohibited imports of dairy products from EU countries, but in 2015 the EU abolished quotas in milk production; as a result, EU producer prices of dairy products fell by one third during 2014–2016. Because of that, Latvian consumer prices of dairy products should have been lower by about 20%. However, in reality the decrease in consumer prices of dairy products was twice smaller, mainly owing to rising labour costs. Moreover, dairy commodity prices in the EU increased sharply in 2017, almost returning to the level recorded at the beginning of 2014. This fact, along with rising labour costs, has determined a further increase in Latvian consumer prices for dairy products (Figure 3).

Figure 3. Dairy products: EU producer prices and Latvian consumer prices (index; 2014 January = 100)

Meat products

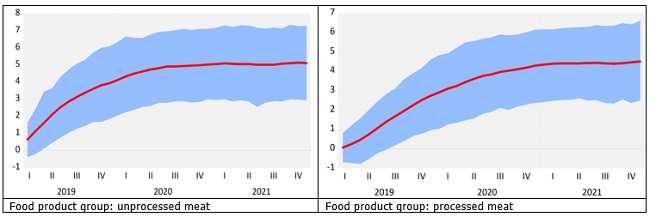

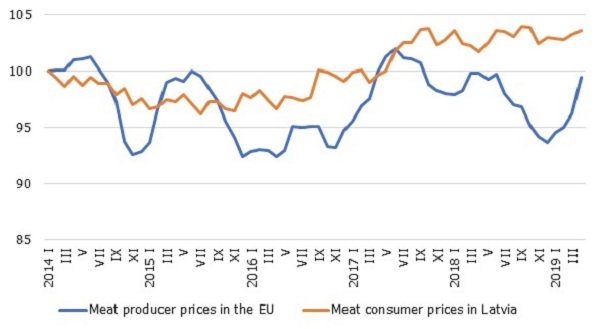

Our estimates show that a 10% increase in EU meat producer prices raises Latvian consumer prices for unprocessed meat (pig meat, beef, chicken etc.) by 5.1% and half of the impact can be seen in the first five months. Meanwhile, consumer prices of processed meat products (sausages, ravioli etc.) increase by 4.5%, (slightly less compared to unprocessed meat) and the pass-through takes a considerably longer time (half of the impact can be seen in the first nine months; Figure 4; Figure A3).

Figure 4. Pass-through of a 10% increase in the global meat prices to consumer prices in Latvia (percentage points)

Notes: Econometric models were estimated over the 2005–2018 period using monthly data; simulation assumes a 10% increase in global meat commodity prices starting in January 2019.

The red line shows the average and the bands show a 68% confidence interval

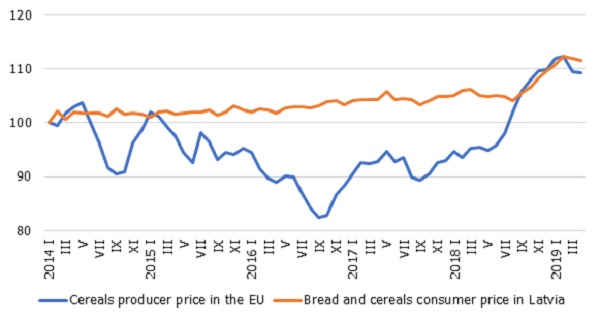

In spring 2019, meat producer prices increased by 7% in the EU (Figure 5), reflecting a wide outbreak of a pig disease in China, which increased the demand for pig meat produced in the EU. Our research results imply that if the global price increase for pig meat persists, consumer prices in Latvia would rise by 0.2% in the medium term.

