Analytics, Banks, Direct Speech, Economics, Financial Services

International Internet Magazine. Baltic States news & analytics

Saturday, 20.04.2024, 02:08

Companies have started to borrow more in Estonia

Print version

Print version |

|---|

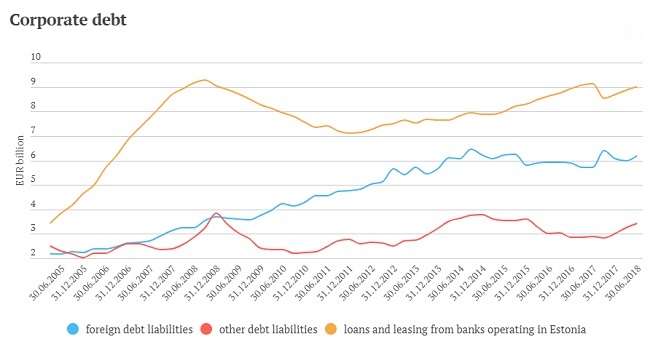

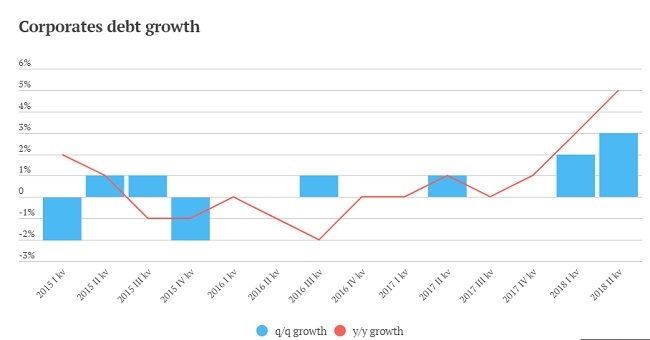

The debt of companies started to increase in the first half of 2018, and yearly growth in it had reached 5% by the end of the second quarter. The growth in loans taken from banks operating in Estonia has been at around 7% for two years now[1]. Borrowing has also increased from the non-bank financial sector, such as holding companies and pension and investment funds are involved in loan intermediation.

The amount borrowed from non-bank intermediaries, however, is a much smaller part of corporate debt than loans from banks. Borrowing from abroad has so far been relatively modest, but it increased in the second quarter as companies in the energy sector took large loans.

Further growth in debt will depend on how much companies invest. In the past couple of years corporate debt has remained at around the same level, as companies have invested little. Growth in debt may indicate that investment increased in the second quarter or will do so in the coming quarters. A further indication of this is that companies have increased their funds through equity capital as well. The Eesti Pank June forecast expects that growth in corporate debt will increase a little to 6-7% in the years ahead, which is about the same as nominal growth in the economy.

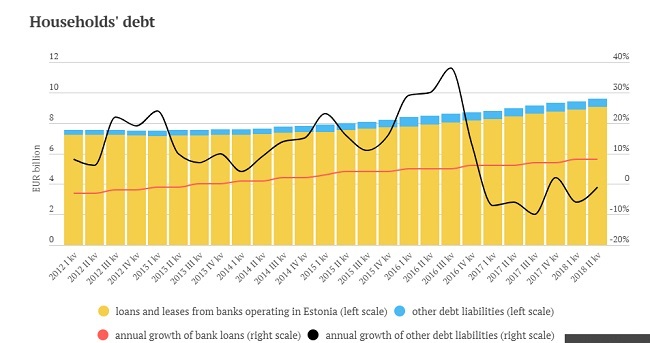

Households are enthusiastically buying housing and cars, and so their debt liabilities at the end of the second quarter were around 7% larger than they were a year earlier. Data for recent months on new housing loans indicate some slight slowing in the rate of growth though. The loans are mainly being taken from banks, and the very fast growth that was earlier seen at other lenders, including instant loan providers, has slowed.

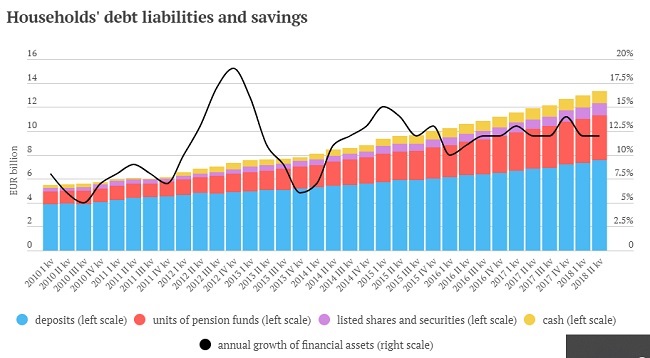

The income and savings of households have increased faster than their debt liabilities, and this has eased the risks from rapid credit growth. Household deposits increased by 10% over the year. The other financial assets of households, like cash, securities, investment fund units and loans granted, have increased a little faster, and the assets built up in pension funds have also increased. Although savings have grown rapidly, the financial savings of Estonian households in relation to incomes are still below the European Union average, and many households would not have sufficient financial buffers to cover unexpected emergencies.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!