All rights reserved.

You may not copy, reproduce, republish, or otherwise use www.baltic-course.com content

in any way except for your own personal, non-commercial use.

Any other use of content requires the hyperlink to www.baltic-course.com.

Printed: 25.04.2024.

PrintLibra – a new global digital currency

PrintLibra – a new global digital currency

|

|---|

Bitcoin is

a digital asset designed to work as a medium of

exchange that uses strong cryptography to secure financial transactions,

control the creation of additional units, and verify the transfer of

assets. Crypto currencies use decentralized control as opposed

to centralized digital currency and central banking systems.

More in: https://en.wikipedia.org/wiki/Cryptocurrency

Short history

For example, Wikipedia

provides a short history of “digital currency” starting with an idea of digital

cash (by David Chaum in 1983), with

the DigiCash as a first electronic cash

company in 1990; after eight years it filed for bankruptcy.

Another idea of

so-called e-gold, as the first widely used “internet money” was introduced in

1996, and grew to several million users before the US Government shut it down

in 2008. Users of the e-gold mailing list used the term "digital

currency" to describe peer to peer payments in various instruments.

In 1997,

Coca-Cola offered buying from vending machines using mobile payments; the

PayPal was launched its $US-denominated service in 1998. In 2009, bitcoin was launched, which marked the

start of decentralized blockchain-based digital currencies with no central

server, and no tangible assets held in reserve.

Also known as

crypto-currencies, blockchain-based digital currencies proved resistant to

attempt by government to regulate them, because there was no central

organization or person with the power to turn them off, acknowledged

Wiki-authors.

More in: https://en.wikipedia.org/wiki/Digital_currency

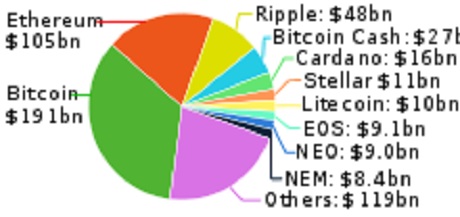

Japanese digital programmer, Satoshi Nakamoto in 2008was the first to develop a bitcoin, called at that

time BTC using a de-centralised server and a database technology, blockchain;

the latter required and electronic signature and certain legitimacy for money

transactions. Initially bitcoin’s market was about 21 million, which turned

presently to $191 billion being the most popular kind of digital currency in

the world (see Table below). Buying and selling crypto-currency is available

through special Bitcoin exchange platforms or ATMs.

More in an article on Bitcoins in: https://www.bitcoin.com/get-started/

Bitcoin is

a peer-to-peer version of electronic cash that allows payments to be sent

directly from one party to another without going through a financial

institution. The network timestamps transactions by hashing them into an

ongoing chain of hash-based proof-of-work; in this way it is forming a record

that cannot be changed without redoing the proof-of-work.

More on “blockchains”

The validity of each crypto currency's coins is provided by

a blockchain, which a sort of continuously growing list of “records”,

called blocks linked and secured by using cryptography. Each block typically contains a “hash pointer”

as a link to a previous block, a timestamp and transaction

data.

By design, blockchains are inherently resistant to modification of the data: as is known, it is a sort of open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way. A blockchain is typically managed by a peer-to-peer network collectively adhering to a protocol for validating new blocks.

Once recorded, the data in

any given block cannot be altered retroactively without the alteration of all

subsequent blocks, which requires collusion of the network majority.

Blockchains are an example of a distributed computing

system which solves two problems: a kind of trusted authority and a central server,

which can serve several crypto currencies.

Reference to “blockchain” in: https://en.wikipedia.org/wiki/Cryptocurrency.

Libra –a new currency

Recently, in particular during 2019, the social network

Facebook has been announcing offers of its own crypto currency Libra based on blockchain. The message

has entailed rising rates for the bitcoin as an already existing digital

currency.

Thus a social media has entered a “combat field” of digital

currencies to change the current business model and bind the users with new

services.

However, possible customers could run a strong risk from

this and other alternative currencies which are without any supervision. Even

though Facebook is planning its crypto currency as a “stablecoin”, which means it is linked to a specific governmental currency;

experts consider this trend with caution.

Reference to: https://www.valantic.com/en/facebooks-cryptocurrency-libra-adds-fuel-to-the-financial-fire/

Officials’ opinion on Libra

The head of the

US Federal Reserve, Jerome Powell, mentioned

in June 2019 that he recognized both potential benefits and risks to Facebook’s

unveiled Libra crypto-currency project.

He believed that modern

societies remain a long way from digital currencies replacing central bank

currencies, and that the central banks are not “too concerned about being able

to implement monetary policy because of them given the infancy of the digital

asset class”.

Mr. Powell acknowledged

both potential benefits and risks particularly of a digital currency such as

Facebook’s, which would have a prospectively large application.

Soon after the

Libra project was published, the French Minister of the Economy and Finance, Bruno Le Maire said that the government

intends to “ask for guarantees” from Facebook in regard to Libra.

The Bank of

England governor Mark Carney believes

“we will wind up having quite high expectations from a safety and soundness and

regulatory standpoint if they do decide to go forward with something.”\

Chairman of the

Russian State Duma Committee on Financial Market Anatoly Aksakov said that the country would not legalize the use of

the token.

Government

officials worldwide have expressed a range of opinions on Facebook’s new token,

which could have potential exposure to a combined 2.7 billion users each month.

Citations from:

https://cointelegraph.com/news/us-fed-chair-facebooks-libra-carries-both-benefits-and-risks

There are Nordic “players” in the digital currencies as well:

for example, Coinify is a global virtual currency player offering two-way virtual currency to

fiat conversion services for businesses and individuals; it was incorporated in

2014 with the headquarters in Denmark.

Coinify is backed

by five main investors: SEB Venture Capital, Nordic Eye Venture Capital, SEED

Capital Denmark, PreSeed Venture and Accelerace; besides, Bitcoin Nordic is

acquired by Coinify.

See more in : https://www.crunchbase.com/organization/coinify-com#section-overview

Table:

Most popular crypto currencies in the

world

Bitcoin as a doubtful investment

The fear of missing out on something draws the attention to

Libra, just as the current bitcoin rates. But excessive euphoria suppresses the

risks, and strong profit taking can only make a few happy, as the price is

falling again.

However, the platform operator Facebook and the members of

the appointed steering committee would profit the most as these “instances” are

in control of the fund-like organised currency.

According to Facebook, only companies having a market value

of at least one billion USD and investing ten million USD in Libra can join the

Libra’s steering committee.

Up to now, apparently 28 of such partners exist; though they

do not include any banks. Moreover, any type of regulation is missing in Libra

although it is important to define clear regulatory guidelines for crypto-currencies.

Otherwise, as some experts say, with untested

pseudo-currencies on the internet, customers would end up in the “stone age” of

payment transactions.

There is somehow

danger that the Libra crypto-currency could undermine national banks’ authority

and erode their powers to influence the economy.