Analytics, Banks, Crisis, EU – Baltic States, Financial Services, Latvia, Rating

International Internet Magazine. Baltic States news & analytics

Saturday, 20.04.2024, 06:51

Moody: Government of Latvia Financial scandals raise questions over supervisory capacity and weigh on institutional strength

Print version

Print versionThe arrest of the central bank governor on allegations of

bribery raises additional integrity challenges. That said, the risk of

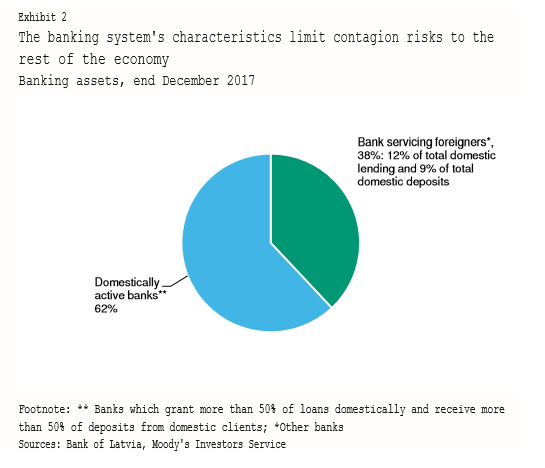

contagion across the broader economy is limited, given that non-resident focused

banks play a marginal role in domestic lending or in attracting domestic

deposits.

Following allegations

of money laundering by the US Treasury’s Financial Crimes Enforcement Network

(FinCen) on 13 February and a moratorium imposed by the ECB on 18 February in

light of a sharp and significant deterioration in liquidity, the authorities

decided to wind up Latvia's third largest bank, ABLV Bank (unrated).

Separately, Latvia's central bank governor, also a member of the ECB’s

governing council, is under investigation by Latvia's Corruption Prevention and

Combating Bureau (KNAB) on allegations of bribery.

In recent years, Latvia had made a number of efforts to

improve banking supervision, particularly in the non-resident part of the

banking sector. The Financial and Capital Markets Commission (FCMC), the

authority responsible for applying macroprudential tools, conducts both on-site

and off-site bank audits, particularly for banks involved in non-resident

banking. Resources for supervisory institutions have also been increased,

sanctions for violations have been strengthened and regulatory requirements for

customer due diligence have become stricter.

However, the recent developments suggest gaps in the

regulatory oversight and continuing challenges in improving banking supervision

and enforcing AML measures. They also weigh on the reputation Latvia's banking

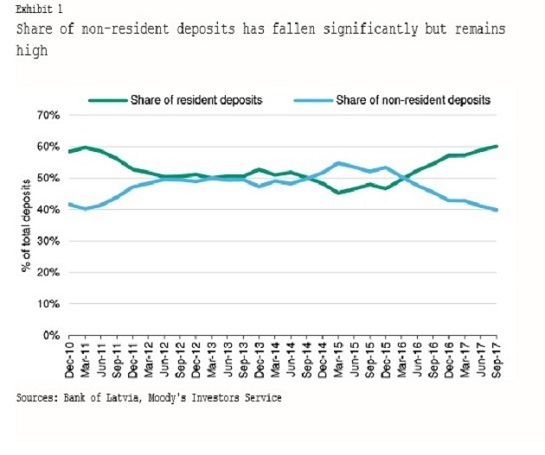

system, particularly the segment dependent on nonresident deposits. Despite a

recent decline, the reliance on non-resident deposits remains high in Latvia

(see Exhibit 1) and its banking system is vulnerable to shifts in external

perception. In that context, we view positively the recent proposal of an audit

of the FCMC as well as the possibility of imposing a tax on transactions of

risky clients aimed at reducing the attractiveness of non-resident-focused

banks, for offshore companies in particular.

Moreover, the banks that are subsidiaries of Nordic banks

have strong financial ratios and a track record of parent support which we

factor in our assessment of banking sector risk in Latvia. More generally, we

note that the overall financial health of banks (beyond subsidiaries of Nordic

banks) in Latvia is sound and significantly better than in 2008, as measured by

solid capitalization and liquidity ratios above minimum requirements.

Furthermore, uncertainties around ABLV have now been reduced. On 23 February, the regulator indicated that the Deposit Guarantee Fund will not be used, as ABLV has enough liquid assets to cover guaranteed deposits (with pay-outs to clients expected no later than 7 March). The withdrawal of the bank's license will depend on the regulator's assessment (to be expected within the next 30 days) of the bank's voluntary liquidation project. The FCMC will submit a draft decision to withdraw ABLV's licence to the ECB if the bank fails to meet its financial obligations in full and within the required time limit.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!