Analytics, Banks, Direct Speech, Economic History, Estonia, Financial Services

International Internet Magazine. Baltic States news & analytics

Thursday, 18.04.2024, 05:16

Estonia`s households were active in borrowing in April

Print version

Print version |

|---|

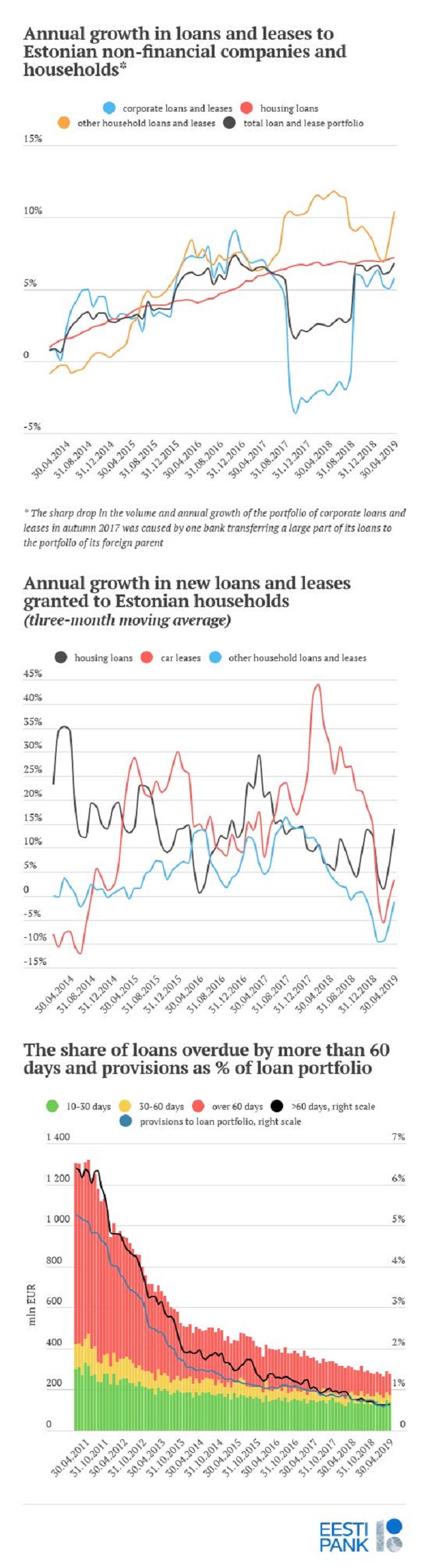

The stock of loans and leases to companies grew by 5.8% over the year, and this growth was encouraged by large one-off loan transactions with energy companies in previous months. The loan portfolio of other sectors grew by 3-4% in volume at the same time. The largest volume of long-term loans issued in April went to companies in real estate and construction, and in retail.

The average interest rate on housing loans has held steady in recent months at 2.5%. The interest rate on long-term corporate loans is more variable and depends on the projects being financed in each month. The average interest rate in April was 2.7%, which is around the average interest rate for loans issued in the past year.

The ability of both households and companies to repay their loans remains good. The share of loans overdue by more than 60 days in the loan portfolio is very small at 0.6%, and the banks have made provisions of almost the same amount to cover potential loan losses from problem loans.

The deposits of households and companies continue to grow very fast. Both grew by around 9% over the year to a joint total of 14.3 bn euros. The deposits at banks and their loan portfolios have increased by about the same amount over the past year.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!