Analytics, Banks, Estonia, Financial Services, Investments

International Internet Magazine. Baltic States news & analytics

Friday, 19.04.2024, 00:34

Coop Bank’s IPO: another growing Estonian bank

Print version

Print versionNow, Estonian Coop Bank is making headlines. The good news

is that anyone from Baltic countries can participate in IPO frenzy and not just

Estonian residents (as it was in case of LHV and Tallinna Sadam, when only

Estonian residents were allowed). From the standpoint of existing shareholders

and company’s management, the potential success rate of this IPO has increased

as the pool of investors for Coop Bank stock got wider.

Coop Bank is an Estonian capital bank, carrying its

business only in Estonia. Group’s main strategic shareholder with ~60% of

shares is Coop Eesti, Estonia’s largest group, engaged in sale of food and

convenience goods. It consists of 19 regional consumer co-operatives (has

around 80 000 members) and has 350 shops and nearly 600 000 regular customers.

As a result, Coop Bank is an organization with very deep roots in Estonia’s

society as Coop shops, having the highest market share by revenues in Estonian

consumer market, are widely spread all over country. Therefore, the group uses

its partnership with Coop Eesti to focus on private customers and small

and medium-sized businesses.

Why IPO now?

Coop bank is tight on capital and lacks sufficient

financing to continue its accelerating

growth strategy based on rapidly expanding

loan portfolio.

In the past, growth was mainly financed through retained

earnings and issue of subordinated bonds (total 7mn EUR in subordinated debt).

Now the company seeks to attract ~37 mn EUR of capital by offering up to 46.28

mn shares (32.18 mn new shares and 14.10 mn shares from existing shareholders)

in a price range of 1.15-1.30 EUR. Total outstanding amount of shares is

forecasted to increase to 94.4 mn and company’s market cap is set to reach

~120mn EUR (to compare: market cap of LHV is 343 mn EUR and Siauliu Bank

is 309 mn EUR).

Coop Bank’s business model in brief:

1)

The Bank operates under current name and with

existing set-up since 2017. It was known as Krediidpank since 1992, but

because of USA sanctions against Russia (bank’s major shareholder was Russian VTB

Bank) Coop Eesti Keskuhistu and Inbank AS acquired it in 2017

and renamed to Coop Bank.

2)

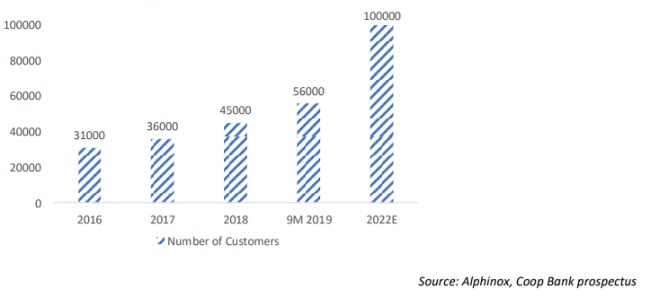

As of September 2019, it had over 56 000 bank

clients and its subsidiary Coop Finants (consumer finance) had 87 000

customer contracts. Company has over 100 000 Saastukaart+ users (Coop shop

loyalty card with credit card’s features). The bank significantly increases its

operating volumes and plans to grow its number of clients to 100 000 until

2022.

Source: Alphinox, Coop Bank prospectus

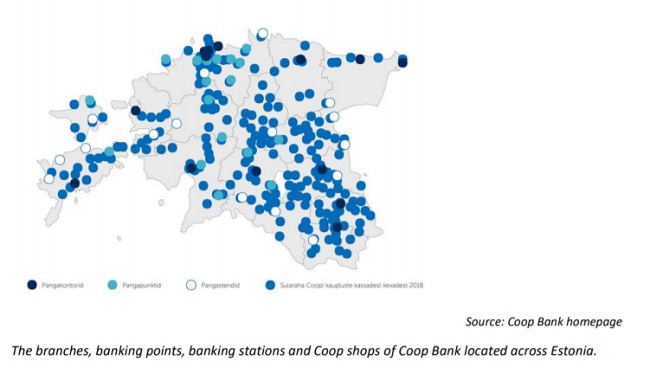

Thanks to its partnership with Coop Eesti (store

chain), bank’s clients have access to 330 spots in the Coop shops, where

they can perform their daily banking operations such as, withdrawing or depositing

money, applying for a small loan, etc.

