All rights reserved.

You may not copy, reproduce, republish, or otherwise use www.baltic-course.com content

in any way except for your own personal, non-commercial use.

Any other use of content requires the hyperlink to www.baltic-course.com.

Printed: 27.04.2024.

PrintInvestment Plan for Europe: €454 billion to invest in business up to 2020

PrintInvestment Plan for Europe: €454 billion to invest in business up to 2020

The Juncker Commission’s top priority is to get Europe growing again and to increase the number of jobs without creating new debt. The European Fund for Strategic Investments (EFSI) – the heart of the Investment Plan for Europe – and European Structural and Investment Funds (ESI Funds) both play a crucial role in creating jobs and growth.

In a brochure published 22 February 2016 (see brochure) the Commission describes the ways to help local authorities and project promoters make using existing opportunities of combining the EFSI and ESI Funds. These two instruments have been designed in a different but complementary way in terms of rationale, design, and legislative framework while reinforcing each other.

European Commission Vice-President Jyrki Katainen, responsible for Jobs, Growth, Investment and Competitiveness underlined that the EFSI was created to make “flexible possibilities” and “huge opportunities” for project promoters to apply for EFSI financing as well as ESI Funds. The guidelines the Commission just published give practical advice to businesses looking for project financing while using existing investment instruments.

In commenting on the new brochure, Commissioner for Regional Policy, Corina Creţu, said that in order to achieving the objectives of the EU Investment some “joint efforts, sources and actors need to be mobilised”.

The Commission sees to it that growth potential of the ESI Funds are fully exploited, with strategic and performance-oriented investments, boosted by an increased use of financial instruments.

Vice-President of the European Investment Bank (EIB), Ambroise Fayolle, said that bringing together European structural and investment funds with the EFSI will allow the EIB to support sustainable growth throughout European countries and regions. By combining EU grants and EIB financing the EIB can reach out to new beneficiaries, in particular smaller projects regrouped in investment platforms.

The Commission’s brochure provides an overview of the possible combinations of EFSI and ESI Funds, either at project level or through a financial instrument such as an investment platform. It will be enriched with the experience drawn from concrete cases and feedback received from stakeholders.

For more information see:

= Frequently Asked Questions; = Brochure on combining ESI Funds with the EFSI; = ESI Funds Open Data Platform; and = Investment Plan for Europe. Reference: European Commission, press release IP-16-329 “Investment Plan for Europe: new guidelines on combining European Structural and Investment Funds with the EFSI”, Brussels, 22 February 2016. In: http://europa.eu/rapid/press-release_IP-16-329_en.htm.

EU’s drive for smart, sustainable and inclusive growth

The most important contributor to sustainable growth in the member states are through European Structural and Investment Funds (ESI Funds). Besides, there is the European Fund for Strategic Investments (EFSI), which makes the cornerstone for the Investment Plan for Europe. The European Commission and the European Investment Bank (EIB) Group launched the EFSI to help overcome the investment gap in the EU by mobilising private financing for strategic investments.

With EFSI support, the EIB Group provides financing for economically viable projects, including projects with a higher risk profile than ordinary EIB activities. Emphasis is put on the following key sectors: (i) transport, energy and the digital economy; (ii) environment and resource efficiency; (iii) human capital, culture and health; (iv) research, development and innovation; (v) support to SMEs and Mid-Caps.

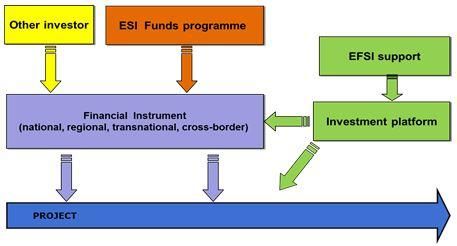

The EFSI Regulation offers the possibility to finance Investment Platforms, to channel a financial contribution to a number of investment projects with a thematic or geographic focus, as well as operations with National Promotional Banks (NPBs).

The ESI Funds are delivered through nationally co-financed multiannual programmes, approved by the Commission and implemented by the EU-28 states and their regions under shared management. Local authorities are responsible for selecting, implementing and monitoring projects supported by ESI Funds.

The reformed framework of ESI Funds for 2014-2020 includes an enlarged scope for the use of financial instruments rather than only grants.

ESIFs & EFSI

Though both funds are aimed at the same purpose, there are some differences between them: thus, the structural funds can finance projects via grants and financial instruments and are implemented in a decentralised way by the managing authorities in the member states. The EFSI provides risk financing instruments via the European Investment Bank.

Important to note: combining EFSI with ESI Funds in a strategic combination can help in the collective and coordinated efforts to tackle the drop in investment across Europe or in a particular region.

