Analytics, Energy, Energy Market

International Internet Magazine. Baltic States news & analytics

Friday, 02.05.2025, 05:50

British Petroleum:The Energy Outlook 2019

Print version

Print versionThe Energy Outlook 2019 edition

The Energy Outlook explores the forces shaping the global

energy transition out to 2040 and the key uncertainties surrounding that

transition. It shows how rising prosperity drives an increase in global energy

demand and how that demand will be met over the coming decades through a

diverse range of supplies including oil, gas, coal and renewables.

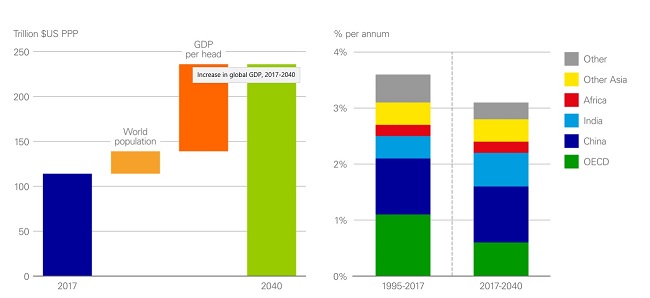

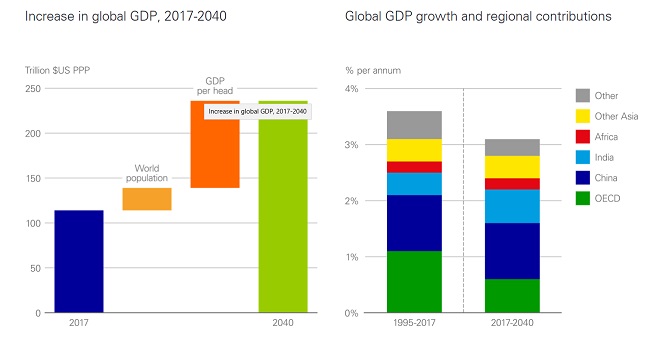

Global economic growth is driven by increasing

prosperity in developing economies, led by China and India.

The world economy continues to grow, driven by increasing prosperity in the developing world.

In the ET scenario, global GDP grows around 3¼% p.a. (on a

Purchasing Power Parity basis) – a little weaker than average growth over the

past 20 years or so.

Global output is partly supported by population growth, with

the world population increasing by around 1.7 billion to reach nearly 9.2

billion people in 2040.

But the vast majority of world growth is driven by

increasing productivity (i.e. GDP per head), which accounts for almost 80% of

the global expansion and lifts more than 2½ billion people from low incomes.

The emergence of a large and growing middle class in the developing world is an

increasingly important force shaping global economic and energy trends.

Developing economies account for over 80% of the expansion

in world output, with China and India accounting for around half of that

growth.

Africa continues to be weighed down by weak productivity,

accounting for almost half of the increase in global population, but less than

10% of world GDP growth.

Higher living standards drive increases in energy demand,

partly offset by substantial gains in energy intensity.

Expansion in global output and prosperity drives growth in

global energy demand.

Energy consumption in the ET scenario increases by around a

third over the Outlook. As with GDP growth, the vast majority of this increase

stems from increasing prosperity, as billions of people move from low to middle

incomes, allowing them to increase substantially their energy consumption per

head.

The overall growth in energy demand is materially offset by

declines in energy intensity (energy used per unit of GDP) as the world

increasingly learns to produce more with less: global GDP more than doubles

over the Outlook, but energy consumption increases by only a third.

Global energy grows at an average rate of 1.2% p.a. in the

ET scenario, down from over 2% p.a. in the previous 20 years or so. This weaker

growth reflects both slower population growth and faster improvements in energy

intensity.

Despite significant growth in prosperity and energy

consumption over the next 20 years, a substantial proportion of the world’s

population in the ET scenario still consumes relatively low levels of energy in

2040. The need for the world to produce ‘more energy’ as well as ‘less carbon’

is discussed below.

Alternative scenario – more energy

The world needs ‘more energy’ to allow global living

standards to continue to improve.

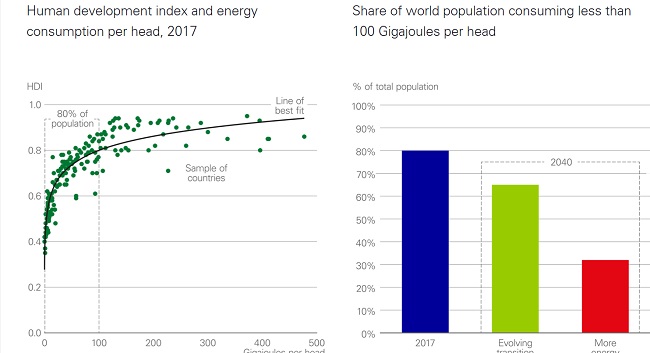

There is a strong link between human progress and energy

consumption.

The United Nation’s Human Development Index (HDI) suggests

that increases in energy consumption up to around 100 Gigajoules (GJ) per head

are associated with substantial increases in human development and well-being,

after which the relationship flattens out.

