Analytics, Economics, EU – Baltic States, Financial Services, Markets and Companies

International Internet Magazine. Baltic States news & analytics

Saturday, 07.06.2025, 19:39

Brexit: how much of a hit to the Baltics?

Print version

Print version

We forecast it to strengthen to about 0.75 after the referendum and fluctuate around this mark in the second half of the year, given a “yes” vote. We expect the Bank of England to start hiking interest rates in the first quarter of 2017.

Swedbank rates the likelihood of Brexit at 40%.

FT’s poll tracker (both online and telephone polls) for the UK’s in/out referendum on EU membership shows a preference for “remain” (46% for “remain” versus 43% for “leave”), although the margin is small. 10% of the public has yet to make up their minds (polls as of May 3rd).

Different estimates of the probability of a vote in favourof leaving the EU range from 20% to 40%.

In case of Brexit, the consequences for the Baltics and the euro area as a whole would be felt through three main channels:

(i) the financial markets channel, (ii) the foreign trade channel, and (iii) the political channel.

i. The effects on the European financial markets would be instantaneous but most of them would be temporary – excessive volatility, a weaker pound, a possible fall in stock prices and bond yields. The effect on the Baltics would be small due to low debt levels.

ii. The trade exposure of the Baltics tothe UK is not sizable, 3-5% of total goods exports. It is more important for some industries, like the manufacturing of wood, machinery and equipment, and in Lithuania also mineral fuel. Limited negative impact is expected on the Baltics.

iii. The political consequences for the EU would probably bethe largest negative effect – an even greater challenge for EU collaboration and a more politically divided Europe, greater likelihood of more radical/populist political forces gaining power, a further delay of necessary structural reforms, larger geopolitical instability, etc. The impact could be extensive also for the Baltics.

The UK has also been one of the major destinations for Baltic emigrants following the 2008-2009 crisis. The social security network in the UK is already being reduced and will continue to do so. In case of Brexit these processes could amplify, and, with a weaker UK economy, emigrants should expect even less social supportand fewer job opportunities. For those considering moving to the UK, it will no longer beas easy.

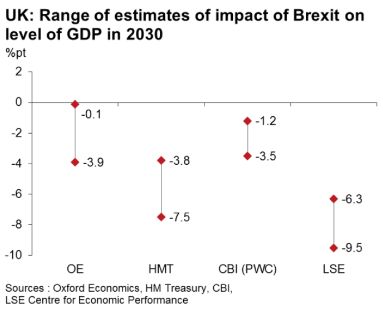

In the case of Brexit, we expect the UK and the EU to suffer both economically and politically. Estimates by some research institutions on the potential impact of Brexit on the UK range from -0.1 to -9.5 percentage points, depending on assumptions, and these estimates are all tilted to the negative side. Since the impact on the EU (and, thus, also the euro area and the Baltics) will be indirect, it will be significantly smaller. We outline three main channels and possible tendencies.

Financial market stress

Worries of an impending UK exit, a vote in favour of a continued EU membership by a very small margin,or a de facto Brexit will lead to short-term high volatility in the financial markets. If there is a Brexit, global stock prices could fall, and a flight-to-quality mentality could emerge that lowers global bond yields further. The pound is currently pricing in a risk premium of approximately 2-3%.

If there is a Brexit, volatility in the financial markets will be very high, albeit temporary. Safe-haven currencies like the US dollar, the Japanese yen, and the Swiss franc,will be favoured. We expect an initial depreciation of the poundn relative to the dollar of at least 5% (currently at 1.45 USD per GBP). The change in the euro relative to the poundwill depend on comments from euro area policymakers who wish to calm macro fears and signal stability.

Furthermore, if there is a Brexit, the banking system could be stressed and credit spreads could widen, which would raise funding costs. We expect this effect to be particularly significant for UK/EU peers.

Baltics will be hit similarly as the euro area on average. The effect is likely to be even smaller, since debt levels are small and resilience quite high.

The full report is available here.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!