ESI Funds and the EFSI can mobilise additional investments by complementing each other and optimising the additionality of the investments. These funds have been designed in a different way but are complementary in terms of rationale, design, and legislative framework; they reinforce each other.

Besides, they can be combined in a number of ways, depending on the investment in question. The combination of ESI Funds and EFSI may be particularly interesting in certain countries or sectors, where the structural funds offer wide opportunities and where the EFSI on its own has not yet been fully mobilised.

Any project that is economically viable has a potential to benefit growth and jobs in the EU and is in line with EU priorities for investments may be eligible for funding from both the EFSI and the ESI Funds. Project promoters should make use of the Advisory Hub and contact the EIB to find out if and how they can combine the funds.

Ways the ESI Funds combined with the EFSI

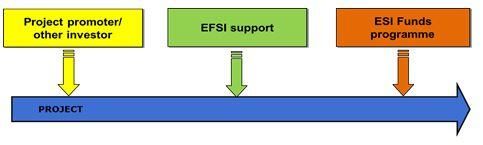

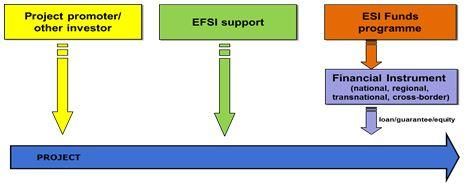

ESI Funds can be combined with the

EFSI in the following ways:

1. Combining ESI Funds with the EFSI at project level:

2. Combining ESI Funds with the EFSI at project level through a financial instrument:

Full explanation of the various

combinations identified so far can be seen in the EU’s brochure.

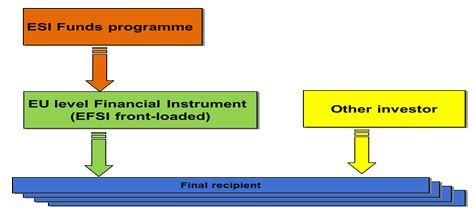

3. Combining ESI Funds with the EFSI for SME financing using EFSI front-loaded, EU-level financial instruments providing guarantees to intermediaries:

ESI Funds programme resources cannot be transferred directly to the EFSI. Given its nature and structure, EFSI support to a project cannot count as national co-financing of an ESI Funds programme. However, national co-financing of an ESI Funds programme could still be provided through another EIB/EIF financial product, either through a Structural Programme Loan or through intervention at project level.

It is also possible that, under certain circumstances, any additional resources leveraged and triggered by the combined ESI Funds and EFSI interventions could be treated as national co-financing for the ESI Funds programme.

Project promoters should contact the European Investment Advisory Hub for more information.

State aid rules in combination with ESI Funds and EFSI

EU state aid rules go hand in hand with the EU Investment Plan's objective of addressing market failures and mobilising private investment. ESI Funds provided to businesses, unless granted on market terms, may entail state aid, which is subject to EU state aid rules; the EFSI does not constitute state aid and is not subject to EU state aid rules.

The Commission will assess ESI Funds entailing state aid on the basis of its modernised state aid framework. To facilitate the deployment of the EFSI, the Commission will assess the compliance of ESI Funds with state aid rules as a matter of priority and give it fast-track treatment. The Commission aims to complete its assessment within six weeks of receiving the complete notification from the member states.

Project promoters getting help in shaping proposals

Project promoters should make full use of the European Investment Advisory Hub which is the gateway to technical and administrative investment advice and support. Designed jointly by the European Commission and the European Investment Bank, the Hub helps public authorities and project promoters identify, prioritise, prepare, structure and implement strategic projects and make more efficient use of EU funds by mobilising private capital.

Part of this one-stop-shop is "fi-compass", an advisory service on financial instruments for ESI Funds.

See, for example: Vol. 3, Financial services through EU’s policies and legislation, Part I & II in:

Modern EU Policies: Integration in Action/Publications series (Vol. 3, Part I); and

Vol. 3 Financial services through EU’s policies and legislation (part II) (baltic-course.com)

Furthermore, the European Investment Project Portal (EIPP) is a brand new web portal enabling EU-based project promoters (both public and/or private) to reach potential investors worldwide. Hosted by the European Commission, this portal is to help promoters access a network of investors, consultants and advisory services to structure their project and finance it.

Reference: European Commission, fact sheet/Memo-16/313 “Combining European Structural and Investment (ESI) Funds and the European Fund for Strategic Investments (EFSI), Frequently Asked Questions”, in: http://europa.eu/rapid/press-release_MEMO-16-313_en.htm?locale=en.