By partnering with Coop Eesti company has access to the

largest existing cash network in Estonia, which provides significant

competitive advantage to the bank even in the digital era, when the majority of

banking operations can be carried online. Access to wide network of clients

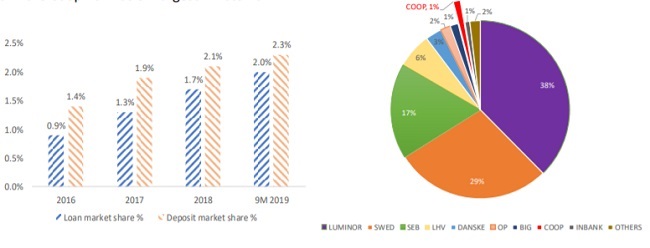

allowed the bank to expand its presence in the domestic market: since 2016, the group has been able to

increase its market share - from 1.4% to 2.3% in deposits and from 0.9% to 2.0%

in loans. Based on total assets of Estonian banking market, its market share is

1.3%, which would rank the Coop Bank as 8th largest in

Estonia.

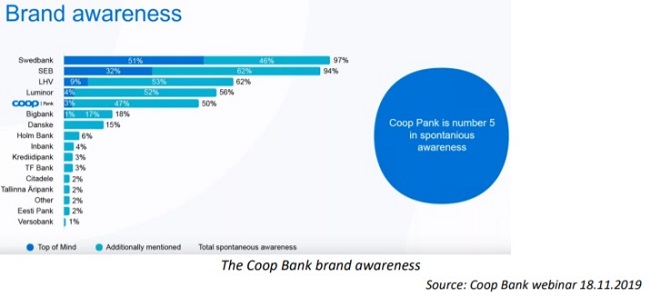

3) Coop Bank’s management particularly puts emphasis on the bank’s brand awareness in Estonia, where it ranks 5th with a significant gap from the pursuers.

The discrepancy between the bank’s

market share (8th place in market) and its notable brand awareness

indicates that there is a potential for further market penetration.

4)

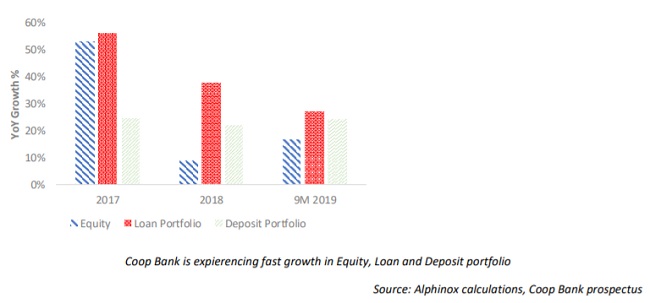

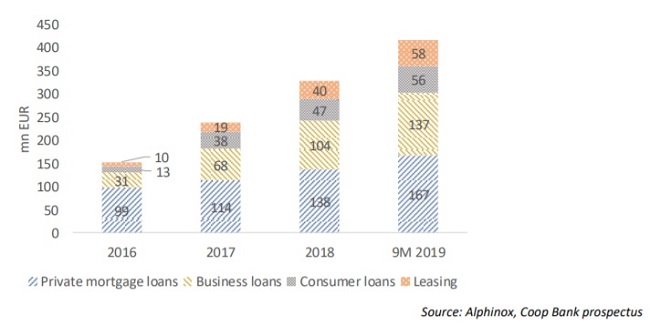

The growth in recent years was quite significant

(loan portfolio CAGR of 44%): Company’s goal is to grow its loan portfolio to 1

bn euros from current 418 mn until 2022.