Around 80% of the world’s population today live in countries

where average energy consumption is less than 100 GJ per head. In the ET

scenario, this proportion is still around two-thirds even by 2040. In the

alternative ‘More energy’ scenario this share is reduced to one-third by 2040.

This requires around 25% more energy by 2040 – roughly equivalent to China’s

energy consumption in 2017.

This assumes that countries in which energy consumption is

much greater than 100 GJ/per head do not economize on their energy use. If all

those countries reduced average consumption levels to the EU average in 2040

(around 120 GJ/per head), this would provide almost the entire energy required.

Improving energy efficiency in countries which use

disproportionate amounts of energy is likely to be key to solving the dual

challenge of providing ‘more energy and less carbon’.

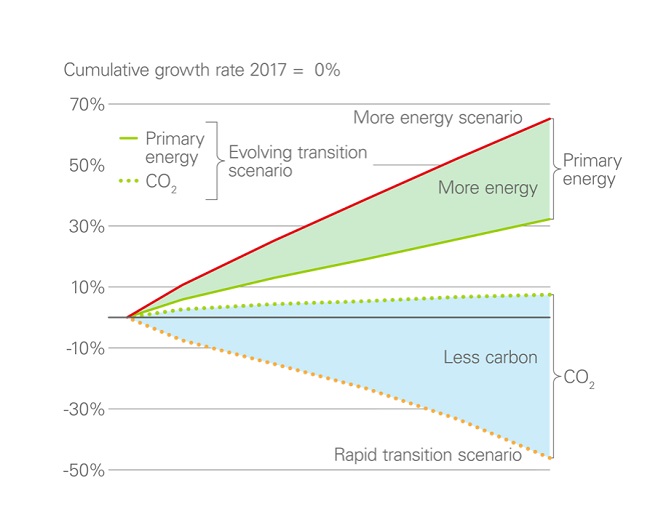

The global energy system faces a dual challenge: the need

for ‘more energy and less carbon’.

The global energy system faces a dual challenge: the need

for ‘more energy and less carbon’.

The ET scenario is not consistent with achieving either of

these challenges:

- energy

demand increases by a third, but two-thirds of the world population in

2040 live in countries in which average energy consumption is still less

than 100 GJ per head;

- CO2

emissions from energy use continue to edge up, increasing by almost 10% by

2040, rather than falling substantially.

The ‘More energy’ scenario represents a half-way step to

reducing the proportion of the world’s population living in countries where the

average level of consumption is below 100 GJ/per head to one-third by 2040.

The ‘Rapid transition’ scenario

represents a similar half-way step on carbon emissions: reducing CO2

emissions by around 45% by 2040, almost half-way to reducing entirely carbon

emissions from energy use.

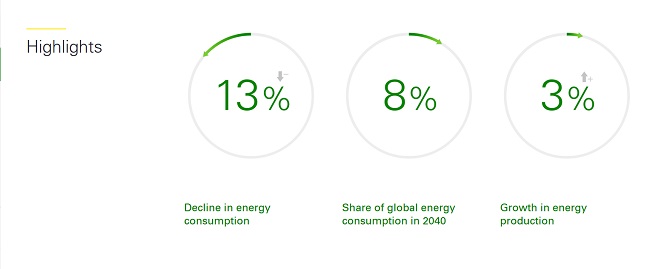

Regional insight – EU

The European Union, thanks to its policies, leads the global

transition towards a carbon-free economy.

Renewables is the largest source of energy in 2040,

accounting for 29% of EU energy consumption.

Primary energy use in power generation grows by 10% over the

Outlook but falls in all end-use sectors.

Carbon emissions in 2040 decrease by 36% compared to the

2017 levels.

Projections

- Primary

energy use in power generation grows by 10% in 2040, reflecting a strong

process of electrification.

- Final

energy consumption declines across the board: non-combusted uses (-26%),

industry (-18%), buildings (-11%), and transportation (-18%).

- As a

result of those trends, power generation amounts to 52% of total primary

energy consumption in 2040, up from 42% in 2017.

- Accelerated

electrification boosts renewables in power (+169%) and, to a lesser

extent, hydro (+6%). Electrification sustains natural gas consumption,

which declines marginally (-2%) over the Outlook.

- Renewables

become the largest source of energy in 2035-2040, surpassing oil. Among

renewable sources, wind represents about two-thirds of total renewable

energy in 2040.

- Despite

the decrease in final energy consumption by transport, biofuels increase

by 37% over the Outlook. In addition, electricity consumption in transport

increases by around 700% over 2017-2040.

- Coal

and nuclear consumption fall significantly (-66% and -46%, respectively)

largely driven by policy.

- Production

of fossil fuels all see robust declines: oil (-28%), natural gas (-52%)

and coal (-73%).

- The

decline in natural gas production leads to a deterioration

self-sufficiency, with the import ratio rising from 75% to 88%.

- Energy

intensity decreases by 35%, in line with the global average for 2017-2040.

- Carbon

emissions decrease sharply (-36%) due to the decline in demand and the

shift toward a cleaner energy mix.

Full BP Energy Outlook here:

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!