Figure 5. Meat products: EU producer prices and Latvian consumer prices (index; 2014 January = 100)

Bread and cereals

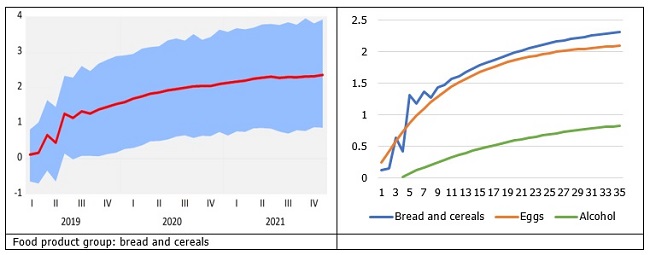

When EU producer prices of cereals grow by 10%, Latvian consumer prices of bread and other products made of cereals rise by 2.3%. This estimate is broadly in line with the anecdotal evidence that cereals only represent a minor part of bread baking costs[2]. Moreover, higher cereal prices tend to raise the prices of eggs and alcoholic beverages. The impact on alcoholic beverage prices is considerably lower and appears later, reflecting a small share of cereals in production costs as well as a relatively long storage term (Figure 6).

Figure 6. Pass-through of a 10% increase in the global cereal prices to consumer prices in Latvia (percentage points)

Consumer prices of bread and cereal products were stable for years in Latvia. However, during the last 12 months it was this food product group that posted one of the steepest appreciations. Previous summer was hot and dry in Europe; consequently, the global wheat harvest was the lowest in five years and this fact significantly increased producer prices of cereals at the end of 2018 (Figure 7; Figure A4). Currently global prices of cereals are on a downward path, since this year the global harvest is expected to reach a record high. Therefore, there are no grounds for bread consumer prices in Latvia to increase at the previous speed.

Figure 7. Bread and cereals: EU producer prices and Latvian consumer prices (index; 2014 January = 100)

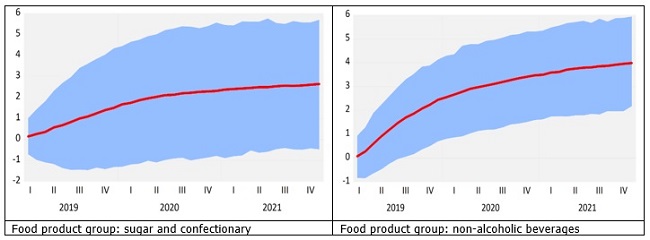

Sugar and coffee

The red line shows the average and the bands show a 68% confidence interval.

Conclusion

People are often concerned about whether large increases in global food commodity prices will pass to consumer prices to the same extent. Our research results imply that these concerns are not justified:

- food consumer prices increase much less than the global prices of the respective food commodity. While food commodities are important components of foodstuff production costs, these are not the only cost components: foodstuff consumer prices also depend on labour costs, car fuel prices and other factors. For instance, a 10% increase in EU producer prices of meat raise Latvian consumer prices of meat products for about 5%. Meanwhile, when EU producer prices of cereals rise by 10%, bread and cereal products in Latvian shops appreciate by about 2%.

- the pass-through of global food commodity prices to Latvian consumer prices is gradual over the course of several months. If global price developments change direction during this period, the impact of the initial global price change does not transmit fully. For instance, six months after a global sugar price rise of 10%, Latvian confectionary consumer prices appreciate only by 1%; moreover, if during this period the sugar global price starts to decrease again, this is likely to change the price trend for confectionary as well.

- simultaneous appreciation of food commodity prices is a rare event: last time it happened in 2011. More often price increases of one food commodity are compensated by price decreases of other food commodities, hence partly offsetting the impact on Latvian headline inflation. For instance, global appreciation of coffee and sugar prices during 2014-2015 coincided with a decline in dairy and meat commodity prices; meanwhile, exactly the opposite trends showed up in 2017.

Our estimates show that a 10% increase in global food commodity prices (which is not extraordinary) can raise Latvian consumer prices by almost 1% in the medium term, hence global food commodity prices are important factors which affect inflation dynamics in Latvia. Thus, the results of our research would allow Latvijas Banka to further improve accuracy of inflation forecasts.

Annex

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!