Noteworthy, the company started to focus more on business

sector: in 2016, private mortgage loans made 64% of loan portfolio, while in

2019 it was reduced to 40% as share of business loans has increased from 20% to

33%. Corporate loans are concentrated around the companies operating in real

estate sector (31% of corporate loans), which increases bank’s sensitivity to

the macroeconomic cycles. Other corporate loans are granted primarily to

wholesale and retail sector. To compare, share of real estate loans in LHV Bank’s

portfolio is 26% and that of Šiauliu Bank’s is 13.5%. Top eight clients account

for more than 10% of Bank’s eligible capital or EUR 42.7 mn, with largest loan

being EUR 6.9 mn (1.6% of total loan portfolio).

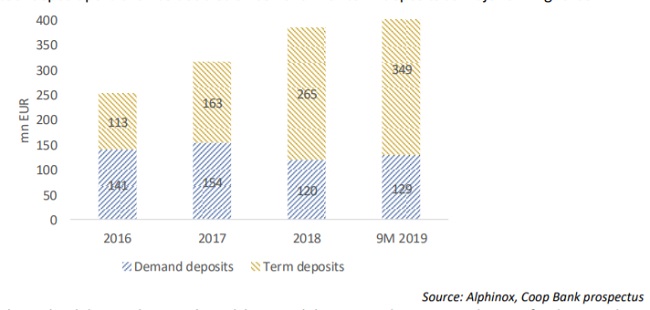

With regard to another part of the bank’s balance sheet -deposits- Coop bank does pretty well too: deposit portfolio has doubled since 2016 with term deposits as major driving force.

This splendid growth is explained by

possibility to easily tap into deposit funding markets abroad. Coop bank

actively uses online deposit marketplace Raisin

through which deposits from German depositors can be obtained. Lately, company

has also received rights to receive deposits from the Dutch and Spaniards.

However, the company’s plan is to reduce its dependence on Raisin

platform and to increase amount of installments from local residents. As of 30

September 2019, around 25% of all deposits came through Raisin platform and

funding costs were 1% in 2019 (0.8% in 2018).

Funding costs has been under pressure as the increase in demand for

customers deposits has not been sufficient to finance bank’s fast- growing loan

portfolio.

5)

Coop Bank undergoes fast growth phase and

its Cost/ Income ratio is on a rather high level, while ROE is lower if

compared with more mature banks on Baltic market. For example, LHV has

Cost/Income ratio of 52%, and more mature Baltic banks have this ratio at 40% (Šiauliu

Bank) and 67% (Citadele Bank). ROE for LHV is 18%, 19% for Šiauliu

Bank and 12% for Citadele Bank. The company plans/aims to stabilize

costs to improve its Cost/Income ratio and ROE by 2022, planning it below 50%

and around 15% respectively.

Company plans to start paying dividends (25% of net profits)

as of 2022. Its Baltic peers, LHV and Šiauliu Bank, are already dividend

paying stocks. LHV’s dividend yield is 1.76%,

that of Šiauliu Bank’s - 5.75%, while Baltic stock market’s

median dividend yield 5.9%.

6)

Based on the offered price range of IPO, we

estimate Coop Bank’s 2019 P/E of 19.4-22.0 and P/B of 1.15-1.3. To compare, LHV

has 12 month trailing P/E of 12.8 and P/B of 1.9, which could be classified as a growth stock

within Baltic stock market context. Šiauliu Bank, which can be

considered as a value stock, has P/E of 5.0 and P/B of 1.0.

Estonian banking market was shaken by a number of scandals

and making few market participants to become extra careful in doing business.

Therefore, there could be an untapped potential for active and opportunistic

bank, although the main concern is how well Coop Bank will be able to use

synergy between banking and retailing. If judged by valuation estimates, company’s

proposed IPO price is justified by its growth potential and risk associated

with it.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!