Analytics, Banks, Direct Speech, Estonia, Financial Services

International Internet Magazine. Baltic States news & analytics

Friday, 19.04.2024, 20:49

Estonia: The net profit of the banks fell last year

Print version

Print version |

|---|

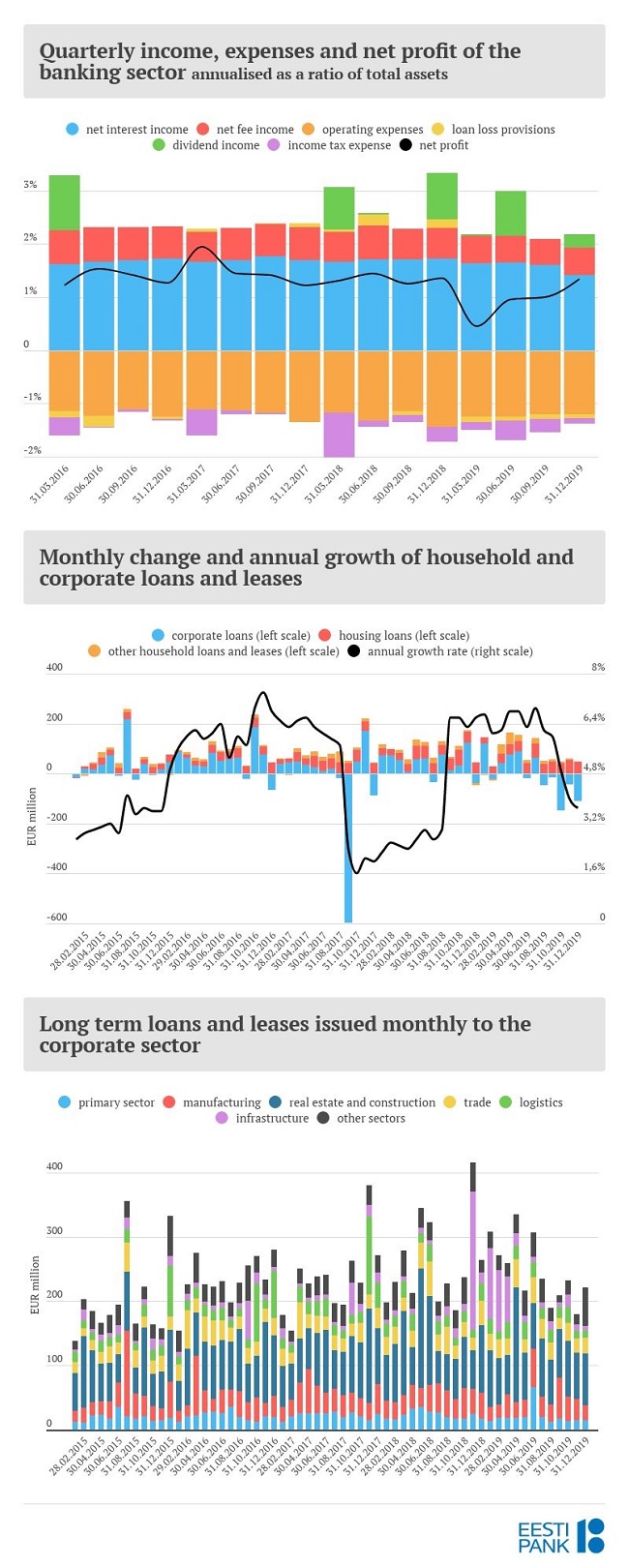

Estonian banks and lease companies had lent 9.2 bn euros to local companies as at the end of last year, which was the same as a year earlier. The portfolio would have grown by some 3-4%, but as two branches in Estonia ended their activities, some loans were moved out of Estonia. Estonian companies were quite modest in their borrowing from the local financial sector, but they offset this by borrowing more from abroad and from other non-financial companies.

There was growth of 7% in loans and leases to households, which stood at 10.1 billion euros in December. The largest share of loans to households are housing loans, and 8 billion euros has been taken in such loans in total. The amount issued in housing loans was 7% more than in 2018, largely because of rising housing prices. The earlier rapid growth in other loans and leases came to a halt in 2019. Demand for loans and leases remains strong, as is shown by the rapid growth in the loan stock. Demand for loans is encouraged by rapid wage growth, which has maintained confidence.

The interest rates on loans issued to households and companies rose a little last year, but the average cost of borrowing was again lower in December. The average interest rate for long-term loans taken by companies was 2.6%, and the rate for housing loans was 2.4%.

Corporate deposits at banks operating in Estonia totalled 7 bn euros, and those of households were 8 bn. This meant the deposits of both companies and households grew by 7% over the year.

- 25.01.2021 Как банкиры 90-х делили «золотую милю» в Юрмале

- 29.12.2020 В Латвии вводят комендантский час, ЧС продлена до 7 февраля

- 29.12.2020 В Rietumu и в этот раз создали особые праздничные открытки и календари 2021

- 29.12.2020 Latvia to impose curfew, state of emergency to be extended until February 7

- 29.12.2020 Lithuanian president signs 2021 budget bill into law

- 29.12.2020 Number of new companies registered in Estonia up in 2020

- 29.12.2020 Президент Литвы утвердил бюджет 2021 года

- 28.12.2020 Рынок недвижимости Эстонии осенью начал быстро восстанавливаться

- 28.12.2020 Tartu to support students' solar car project

- 28.12.2020 New Year Cards and Calendars of Rietumu Bank presented

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!