Analytics, Business, Economics, EU – Baltic States, Markets and Companies

International Internet Magazine. Baltic States news & analytics

Saturday, 07.06.2025, 19:42

YPO: EU business leaders remain most confident in the world for third consecutive quarter

Print version

Print version

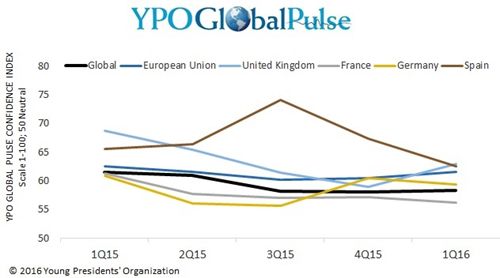

The YPO Global Pulse Confidence Index for the EU witnessed a moderate increase of 1.1 points to a confidence index of 61.6 in the first quarter of 2016.

For the third consecutive quarter, EU business leaders recorded the highest levels of economic confidence globally, as sentiment in most regions in the world remained more cautious. This contrasts starkly with the situation from 2011-2013, at the height of the global economic recession and the debt crisesacross Europe, when CEOs in the region reported the most pessimistic economic outlook in the world.

However, confidence in the region has remained strong and stable over the last two years, as the EU has experienced record low interest rates, a drastic reduction in oil prices and a sharp drop in the value of the euro against the dollar – all of which have bolstered EU exports and stimulated economic growth.

Globally, in the first quarter of 2016, the YPO Global Pulse Index composite score remained steady at 58.3, reflecting a stable economic outlook. Confidence in Africa increased 2.2 points to a relatively positive 53.2 while confidence in the United States edged up 0.5 point to 59.6. Economic sentiment in Asia remained almost unchanged, gaining 0.3 point to 60.0 while confidence in the Middle East slipped 0.8 point to 55.6. In Latin America, confidence significantly declined 3.6 points to 50.8.

"It is remarkable that CEO confidence has held steady over the past few months, when you consider the global market volatility as well as recent political and economic challenges," said Nick Hungerford, founder and director of Nutmeg and member of YPO Greater London Chapter. "It is encouraging to see that business leaders across the EU remain optimistic given that the European economy continues to grow at a moderate rate. As ever, the world economy faces major challenges and CEOs will have to stay alert and adapt their plans accordingly."

Key findings in the EU

CEOs in United Kingdom most optimistic in Europe:

The YPO Global Pulse Index for the United Kingdom jumped 4.0 points to 62.9 in the first quarter, comfortably ahead of France and Germany, the other two largest economies in the region. Both Germany and France experienced slight reductions in confidence with France dropping 1.0 point to 56.2 and Germany slipping 1.1 points to 59.3.

Spain recorded a significant decline in confidence, falling 4.9 points to 62.5, although it remained in firmly optimistic territory. Similarly, in Poland, confidence declined 5.7 points to land at 62.7.

On the other hand, there were notable improvements in confidence in several countries, including some economies that required IMF assistance to navigate sovereign debt crises in 2011-2012. Greece climbed 5.2 points to 54.5, its highest level since the second quarter of 2014.

Record confidence levels for future sales, hiring and fixed investment:

When assessing the economy one year from now, business leaders in the EU reported record levels of optimism for each of the three individual components of the index, tracking sales, employment and fixed investment forecasts. The YPO Global Pulse Sales Index for the European Union jumped 2.6 points to 70.0, its highest level in the seven-year history of the survey. The Employment Index rose 1.8 points to 60.6, another record high, and the Fixed Investment Index climbed 1.7 points to 61.9, matching its previous high in the second quarter of 2015.

As many as two-thirds (67%) of CEOs in EU expected to increase turnover in the next 12 months, 40% anticipated to increase headcount, and 42% expected to increase fixed investment. Only 5% of CEOs predicted sales and staff numbers to decline, and 6% expected fixed investment to decrease in the next year.

More caution outlook relating to wider economic conditions:

When it came to looking at the wider economic and business conditions in which their organisations operate six months from now, CEOs were more cautious than in fourth quarter 2015. More than one-third (35%) of respondents predicted conditions will improve in the next six months, down from 40% in the previous survey. More than a fifth (22%) expected conditions to deteriorate, compared to only 16% in the previous quarter.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!